Tilray (TLRY) stock appears poised to soar, along with the company’s EBITDA, in the coming years. Here’s a look at the Canadian cannabis company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TLRY is focused on conducting medical cannabis research, along with the processing, distribution, and cultivation of products worldwide. The company also supplies cannabis products to pharmaceutical distributors.

It is the world’s largest cannabis company, with the operational scale and strategic footprint to compete effectively in the market. (See Tilray stock charts on TipRanks)

The company has established a network of consumer chains, thanks to its robust capital structure, highly scalable operational footprint, organized executive team, and passion for improving the quality of life of its customers. This author is bullish on TLRY stock.

Tilray’s Valuation

While Tilray enjoys a lengthy growth runway, backed by current growth momentum, it still needs to grow into its valuation. While the company is profitable on a forward EBITDA basis, it is not expected to turn a GAAP net profit for the foreseeable future.

The EV/forward revenue ratio is pretty attractive at just 7.9, but the EV/forward EBITDA ratio is still quite high at 67.8. Fortunately, growth is expected to be strong over the next several years, with EBITDA expected to surge by 197.4% in 2021, 129.5% in 2022, and 66.9% in 2023.

Wall Street’s Take

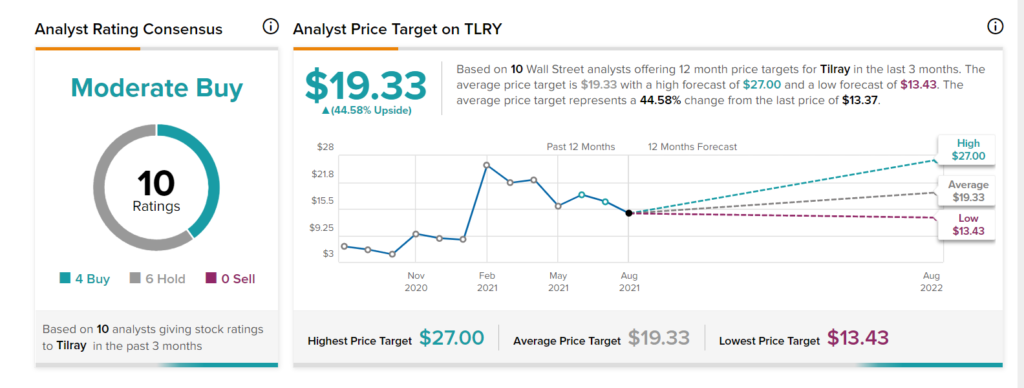

From Wall Street analysts, Tilray earns a Moderate Buy consensus rating based on four Buy ratings, six Hold ratings, and zero Sell ratings in the past three months. Additionally, the average TLRY price target of $19.33 puts the upside potential at 44.6%.

Summary and Conclusions

Tilray is enjoying rapid growth, thanks to its strong presence in a dynamic-growth industry. EBITDA is expected to soar over the coming years, making the 67.8 EV/forward EBITDA ratio more palatable than it might otherwise appear.

Furthermore, Wall Street analysts are generally bullish on the stock. As a result, the current valuation looks pretty attractive. The stock looks like it could be a good buy.

Disclosure: On the date of publication, Samuel Smith had no position in any of the companies discussed in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.