Considering the tough macro environment and its impact on the markets, investors can be forgiven for some indecision when it comes to choosing stocks right now. But there are clues, hints that will point out the right stocks, even in an unsettled market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The simplest move, of course, is to look for quality stocks that have fallen sharply in recent months, down to bargain-level prices. The adage is ‘buy low and sell high,’ and fundamentally sound stocks that have fallen 50% or more in less than a year are prime targets for such a strategy.

And the prospects for selling high later may be better than the pundits have been predicting, according to BMO’s chief investment strategist Brian Belski.

“From our perspective, market prognostications have become increasingly academic this year with many choosing what we believe are the ‘easy’ and ‘scary’ options. For our part, we have learned that hardly anything has been textbook or easy the past few years for US stock market performance, and that is something we do not expect to change in the coming months either… we truly believe that stocks can and should rebound from current levels,” Belski opined.

Quantifying that potential rebound, Belski believes the S&P 500 can see a gain of 20% in 4Q22.

Against this backdrop, using the TipRanks platform, we have pinpointed 2 names which all fit a certain profile; beaten-down stocks that are rated as Strong Buys by the Street’s experts and are poised to forge ahead over the coming months. Let’s take a closer look why the analysts think these names could make compelling investment choices right now.

Aspen Aerogels, Inc. (ASPN)

We’ll start with Aspen Aerogels, a firm that has specialized in aerogel insulation materials for the last 20 years. Aerogels use a liquid-filled internal pore space, filled with gas, to create an ultra-low density solid purposed as high-end, multi-use, light-weight insulation. Aerogels are capable of retaining their structural strength and integrity in combination with low thermal conductivity ratings. The company’s aerogel products are used in a wide range of sectors, including construction, petrochemical refining, liquid natural gas storage, and even in the manufacture of electric vehicle battery packs.

A high-end product with such a wide range of uses makes for a solid sales foundation – and Aspen has seen rising revenues for the past two years. In the last quarter reported, 2Q22, Aspen showed a quarterly revenue of $45.6 million, up 44% year-over-year. At the same time, the company runs a quarterly net loss – typical for cutting edge technology firms – which expanded y/y in 2Q22 from $6.7 million to $24.1 million.

Aspen’s pattern this year has been a combination of rising revenues, deepening quarterly losses – and a declining share price. ASPN shares are down an eye-popping 82% this year.

Meanwhile, the company has been working recently on development and optimization of its PyroThin aerogel products, a lightweight, fire-proof thin insulation with potential applications in the EV battery market.

The EV market is at the center of Canaccord analyst George Gianarikas’ view of Aspen’s path forward. The analyst writes: “Aspen’s aerogel materials are compatible with ~80% of EV battery architectures that opt for pouch/prismatic battery cell designs – presenting a lucrative market opportunity as OEMs transition to EVs. Today, Aspen has contracts to supply its PyroThin thermal barrier to GM and Toyota with ~$3B in potential program awards through 2028. We also estimate strong interest among other auto OEMs and expect additional contracts to be announced over time.”

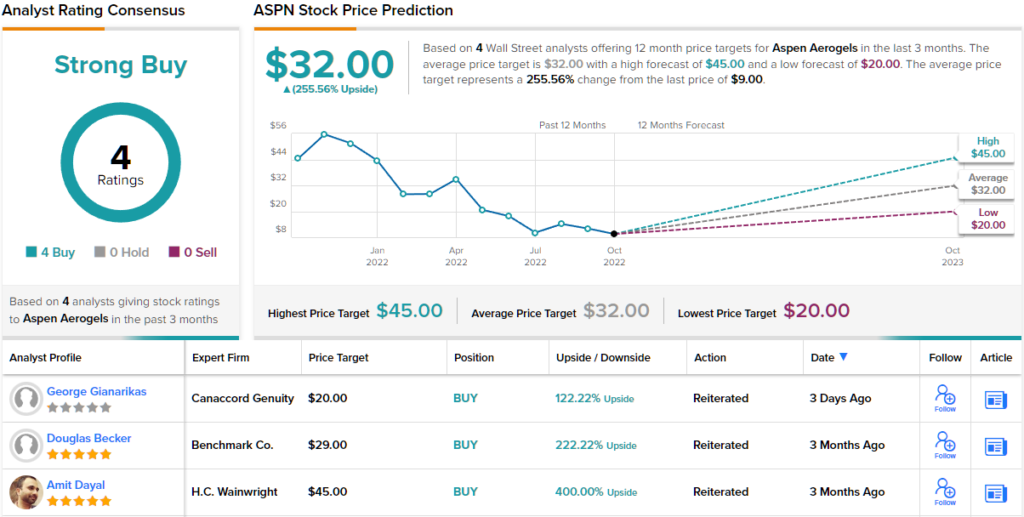

Looking forward, Gianarikas puts a Buy rating on ASPN, and sets a price target of $20, suggesting an upside of 122% for the year ahead. (To watch Gianarikas’ track record, click here)

Overall, Aspen has picked up 4 analyst reviews recently, and all 4 are positive – giving the stock its Strong Buy consensus rating. The shares are priced at $8.99, and the $32 price target is even more bullish than the Canaccord view, implying a gain of ~255% in the next 12 months. (See ASPN stock forecast on TipRanks)

Marvell Technology Group (MRVL)

Next up is Marvell Technology, another tech firm, but one with a very different bent and niche than Aspen. Marvell is a maker of silicon semiconductor chips, and markets its products in the automotive sector, where they are used in autonomous vehicle systems; in the data center sector, where they are applied to server functions; as well as ethernet networks and storage accelerators. Marvell’s chips are also used in SSD controllers.

Marvell is profitable – highly profitable. In August, the company reported its Q2 results for fiscal year 2023 in which it posted diluted EPS of 57 cents per share. The top-line showed record quarterly revenues of $1.52 billion, up 41% year-over-year.

Despite these gains, Marvell’s stock has fallen sharply through 2022, and is now down 55% year-to-date. We should note here that looking forward, Marvell’s Q3 guidance came in slightly below expectations – and that the company is under continuing pressure due to a combination of ongoing supply constraints and fears of a weakening macro.

These current headwinds, however, haven’t stopped Wells Fargo’s 5-star analyst Gary Mobley from seeing a clear path forward for this chip maker.

“While MRVL won’t be able to completely avoid global macro pressures, we believe the company is heavily insulated from the consumer weakness that has been most pronounced in the current macro softness. When the global economy does find more sure footing, we believe MRVL’s fundamentals and share price can outperform peers’ in the broader chip sector,” Mobley wrote.

Mobley quantifies his bullish stance on Marvell with an Overweight (i.e. Buy) rating, and a $58 price target that implies an upside of 51% on the one-year horizon. (To watch Mobley’s track record, click here)

This stock has plenty of support on Wall Street, with a Strong Buy rating from the analyst consensus, based on 17 recent analyst reviews that include 15 Buys against just 2 Holds. The shares are currently trading for $38.39 and have an average price target of $70.53, indicating a one-year upside potential of ~84%. (See MRVL stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.