With stock markets hitting record high levels, it’s tempting just to buy in – but even in a bullish environment, due diligence remains a necessity. Some of Wall Street’s largest publicly traded firms are still pulling in the lion’s share of the gains, making it easy to overlook smaller opportunities. But a savvy investor can find some beautiful shoots popping up right now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Finding them takes a willingness to shoulder some extra risk, and to look into some less-publicized sectors. Travel, energy, healthcare, leisure – all of these have their fans, and all of these have their share of winning stocks. But finding those winners is the trick, isn’t it?

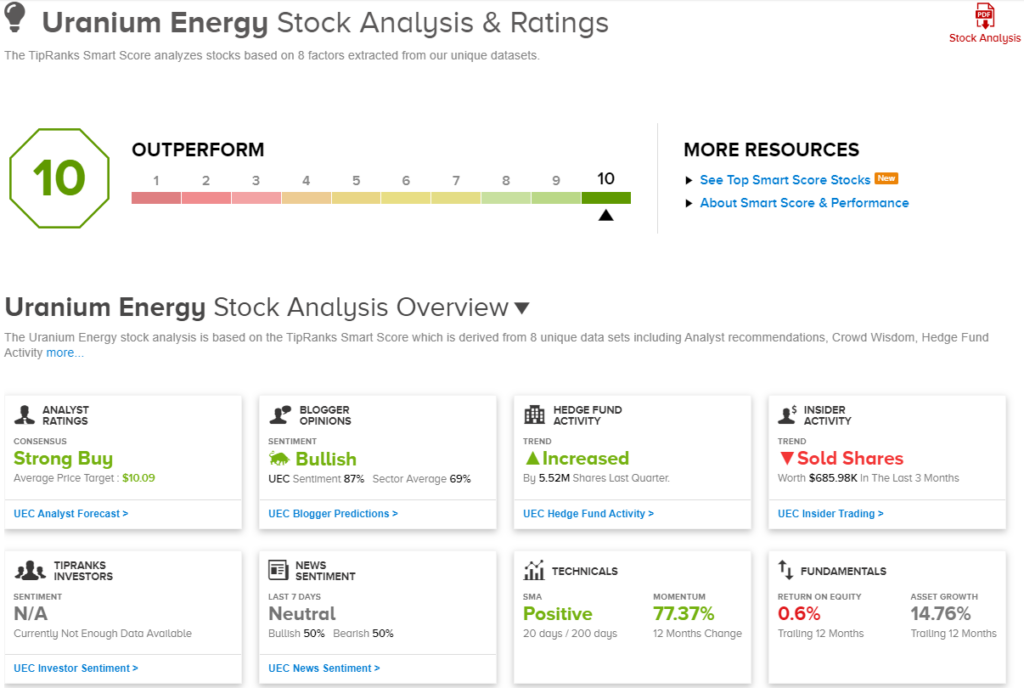

That’s where investors can turn to the Smart Score from TipRanks. This data tool uses a combination of AI and natural language processing to scour the reams of data produced by millions of daily stock transactions, and it uses that data to rate the publicly traded stocks.

Every stock is compared to a set of factors that have demonstrated their correlation with future outperformance, and then is given a rating, a simple score, on a scale of 1 to 10 – with the ‘Perfect 10s’ indicating those shares that are primed for more growth on tap.

With this in mind, we dipped into the TipRanks databases to find out the broader Wall Street views on two such top-scoring stocks. The Street sees them as Strong Buys, with plenty of upside – and taken with the ‘Perfect 10s’ from the Smart Score, that’s a combination that deserves closer scrutiny from investors. Here’s the lowdown.

Copa Holdings (CPA)

The first stock we’ll look at is an airline company. Copa Holdings is a major carrier in the Latin American airline market, and operates through two important subsidiaries – the larger of them, Copa Airlines, is an international carrier based in Panama and operating in South and Central America, the Caribbean, and North America, while the smaller, Wingo, is a low-cost carrier operating mainly in Colombia. Copa Holdings, the parent company, is based in Colombia.

In the company’s most recent air traffic updates, from December and January, the airline posted diverging results. The December update showed a 9.3% increase in capacity to 2.5 billion available seat miles, and a 10.6% increase in revenue passenger miles compared to the prior year. Those numbers fell in January, with available seat miles dropping 3.8% to 2.27 billion, and the revenue passenger miles falling 5.9% compared to January 2023. These measures are key metrics in the airline industry, indicating how many passengers the airline is capable of carrying, and how full its routes actually are.

