Successful stocks naturally make the cornerstone for successful investment portfolios. The only trick is recognizing stocks that check all the boxes for success. That’s some trick, though, since there are thousands of stocks on the market, and many millions of shares changing hands every day. The sheer volume of data makes a daunting wall for the retail investor to scale.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

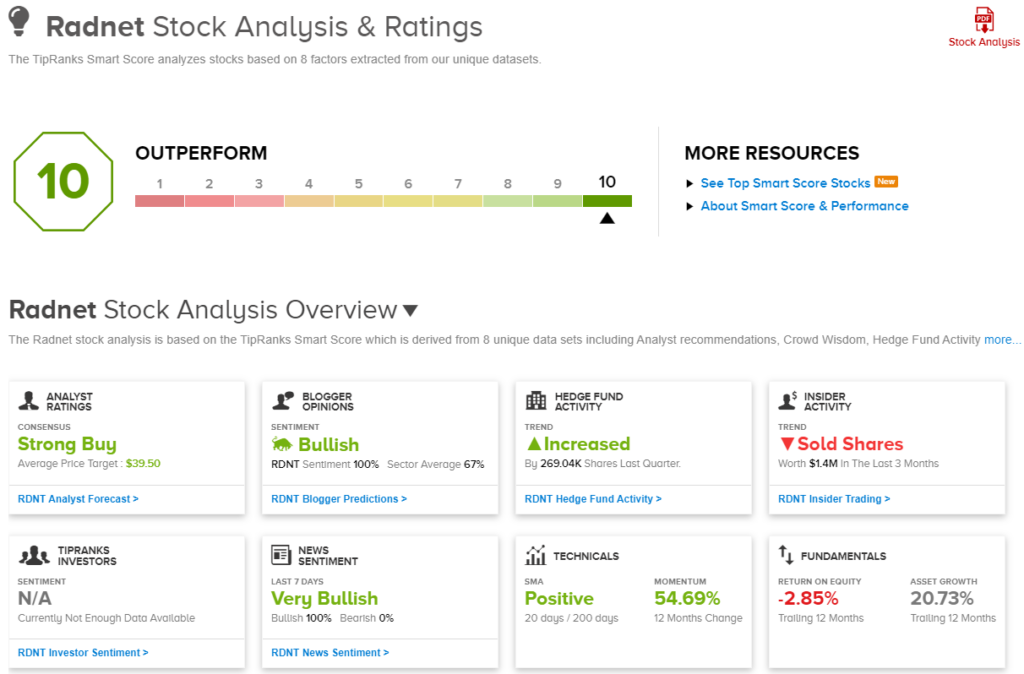

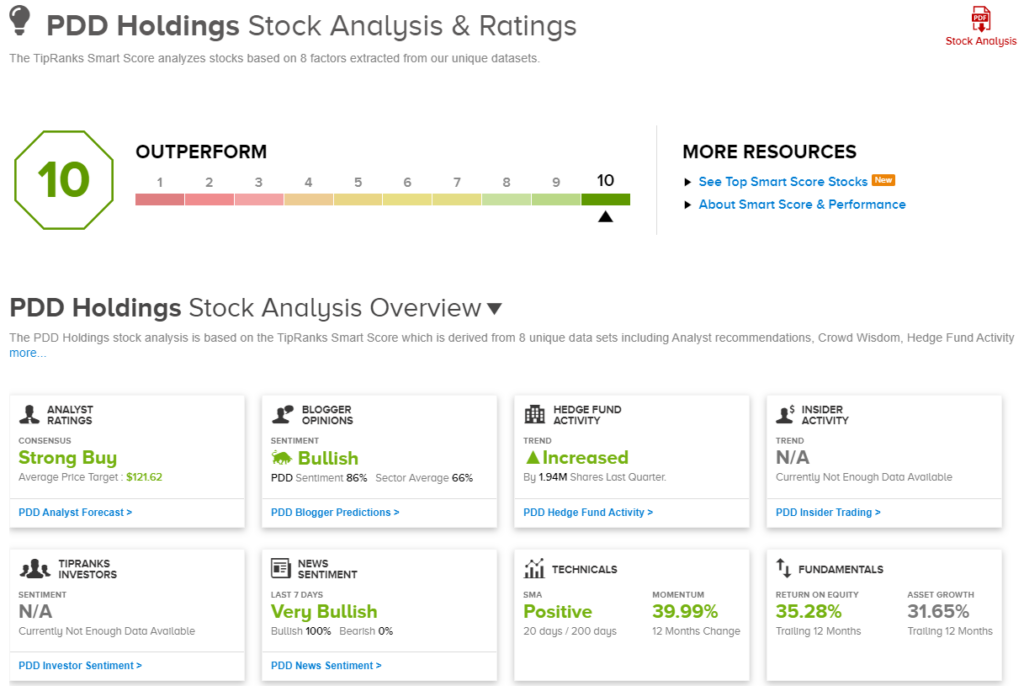

Enter the Smart Score. TipRanks’ innovative, AI-powered data collection and collation tool does the legwork, automatically gathering and sorting the stock market’s data – and then rating every stock according to how it stands up against a set of 8 factors, all known to correlate with future share outperformance. The result – a simple score for every stock, based on objective data, giving investors a quick-and-easy guide to a stock’s likely chances.

