Buoyed by its leading position in Generative AI, Microsoft (NASDAQ:MSFT) investors have had plenty to shout about this year. The proof is in the pudding, with the shares up by 45% on a year-to-date basis. Additionally, the tech giant only recently delivered a strong fiscal first-quarter (September quarter) report that beat expectations all around.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But that is only the starter course, according to Piper Sandler analyst Brett Bracelin. With the company starting to sell its Copilot AI assistant tool in Microsoft 365 today, the impact of the new product could be equal to the groundbreaking introduction of Apple’s iPhone more than a decade and a half ago.

“We see the formal release of M365 Copilot this week as an ‘iPhone moment’ for MSFT as part of a broader strategy to capitalize on a first-mover advantage in generative AI,” Bracelin said. “Similar to the Microsoft Cloud opportunity that began in 2008 that has now grown into a $125B+ revenue franchise, we see Microsoft AI having similar $100B+ scale potential longer-term.”

But it should reach that milestone at a much faster pace. While the combination of OpenAI, Azure AI, and GitHub copilot saw Microsoft AI generate only an estimated $0.5 billion last quarter – representing roughly 1% of sales – given the “unprecedented pace of innovation, aggressive AI investments, and broad enterprise reach,” within three years, as M365 Copilot gets widespread adoption, Bracelin sees that figure growing to over $10 billion. That is growth at a far better rate than the decade it roughly took for Azure and AWS to exceed revenues of $10 billion.

If that’s not enough as far as AI catalysts go, there are plenty of events taking place this month to further boost sentiment. The general availability release of M365 Copilot this week will be followed by the OpenAI DevDay event on November 6th, GitHub Universe 2023 user event on November 8th, and the Microsoft Ignite user conference on November 14-17, all events that could “further elevate the AI narrative into year-end.”

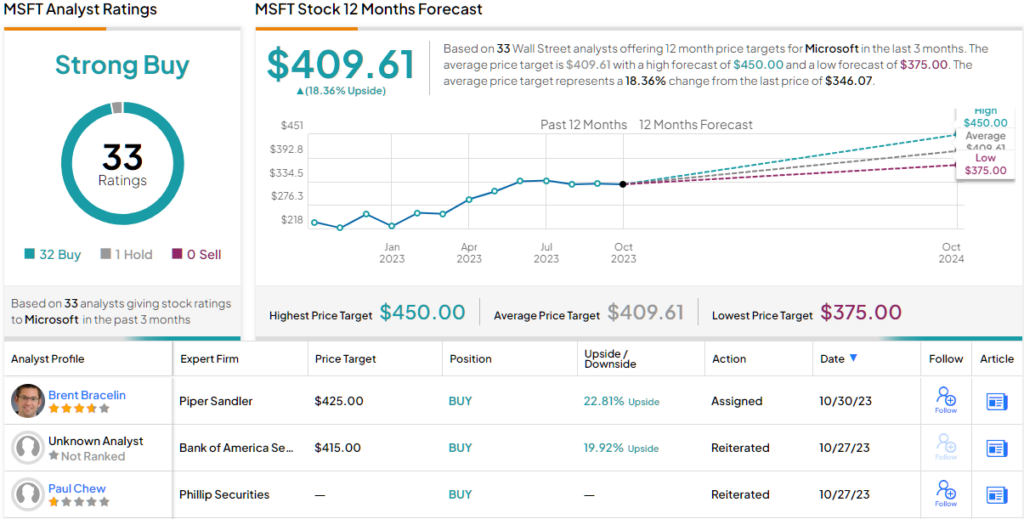

Accordingly, Bracelin reiterated an Overweight (i.e., Buy) rating on MSFT shares, along with a $425 price target, implying shares will climb 26% in the year ahead. (Watch Bracelin’s track record)

Overall, the word of the Street is an overwhelmingly bullish, as TipRanks analytics exhibit MSFT as a Strong Buy. Out of 33 analysts polled by TipRanks in the last 3 months, 32 are bullish on the stock, while only 1 stays on the sidelines. With a return potential of 19%, the stock’s consensus target price stands at $409.61. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.