AI – artificial intelligence – has been stirring up the tech pot in recent times. With the release of ChatGPT, and the explosion of AI-powered natural language into the realm of online search, content creation, and even picture editing, it’s become clear that AI is the next frontier of the tech space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A sudden boom of this sort will always bring opportunities with it. New jobs and new products, of course – but also renewed opportunities in the stock market. Companies related to AI, either directly or through connections to high-profile applications such as ChatGPT, will find or forge new paths, and they’ll be hungry for investors.

Investors, however, will need to take care in choosing where to put their funds. Some AI-related firms are more equal than others, and some careful sorting is in order before buying in. That brings us to the Smart Score, the AI-powered tool from TipRanks that collects and collates all the data on more than 8,400 publicly traded equities, and rates them according to 8 factors that are strongly correlated with future outperformance. The combined score is given according to a simple linear scale, 1 to 10, with a ‘perfect 10’ indicating a stock that clearly deserves a closer look.

The combination of a Perfect 10 with a strong connection to AI/ChatGPT should make a solid starting point for today’s tech investments. Here are two such stocks, presented along with comments from the Wall Street analysts.

Perion Network (PERI)

We’ll start with Perion Network, an innovative leader in the global digital advertising business. The company focuses on increasing engagement for its clients, through ad search, social media, and video/CTV content, and estimates its potential market as $300 billion or more. That’s not peanuts, so a big opportunity there for Perion.

The company is already part of a strategic relationship with Microsoft and its Bing search engine, and that leads to its direct AI connection. Microsoft has publicly gone big on AI and ChatGPT as the base for improving and upgrading Bing; Perion and Bing work together in a strategic partnership for search engine advertising. In fact, Perion’s earnings show a strong correlation with Bing’s user numbers – and the integration of ChatGPT into Bing has already had a strong effect on Perion’s financial results.

That was visible in Perion’s last quarterly report, for 1Q23 – the first full quarter after the release of ChatGPT. The company showed a 16% year-over-year increase in total revenue, jumping from $125.3 million to $145.2 million. This total included y/y increases of 16% in ‘display advertising revenue’ and 15% in ‘search advertising revenue.’ At the bottom line, Perion’s non-GAAP net income grew 44% y/y, to reach $29.9 million; this gave an EPS figure of 60 cents per share, up 36% from the 44 cents reported in the year-ago quarter.

In addition to solid y/y growth, the company’s results also came in higher than expected. Perion’s revenue total beat the forecast by $3.8 million, and the non-GAAP EPS was 10 cents higher than the estimates.

Video revenue provided a large share of Perion’s growth, with a 26% y/y increase. Vid revenue made up 44% of the total display advertising revenue, an increase from the 41% in the prior-year quarter. This growth was supported by a 63% y/y increase in the number of video platform publishers.

