The JPMorgan Equity Premium Income Fund (NYSEARCA:JEPI) has become a hit in the ETF world thanks to its 12.2% dividend yield and its monthly payout. While many investors are likely familiar with JEPI thanks to the considerable level of fanfare it has garnered as it has grown to $21.8 billion in assets under management (AUM), they may not be as familiar with JEPI’s newer and somewhat less heralded cousin — the JPMorgan Nasdaq Premium Income ETF (NASDAQ:JEPQ).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There are some notable differences between the two ETFs, but what they have in common are monthly payouts, high yields, and the methods that they use to achieve those.

What is JEPQ ETF?

JEPQ is similar to the more established JEPI, but this tech-focused ETF invests specifically in large-cap U.S. growth stocks. JEPQ launched in 2022 and is currently much smaller than JEPI, with $1.75 billion in assets under management. Like JEPI, this ETF pays a dividend on a monthly basis and features an attractive yield, in this case, 11.4% (versus a slightly higher 12.2% for JEPI).

JEPQ’s strategy is to generate “income through a combination of selling options and investing in U.S. large-cap growth stocks, seeking to deliver a monthly income stream from associated option premiums and stock dividends.” In addition to generating monthly income, JEPQ also tries to mitigate volatility, aiming to “deliver a significant portion of the returns associated with the Nasdaq 100 Index with less volatility.”

Investors should be aware that this isn’t just a typical plain vanilla ETF. To achieve this outsize yield, the fund invests up to 20% of its assets into ELNs (equity-linked notes) and sells “one month, out of the money call options” to produce income and to give holders a portion of the upside of these large-cap growth stocks with less volatility.

This strategy helps generate monthly income and reduce volatility. However, one potential downside that investors should be aware of is that this can limit some of the upside of JEPQ in terms of capital appreciation because it likely sacrifices at least some potential upside in exchange for this lower volatility and income.

In a market environment where tech and growth stocks are surging, JEPQ isn’t going to have the same type of upside as many of its underlying holdings or as the Nasdaq 100. However, for many income-oriented investors, giving up a few points of upside for a steady double-digit dividend payout is a trade-off that they will happily make.

The fund shares one portfolio manager with JEPI (Hamilton Reiner), who boasts 36 years of investing experience. It also has two additional portfolio managers who have 10 and 15 years of investing experience, respectively.

JEPQ has an expense ratio of 0.35%, which seems reasonable for an ETF with this degree of active management.

JEPQ’s Top Holdings

While JEPI’s top holdings are populated by stocks from steady, defensive, but lower-growth industries like consumer staples and financials, JEPQ features a heavy focus on the tech sector.

The fund is fairly well-diversified with 78 holdings, although JEPQ’s top 10 holdings make up 53.3% of assets, mirroring the composition of other Nasdaq-oriented funds like the Invesco QQQ Trust.

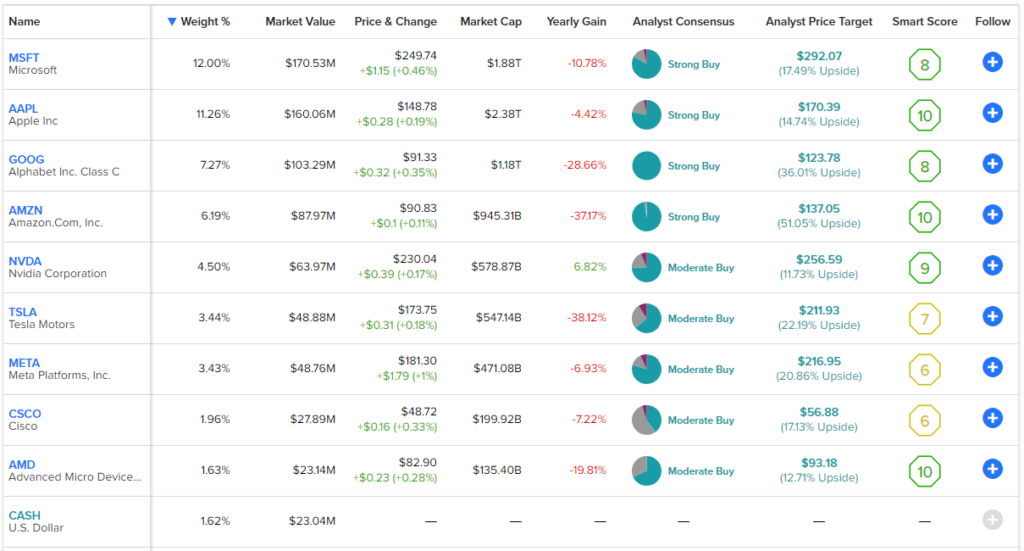

The top two holdings, tech heavyweights Microsoft and Apple, combine to make up nearly 25% of assets. The rest of the top 10 is largely comprised of tech mega caps like Tesla, Nvidia, Amazon, Alphabet, and Meta Platforms.

Below, you will find an overview of JEPQ’s top holdings, along with a number of key data points about each, using TipRanks’ Holdings tool.

The top five holdings here all have Smart Scores of 8 out of 10 or higher. The Smart Score is TipRanks’ proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. Stocks with a Smart Score of 8 or above receive “Outperform” ratings.

What is the Price Target for JEPQ?

Wall Street analysts are bullish on JEPQ. The ETF receives a Moderate Buy rating from analysts, and the average JEPQ ETF price target of $49.89 implies upside potential of ~20%.

Of the 1K ratings on JEPQ, the majority are bullish — 67.74% are Buys, 28.43% are Holds, and just 3.83% are Sell ratings.

TipRanks uses proprietary technology to compile analyst forecasts and price targets for ETFs based on a combination of the individual performances of the underlying assets. By using the Analyst Forecast tool, investors can see the consensus price target and rating for an ETF, as well as the highest and lowest price targets.

TipRanks calculates a weighted average based on the combination of all the ETFs’ holdings. The average price forecast for an ETF is calculated by multiplying each individual holding’s price target by its weighting within the ETF and adding them all up.

Apart from its consensus price target, JEPQ also looks attractive based on a number of other TipRanks indicators. It has an ETF Smart Score of 8 out of 10 (an Outperform rating), while blogger sentiment and crowd wisdom are bullish as well.

Investor Takeaway

For income-seeking investors, especially those looking for monthly income and a high yield that beats the rate of inflation, JEPQ looks like a great tool to add to your portfolio. JEPQ’s yield is nearly double the inflation rate, and it dwarfs the average yield of the S&P 500 or what investors can receive from holding 10-year treasuries.

These investors should also be aware that JEPQ’s structure means it most likely won’t have quite the same upside as the growth stocks it invests in, in the event of a tech bull market. Ultimately, for investors who are content to make that trade-off in exchange for the substantial dividend payout and lower volatility, this is a sensible ETF to own.

I own JEPI, and I like the idea of combining a position in JEPI with one in JEPQ to diversify a bit, have two different streams of monthly payments, and add some more exposure to growth and tech stocks. I view the combination of both of these ETFs as one part of a well-rounded portfolio.