With the rise of ChatGPT, AI (artificial intelligence) has been generating an enormous amount of buzz this year, based on the tech’s potential to impact so many facets of everyday life and the way we interact with the world around us.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But is it really a seismic development or just overhyped tech? Billionaire entrepreneur Mark Cuban falls resolutely in the former camp. Having recently waded in on the conversation, Cuban has said the tech’s potential is “beyond anything I’ve ever seen,” comparing ChatGPT to HTML and the early days of the internet.

Cuban’s advice to companies is simple: get in on the AI game or risk becoming a dinosaur. “There are two kinds of companies in the world, Those who are great at AI, and everyone else,” Cuban opined.

Of course, some companies are already ahead of the curve and are making huge investments in AI to catch a significant chunk of this potentially mega-huge industry. With this in mind, we used the TipRanks database to get the lowdown on two names working hard on the AI front who get the endorsement of Wall Street’s analysts. Let’s take a deeper look.

Alphabet (GOOGL)

Given its investment in ChatGPT, Microsoft is considered to have gotten a head start in the AI arms race, but Alphabet is not about to throw the towel in. Google’s parent company has its fingers in many pies – from the core search engine business to YouTube to the Android operating system and self-driving car firm Waymo – but has also made significant investments in AI over the years.

Recent headlines have been about its ChatGPT retort, its chatbot Bart, but you can trace the beginning of the company’s serious AI journey to the 2015 acquisition of AI research company DeepMind. Alphabet has invested in several other AI startups and companies, while it also operates an AI research lab called Google AI, which is focused on developing new AI technologies. More recently, the firm’s late-stage venture capital arm, CapitalG led a $100 million investment in corporate data company AlphaSense.

And this week, the company’s Google I/O 2023 developer event took place, where the company announced new AI-powered features for its products and services, such as Google Search and Android and launched new hardware products, such as the Pixel Fold foldable smartphone and a Pixel tablet.

If investors were previously concerned about Alphabet losing ground to Microsoft, following the event, Morgan Stanley analyst Brian Nowak puts those fears to rest.

“Google I/O showcased GOOGL’s strong long term AI competitive position across search, the developer community and productivity apps,” the analyst said. “AI is reshaping all of GOOGL’s products faster than expected as many of its newly announced AI features/products are rolling out over the coming weeks and months. Its speed of innovation and go-to-market motion are improving, which should make investors feel more comfortable about GOOGL’s long term positioning despite recent competitive concerns. Successful integration of these new AI features into Google’s 6 products that serve over 2bn users, and 15 products that serve more than 500mn users should build further confidence in AI driven upside to come.”

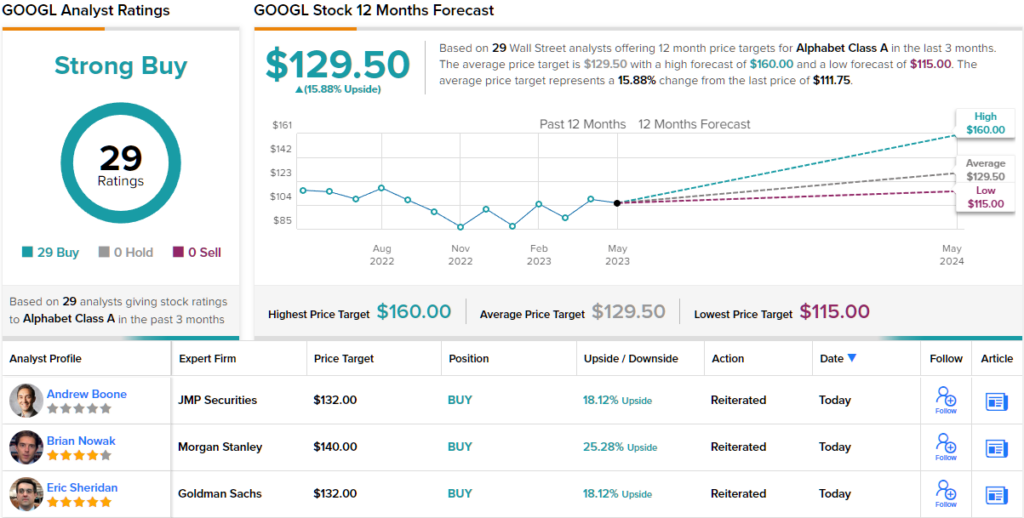

To this end, Nowak rates GOOGL shares an Overweight (i.e., Buy) while his $140 price target makes room for one-year returns of 25%. (To watch Nowak’s track record, click here)