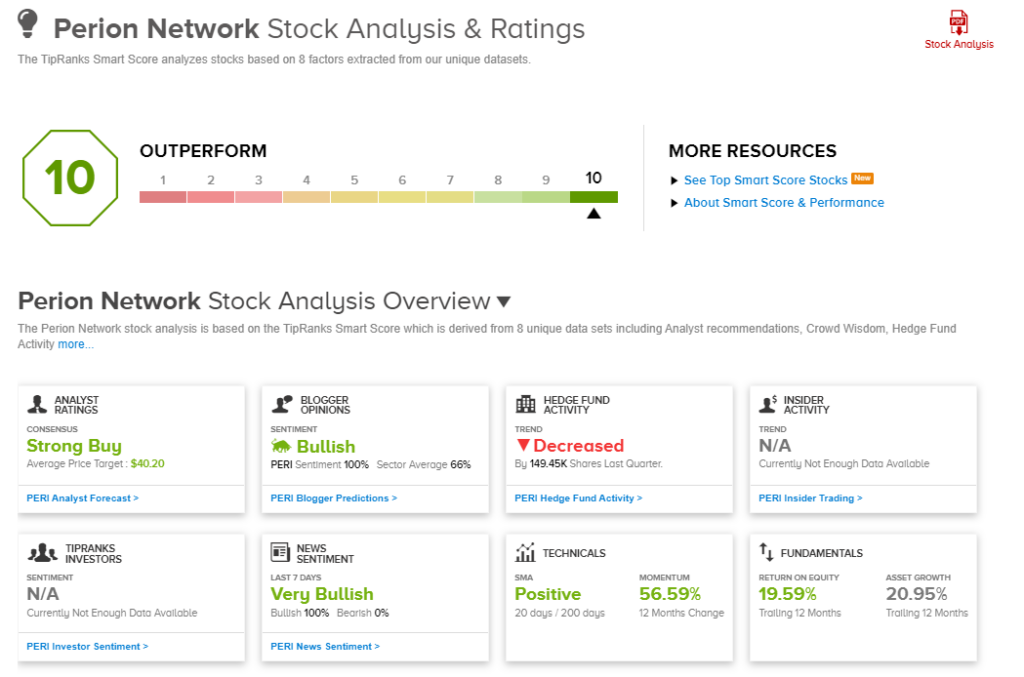

Turning to PERI’s Smart Score, we find that Perion checks nearly all the boxes. The stock has sound technical and fundamental factors, but the biggest boost comes from the sentiment measures. The financial bloggers are 100% positive on PERI, compared to a 67% sector average; the news sentiment is 100% positive, as well; the crowd wisdom on PERI registers ‘very positive,’ as individual investors have increased their holdings in the shares by 42% in the last 30 days. And, of the hedge funds tracked by TipRanks, PERI holdings were up more than 344,000 shares last quarter. This all adds up to a Perfect 10.

The Street’s analysts are also bullish. Needham’s Laura Martin, an expert in the tech sector, sums up the prospects for Perion: “Of all the public AdTech companies, PERI has the most near-term upside from ChatGPT because it distributes Bing (owned by Microsoft) in 60 countries, including the US, Canada, India, UK, etc. In 1Q23, PERI reported nearly 30mm monetized searches per day, out of a total of 150mm searches. PERI gets a rev share of the Bing ad revs from its clients in these countries. In 1Q23, PERI reported that 45% of its total revs were from its Bing search affiliates, up 15% y/y.”

Martin’s comments back up her Buy rating on the stock, while her $42 price target indicates her confidence in a 37% share appreciation over the next 12 months. (To watch Martin’s track record, click here.)

There are 5 recent analyst reviews on Perion and they break down 4 to 1 in favor of Buy over Hold, to give the stock its Strong Buy consensus rating. The shares are currently trading for $30.63 and the $40.20 average price target implies a one-year upside potential of 31%. (See Perion stock forecast)

Nvidia Corporation (NVDA)

For the second stock on our list, we’ll shift gears slightly and look at one of the leaders in the world’s semiconductor chip industry. Nvidia has built a solid reputation in the graphics processing unit (GPU) segment, and holds approximately 70% market share in these high-end chips. The strong market share in GPUs has benefited Nvidia greatly in recent years; GPUs are in high demand from both professional graphic designers and serious online gamers. In addition, GPU’s high computing capacity has found application in AI and machine learning systems, as well as data processing, ‘smart’ home and city technology, and IoT.

That’s the good news. The bad news is that, post-pandemic, Nvidia’s gaming segment slid through much of fiscal year 2023, hurting the company’s revenues and earnings. In the most recent quarter, the company did report a rebound in gaming, and importantly, it detailed ongoing moves into the AI sector, making the company well-positioned to benefit from this secular trend.

In the fiscal year 2023, which ended on January 29 of this calendar year, the company reported a top line of $26.97 billion, essentially flat from the $26.91 billion reported in fiscal 2022. Nvidia’s sales growth dropped off starting in the second fiscal quarter, and in the last reported quarter, fiscal 4Q23, the company’s top line of $6.05 billion, was down 21% y/y. At the bottom line, the non-GAAP EPS was reported at 88 cents, compared to $1.32 in the prior-year period. It should be noted, however, that both the top-and bottom-line results beat expectations.

