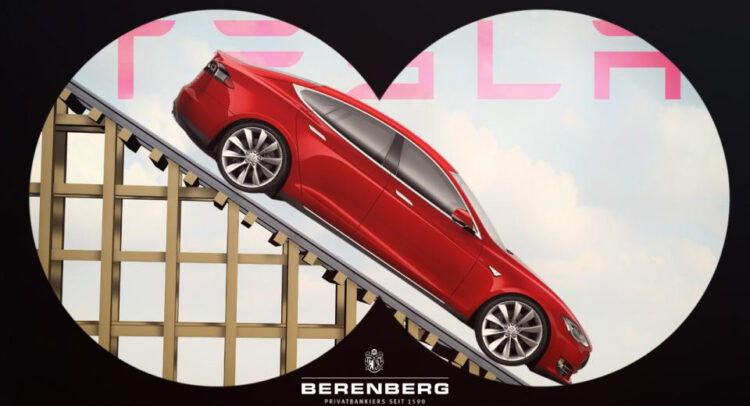

After a big build up, Tesla’s (NASDAQ:TSLA) recent investor day turned out to be a bit of a disappointment. Since the event, Tesla shares have been heading in one direction: down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The negative stock action, according to Berenberg analyst Adrian Yanoshik, was “partly caused by the limited new detail on the launch of a new, lower-priced model.”

That said, within the next year, Yanoshik still expects Tesla will release the details of a new vehicle model. And by moving into a new, smaller vehicle segment, Tesla could unlock a big volume opportunity.

“It could expand Tesla’s total addressable market (TAM) by cUSD1trn, which is 75% larger based on our forecast of market size in 2026,” Yanoshik went on to add.“ However, Yanoshik also thinks this will be a slow rollout, with 2028 the earliest the company breaks through a 1 million vehicle delivery run rate.

In the meantime, growth could come from elsewhere, with the recent price cuts representing an “investment in growth.” At the expense of near-term margins, Tesla’s growing production capacity allows the company to price its vehicles to boost volumes.

“This positions them competitively against new electric vehicle (EV) launches as the Berlin and Austin plants ramp up, replicating elements of Shanghai’s low-cost processes,” notes Yanoshik.

And following an expected “price-led margin blip” in 2023, as the production mix shifts away from the steep labour costs, “inefficient” layout and old equipment at the Fremont, California facility, Yanoshik anticipates margins will slowly recover.

What does it all mean for investors? Well, although the shares have been on the backfoot in recent sessions, the analyst sees “less upside in the shares” from current levels.

As a result, Yanoshik downgraded Tesla stock to Hold (from Buy), while issuing a $210 price target. (To watch Yanoshik’s track record, click here)

8 other analysts join Yanoshik on the sidelines, but with an extra 21 Buys and 3 Sells, the consensus view is that TSLA stock is a Moderate Buy. Over the next year, the shares are expected to deliver returns of 16.5%, considering the average price target currently stands at $211.93. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.