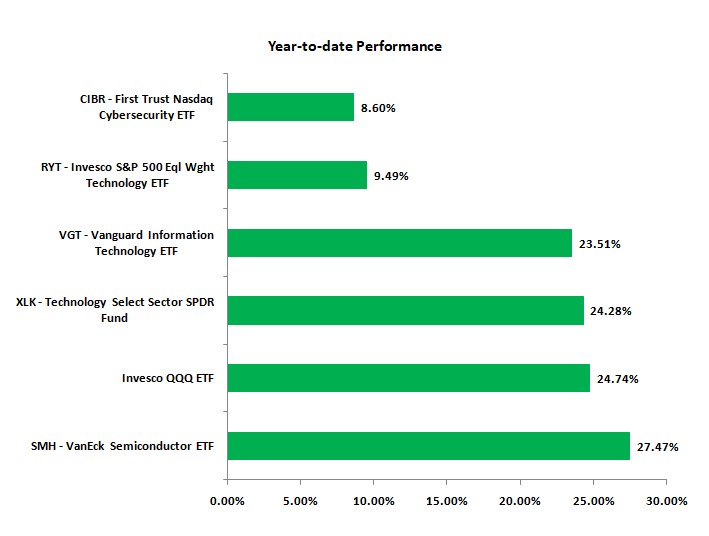

Thanks to the recovery in the shares of technology companies, the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100 index (NDX), has delivered a year-to-date return of 24.74%. While QQQ outperformed the broader market and most of its peers (refer to the graph below), the VanEck Semiconductor ETF (SMH) has edged past QQQ and registered a gain of 27.47% so far in 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The SMH ETF, which tracks the MVIS US Listed Semiconductor 25 Index (which includes companies involved in semiconductor production and equipment), benefitted from the sharp recovery in the prices of chip companies like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD).

It’s worth highlighting that NVDA stock has more than doubled this year. Further, it is up about 25% in the after-hours of trade following its stellar Q1 beat and robust outlook on the back of growing AI (Artificial Intelligence) demand. Meanwhile, AMD stock is up over 67% year-to-date. NVDA and AMD stock together account for 21.09% of SMH’s total holdings.

SMH has delivered an average annualized return of 22% in the past decade and is up about 675.5%. In comparison, the S&P 500 Index (SPX), QQQ, and NDX have gained nearly 149%, 395%, and 355%, respectively.

What is the Price Target for the SMH ETF?

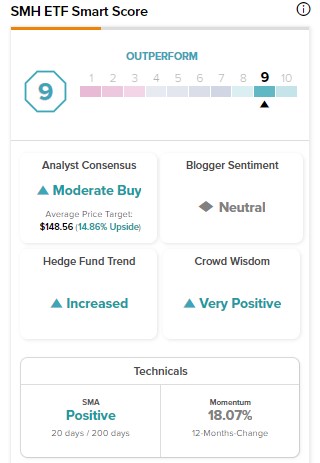

The SMH ETF has a Moderate Buy consensus rating on TipRanks. Among the 373 analysts providing ratings on the holdings of SMH, 67.02% have given a Buy rating, 28.95% have assigned a Hold rating, and 4.02% have given a Sell rating.

Per the recommendations of 373 analysts, the 12-month average VanEck Semiconductor ETF price target of $148.56 implies 14.86% upside potential.

While the VanEck Semiconductor ETF outperformed broader markets and peers, its expense ratio of 0.35% remains low, making it an attractive investment. Overall, SMH stock has an Outperform Smart Score of nine on TipRanks.