The recent groundings of Boeing 737 MAX-series aircraft, due to safety concerns, has impacted Copa. Over the past several years, the company has purchased numerous MAX-series aircraft, in a move to modernize its fleet. At the end of 2022, the company had firm orders on 66 737-MAX aircraft, with deliveries scheduled between 2023 and 2028. On January 8 of this year, Copa had to cancel as many as 22% of its flights due to the groundings.

On a positive note for Copa, the company finished last year with top and bottom line quarterly beats. In the 4Q23 report, Copa showed a quarterly top line of $916.9 million, up 3% year-over-year and beating the forecast by nearly $28.8 million. At the bottom line, the company’s non-GAAP adjusted EPS came to $4.47 per share. This figure beat expectations by 58 cents per share.

Of interest to return-minded investors, Copa has initiated a strong increase to its quarterly dividend. The company had a history of regular payments, until the dividend was suspended during the COVID pandemic. Payments were resumed, at 82 cents per share, in 2023. The next dividend payment has been declared at $1.61 per share, for a March 15 payout. The annualized rate of the new dividend, $6.44, gives a forward yield of 6.5%.

Watching this stock for Bank of America, analyst Rogerio Araujo is upbeat about Copa’s prospects for the near term. He sees plenty of room for the company to increase margins through higher fares, if needed, and room for the stock to appreciate. Summing it up, he writes, “We think Copa will likely operate at higher margins going forward, as margin gains since pre-Covid have been mostly driven by cost efficiencies rather than strong fares (up only 12% vs 2019, less than inflation). Therefore, we expect not only positive consensus earnings revision, but also a potential stock re-rating closer to historical levels… We have a Buy rating on an attractive valuation level, with the stock trading at 5.0x Adjusted EV/EBITDA, significantly below the 8x historical average.”

That Buy rating is backed by a $170 price target that projects a robust 72% gain in the next 12 months. (To watch Araujo’s track record, click here)

The Strong Buy consensus rating on COPA, from the Street’s analysts, is based on 4 positive reviews and a lone skeptical one posted in recent months. The shares, which are priced at $98.83, have an average price target of $162.40, suggesting a one-year upside potential of 64%. (See CPA stock forecast)

Uranium Energy (UEC)

From airlines, we’ll shift our view to the energy industry. Specifically, we’ll take a look at uranium, and a uranium miner. The company, Uranium Energy, is operating a combination of in-situ recovery (ISR) and conventional mining projects in North America, producing usable uranium for the nuclear energy industry. Currently, this firm has active development and mining projects in Texas, New Mexico, Arizona, and Wyoming, and bills itself as the fastest-growing uranium miner in North America.

For now, Uranium Energy’s key development activities are those located in south Texas and in Wyoming, where the firm is working to start up ISR production. The Texas sites, which are based in roll-front formations, have shown promise in numerous drill holes. In Wyoming, the company’s project is divided into twelve project areas, and has been shown to have rich recoverable uranium resources. The project in Wyoming is expected to begin production in August of this year.

Overall, Uranium Energy claims to have capacity to recover more than 8.5 million pounds of U3O8 per year. This is a greater capacity than is currently produced within the US. Achieving this production will make Uranium Energy the primary provider of low-cost, relatively low-capital fuel for the US fleet of electricity-generating nuclear plants.

The solid prospects for this stock going forward have the full attention of H.C. Wainwright’s sector expert Heiko Ihle, who notes the company’s strong development position and potential for high production in the near term. Ihle writes, “We note that UEC’s management plans to grow its Irigaray CPP (the focal point of the firm’s Wyoming ISR Hub and Spoke operations) up to a licensed capacity of 4Mlbs of uranium (present: 2.5Mlbs). In our view, this should ultimately allow for meaningful future growth across the area. We reiterate that a variety of initiatives are being taken to restart production at the South Texas Hub & Spoke platform, which are likely to further accelerate growth for the company thanks to the Hobson CPP. We also note that the company currently has 866,000lbs of inventory on hand, which was acquired at an average cost of $49/lb, and that the company expects to purchase 1.3Mlbs of uranium at an average cost of $46/lb. Finally, we reiterate our view that UEC seems to have an opportunity for higher than expected profitability if uranium prices continue to thrive.”

For Ihle, this company’s situation deserves a Buy rating, backed up with a $9.75 price target that implies an upside potential of 53.5% on the one-year horizon. (To watch Ihle’s track record, click here)

The overall view of this stock from Wall Street is positive, a unanimous Strong Buy consensus rating based on 4 Buy recommendations. The shares are trading for $6.35 and the $10.09 average target suggests a one-year gain of 59%. (See UEC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.