Tilray’s (TLRY) descent from the lofty peaks achieved during the 2018 Canadian pot industry boom has been brutal – shares are down 96%, as it happens.

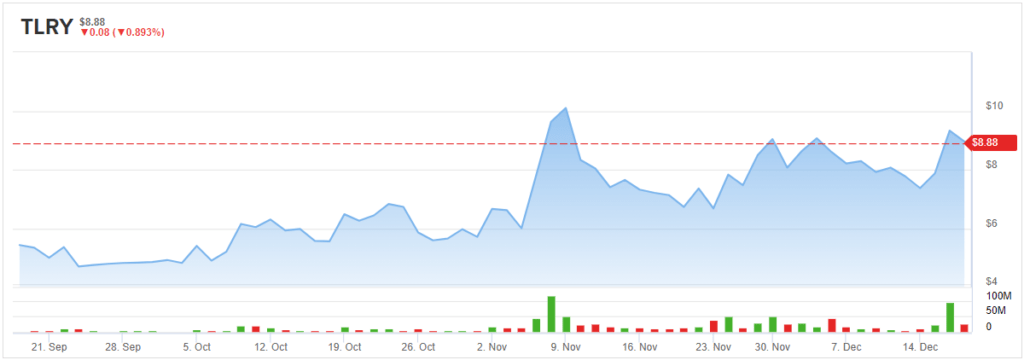

However, the Canadian cannabis player is on the verge of a turnaround. Tilray’s stock surged 14% this week after announcing a merger with Aphria in a deal valued at $4 billion.

The merger will result in the biggest Canadian LP, over which Aphria CEO Irwin Simon will preside while his counterpart Brendan Kennedy will become a board member. The deal is anticipated to be sealed by 2Q21.

Aphria will pay a 23% premium in an all-stock transaction, which will give Aphria shareholders ownership of 62% of Tilray stock. The newly formed company will keep the Tilray name.

The combined entity will now command 17% of market share in Canada. For Aphria, as the country’s number one retail seller, the move will bring it a step closer to its goal of owning 30% in this highly competitive market. It also furthers the opportunity in the European cannabis market, where Tilray has a stronger presence.

So, who wins from this merger?

Overall, BMO analyst Tamy Chen thinks it is “an Incremental positive for industry consolidation,” although in this particular case, it is tilted in Tilray’s favor, given the 23% premium Aphria paid for its acquisition.

However, the analyst remains skeptical on various aspects of the merger, including management’s bullish tone on the “European cannabis opportunity,” of which Chen remains “cautious with respect to meaningful growth.”

Considering the “$100 million of synergies,” management is expecting over the next two years, Chen notes, “conceptually it is feasible to achieve but there is execution risk given the complex transaction.”

Additionally, the strategy for consolidation in the largest market of all – the U.S. – remains “unclear.”

“We believe the MSO model (with all its state-by-state infrastructure) would be the most direct path to U.S. cannabis exposure upon federal legalization,” Chen said. “TLRY’s Manitoba Harvest platform and APHA’s recently acquired U.S. craft brewer SweetWater are not as direct of pathways to U.S. cannabis as the MSO model and we believe upon federal legalization, would take time to extend into U.S. cannabis.”

Overall, Chen reiterated a Market Perform (i.e. Hold) rating on TLRY shares along with a $9 price target, suggesting shares will stay range-bound for the foreseeable future. (To watch Chen’s track record, click here)

Most Street analysts agree. Based on 1 Buy, 7 Holds and 1 Sell, the analyst consensus rates Tilray a Hold. At $9.75, the average price target implies ~10% upside potential from current levels. (See TLRY stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.