That all sounds like a mouthful, but what it comes down to is: a stock with a perfect Smart Score, a ‘Perfect 10,’ is a stock that deserves some extra attention. It’s as clear a signpost as an investor could want.

Sometimes, though, the sign even gets a bit clearer. When Wall Street’s analysts give their own ‘thumbs up’ to a stock, and that stock also holds a ‘Perfect 10,’ the clear signpost turns into a flashing neon arrow that’s impossible to ignore.

So let’s follow it. Here are the details on two top-rated stocks, each with a Strong Buy rating from the Street and a ‘Perfect 10’ from the Smart Score.

RadNet, Inc. (RDNT)

We’ll start in the healthcare industry, where RadNet is the US’ largest independent provider of outpatient imaging services. The company offers diagnostic imaging services through a network of 357 outpatient clinics across 7 states, and employs more than 9,000 people. RadNet services include a wide range of radiological imaging solutions, including cloud-based tech to manage the medical imaging workflow, and diagnostic imaging at all levels, including services such as bone scans, digital mammography, and MRIs, to body area imaging, to specialty care imaging, for brain health, cancer diagnoses, and sports injuries.

RadNet uses this wide portfolio to serve every stakeholder in the field of diagnostic imaging: patients, providers, and payors. The company offers the highest quality in imaging services, giving providers and patients access to the latest in advanced equipment, with competitive pricing to bring value for the dollar.

Quantifying the dollar value, RadNet can boast that its overall revenues have been on an almost constant rising trend throughout the years. In the last quarter, 2Q23, RadNet’s top-line revenue was $403.7 million, almost $13 million more than expected. That revenue figure was also up 14% year-over-year, and a quarterly record for the company. At the bottom line, the company’s revenue supported a $0.24 adjusted diluted EPS, up from $0.15 in the prior-year quarter – and 15 cents higher than had been forecast.

David MacDonald, a 5-star analyst from Truist, is optimistic about RadNet’s future. He sees RadNet’s wide-ranging services as a strong foundation for the company to grow going forward.

“The company has a high degree of geographic density in its key markets which we think provides attractive benefits (e.g. scheduling, labor, cost/quality), and we view RDNT’s broad, multi-modality suite of capabilities as positioning the company well to be an attractive partner for radiology groups, hospitals and health systems. Furthermore, we like the company’s capitated arrangements in the context of VBC (value-based care), view the commercial heavy payor mix and broad service offering as providing some insulation from reimbursement risk, and see potential opportunity from both the AI segment and Alzheimer’s over time,” MacDonald opined.

Going forward, MacDonald gives RDNT shares a Buy rating with a $40 price target that suggests a 33% upside potential for the next 12 months. (To watch MacDonald’s track record, click here)

With 4 recent positive analyst reviews on record, RadNet shares get a unanimous Strong Buy consensus rating from the Street’s stock pros. The stock is currently trading for $30.14, and its $39.50 average price target indicates potential for a 31% upside over the coming year. (See RDNT stock forecast)

PDD Holdings (PDD)

Next on our Perfect 10 list is PDD Holdings, the parent company of the leading Chinese e-commerce retailer Pinduoduo and the global online marketplace Temu. PDD’s business portfolio links people and local companies into the digital marketplace, so that everyone can reap the benefits of high productivity and growing opportunities.

Through its leading company, Pinduoduo, PDD reaches over 900 million users, and has an especially strong reach into the agricultural sector. The company has worked with over 16 million farmers and farming communities, bringing them into closer alignment with the digital world. PDD has an extensive network of sourcing, logistics, and fulfillment capabilities to support its component businesses.

A strong footprint in the world’s single largest online market – China has more than 1.4 billion people, after all – shows off PDD’s size.

In the most recent quarterly report, released late last month for 2Q23, PDD’s revenue was reported as $7.18 billion, a total that was 57% higher than in the prior year period – and was $1.15 billion above expectations. The $1.44 in non-GAAP diluted earnings per American Depositary Share (ADS) was 42 cents, or 41%, better than the estimates.

More impressive than just the beats on revenue and earnings, PDD pulled off this feat even as China’s economy is showing signs of a genuine slow-down.

Assessing the company’s prospects, Goldman Sachs analyst Ronald Keung specifically cites Pinduoduo’s position near the top of China’s retail ecosystem as key. Keung states, “We continue to be positive on PDD’s longer-term outlook, as we note (1) Pinduoduo maintains the strongest value-for-money mind share amongst Chinese consumers eCommerce platforms, despite more aggressive strategies from Alibaba/Douyin, and Pinduoduo’s strong presence in relatively under-penetrated fresh/groceries categories, (2) undemanding valuation of 13x 2023E domestic main platform adj. NOPAT (net operating profit after tax) with faster-than-peers growth outlook; and (3) free option value in Temu, tapping into overseas TAM with strong traction despite geopolitical risks/our estimate of Rmb29bn loss drag this year.”

Along with a Buy rating on the shares, Keung’s $129 price target together imply a one-year upside potential of 35%. (To watch Keung’s track record, click here)

The 13 recent analyst reviews of this stock include 12 Buys against just a single Hold, and give the shares a Strong Buy consensus rating. The share price here is $95.34 and the average price target is $121.62, pointing toward a 27.5% potential upside in the year ahead. (See PDD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.