No one on Wall Street seems to have a problem with that assessment. All 29 recent analyst reviews on GOOGL are positive, naturally resulting in a Strong Buy consensus rating. Going by the $129.50 average target, the shares will climb ~16% higher over the one-year timeframe. (See GOOGL stock analysis)

Five9 (FIVN)

The AI opportunities are not the preserve of only Big Tech. Smaller companies are in the game too, ones such as Five9, a leading CCaaS (Contact Center as a Service) company. Five9 provides cloud-based contact center software to businesses with the software designed to help organizations improve customer experience and increase productivity while reducing costs. The offerings include omnichannel routing, IVR (interactive voice response), speech recognition, workforce management, and reporting and analytics.

Five9 uses AI and machine learning tech to improve the efficiency and effectiveness of its contact center software and the AI capabilities are integrated into various features of their platform, including automated chatbots, speech recognition for customer self-service and predictive analytics.

Going by the recent Q1 report, the business is in good health. Revenue climbed by 19.5% year-over-year to $218.4 million, beating the Street’s forecast by $10.42 million. Adj. EPS of $0.41 also trumped the $0.24 expected by the analysts. For the full year 2023, the company sees revenue hitting the range between $906.0 to $909.0 million, some distance above consensus at $902.61 million.

Despite the strong results, Five9 shares have been on the backfoot this year, and that is partly down to fears that the rise of AI could actually make services like the ones Five9 offers redundant.

Au contraire, says Piper Sandler analyst James Fish, who highlights the positive noises made by the company on the matter.

“While bears point to ChatGPT/ LLM technology as a headwind to the space, management confirms our AI thesis, noting adoption of AI is both accretive to revenue and the CCaaS TAM overall,” Fish wrote. “AI is acting as the main catalyst behind most of Five9’s large wins. New logo resilience remains with Five9’s pipeline hitting new highs and up 2x Y/Y, with further forward stability coming from a meaningful acceleration in long-term RPO, and management looking to continue to hire across the organization to support the pipeline.”

“We believe these recent pullbacks provide opportunities for shareholders to buy into this strategic space that is an AI beneficiary, with a favorable competitive landscape, conservative 2023 guide, & large-deal catalysts on the horizon,” Fish went on to add.

What does this all mean for investors? Fish rates FIVN an Overweight (i.e., Buy), along with an $89 price target. There’s plenty of upside – 63% to be exact – should the target be met over the next 12 months (To watch Fish’s track record, click here)

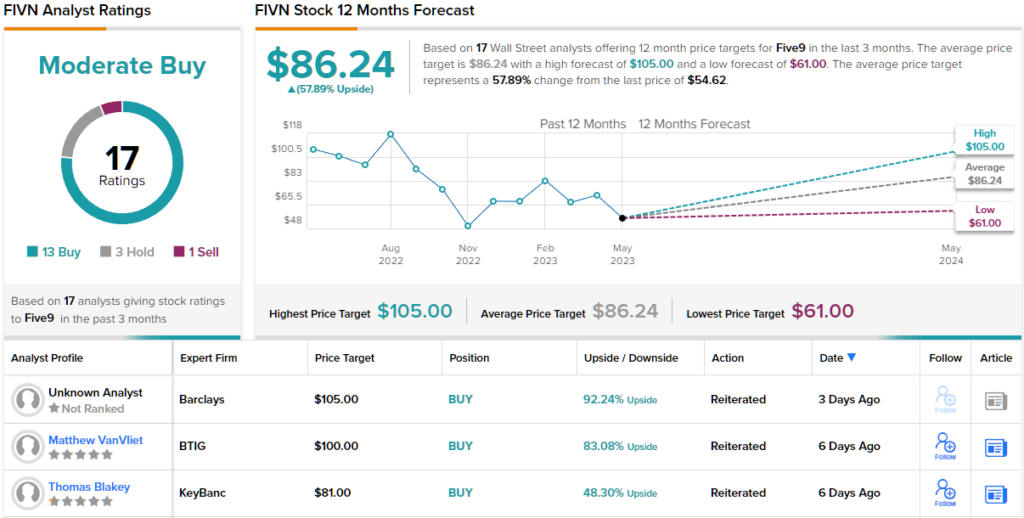

Most of Fish’s colleagues are on the same page. Based on 13 Buys, 3 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. A year from now, shares are anticipated to change hands for ~58% premium, considering the average target clocks in at $86.24. (See FIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.