Rewind back to mid-November and investors reacted with dismay to ChargePoint’s (NYSE:CHPT) preliminary Q3 announcement.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The EV charging network operator said revenue for the quarter would be in the range between $108 to $113 million, compared to the $150 to $165 million expected beforehand. Investors rushed to the exit doors, sending shares down by 35% in the subsequent session. This only added to the misery of a name that was already struggling in 2023; throughout the year, the shares had shed 76%.

So, investors knew more or less what was coming when the company delivered its third quarter of fiscal 2024 report (October quarter) on Wednesday.

The eventual revenue haul came in at $110.28 million, amounting to a 12% year-over-year drop and still falling shy of expectations by $8.3 million. There was a miss on the bottom-line too, with EPS of -$0.43 underwhelming by $0.12.

That said, targeting operational improvements, lowering opex, pushing gross margins modestly higher and factoring in only slight revenue growth next year, the company stressed it is still on course to reach positive adjusted EBITDA by the end of FY25 (CY24).

For J.P. Morgan analyst Bill Peterson there were several takeaways from the earnings call that offer optimism for ChargePoint as we head into the next year. These include: “1) clear management focus on operational excellence that is already in motion, 2) a channel that appears to be lean, which indicates no/ limited destocking ahead, 3) no signs of share loss (and if anything market share may be increasing), 4) consistent growth in the Software and Services segment that acts as a natural dampener to the more cyclical hardware segment, and 5) a solid balance sheet with no need to raise capital in 2024 assuming the team reaches its profitability targets.”

As far as sentiment around the stock is concerned, while assuming it could be a few quarters before ChargePoint is ready to “deliver solid execution and for negativity across the EV value chain to subside,” Peterson thinks patient investors will eventually be rewarded with “significant upside.”

Significant upside, indeed. Peterson’s price target stands at $5, making room for 12-month returns of 144%. Peterson’s rating remains an Overweight (i.e., Buy). (To watch Peterson’s track record, click here)

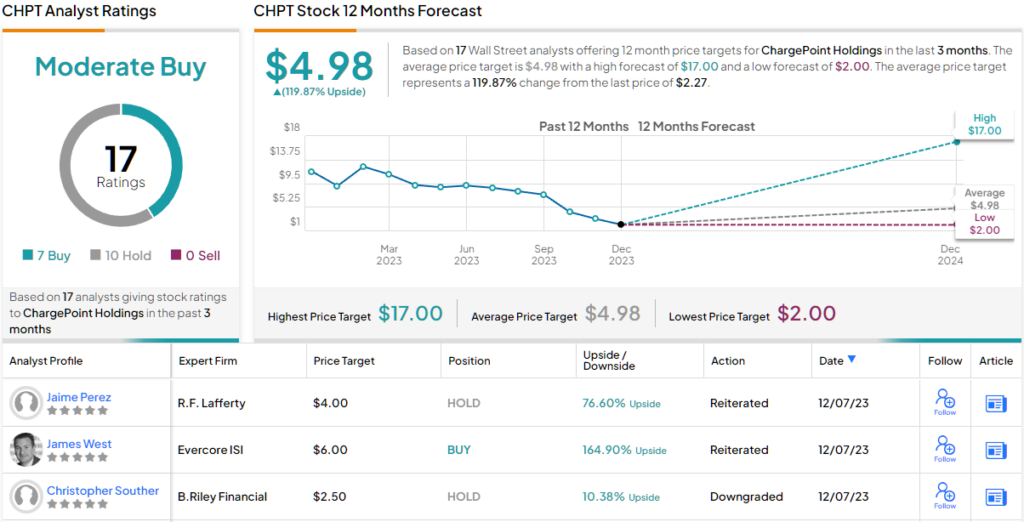

Overall, CHPT gets a Moderate Buy rating from the Street’s analyst consensus, based on 17 recent reviews that include 7 Buys and 10 Holds. The shares are trading for just $2.27 and their $4.98 average target price suggests a one-year upside potential of ~120%. (See CHPT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.