On the AI side, Nvidia has made its AI platform available as a cloud offering in partnership with leading cloud software providers, including Microsoft and Google. AI chips feature prominently in Nvidia’s data center business, which is responsible for the bulk of revenue – and saw an 11% increase y/y to $3.62 billion in FQ4. The automotive and robotics segment of Nvidia’s business, which is also tied to AI and includes cloud access, showed gains y/y, growing 135% from fiscal 4Q22 to reach $294 million.

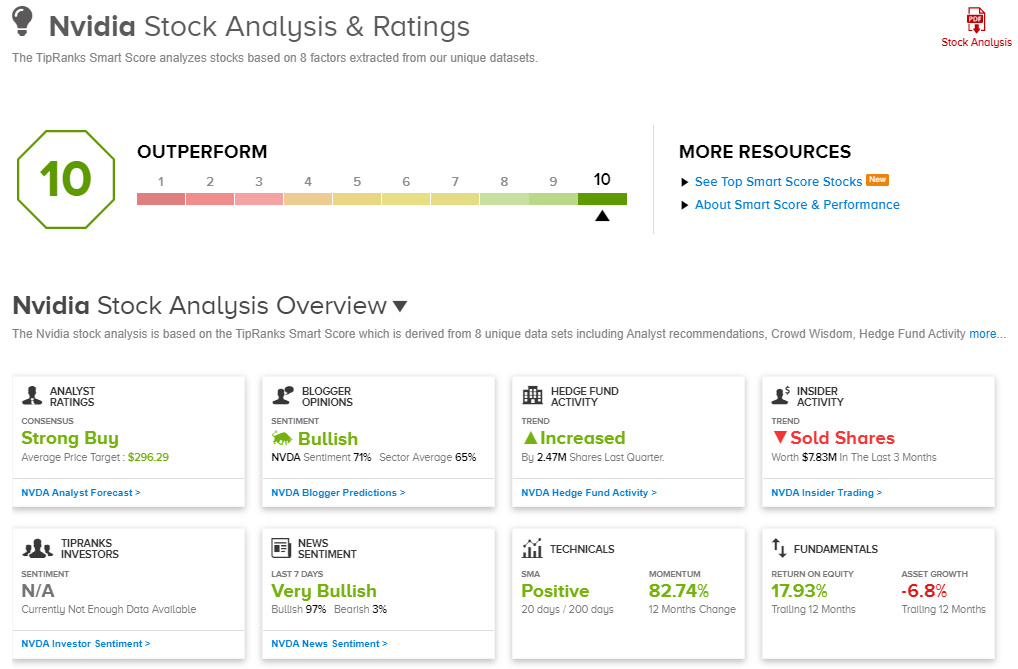

Investors have bought into the NVDA AI story, and the shares are up by 114% year-to-date. This jibes well with the strong sentiment factors in the ‘Perfect 10’ Smart Score. Nvidia scores high on blogger sentiment (71% positive), on crown wisdom (holdings up 5.6% in the last 30 days), and on news sentiment (97% positive). The hedges increased their shares in Nvidia by 2.5 million last quarter, a clear sign of confidence.

So, it’s no wonder that this stock caught the attention of HSBC analyst Frank Lee, who is somewhat taken aback by the opportunity at play. He writes, “We’re shocked by Nvidia’s pricing power on AI chips that we see driving earnings upside, higher valuation… Given the aggressive rollout of ChatGPT by Microsoft as well as other AI initiatives from US and Chinese cloud service providers, we expect AI GPUs could contribute additional revenue of USD5.2bn and USD11.1bn in FY1/24e and FY1/25e… We also acknowledge further re-rating potential on Nvidia’s market dominance (>80% market share) and the fact that it is a prime beneficiary of the AI trend.”

Lee goes on to rate NVDA as a Buy, and he sets a $355 price target to suggest a 13% upside in the coming months. (To watch Lee’s track record, click here.)

Of the 37 recent analyst reviews on file for NVDA, 29 are to Buy and 8 are to Hold – for a Strong Buy consensus rating. The shares’ rapid increase this year, however, has pushed the trading price above the average price forecast; Nvidia is trading for $312.64, but the analysts’ average price prediction currently stands at $296.29. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.