Is it time to look at AT&T (NYSE:T) in a new light? After several years of a declining share price amidst various missteps, it seems the company is finally turning a page. Investors have liked what they’ve seen this year and have helped the stock outperform the market for a change. To wit, the shares are up 11% year-to-date against the S&P 500’s 17% decline.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While a turnaround seems to be at play, Argus analyst Joseph Bonner thinks this blue-chip dividend stock is still undervalued.

“AT&T shares have begun to recover from the market pummeling the company took in response to the company’s strategic about-face on entertainment, the WarnerMedia spinoff, and the dividend cut though valuation remains below historical norms and the peer average,” Bonner explained. “While telecoms are typically seen as safe havens in turbulent economic times, in AT&T’s case its focused debt reduction and refinancing in the last few years has made it more resilient in the current macro-environment.”

With the “long sad foray” into the media business now over since the spinoff of WarnerMedia to Discovery, and the past year’s dividend cut now in the rear-view mirror too, the company has refocused its energies on “creating the underlying framework for sustainable long-term growth.” This the telecoms giant is strategically doing by reducing the debt load and investing in its 5G and fiber broadband networks.

The “star” of the show in 2022 has been the wireless business, which despite a price increase, has grown the subscriber count substantially. While industry leader T-Mobile has added more subs, AT&T has put in a much better performance than Verizon’s subscriber losses and “anemic numbers.”

With management anticipating network data traffic to grow fivefold between 2021 and 2025, the company has recognized the increasing need for wireless and fiber bandwidth as a “positive secular trend” for both the industry and its own growth. AT&T expects trends in smart homes and connected devices, the rise of work from home, and the expansion of streaming and gaming will boost consumer demand.

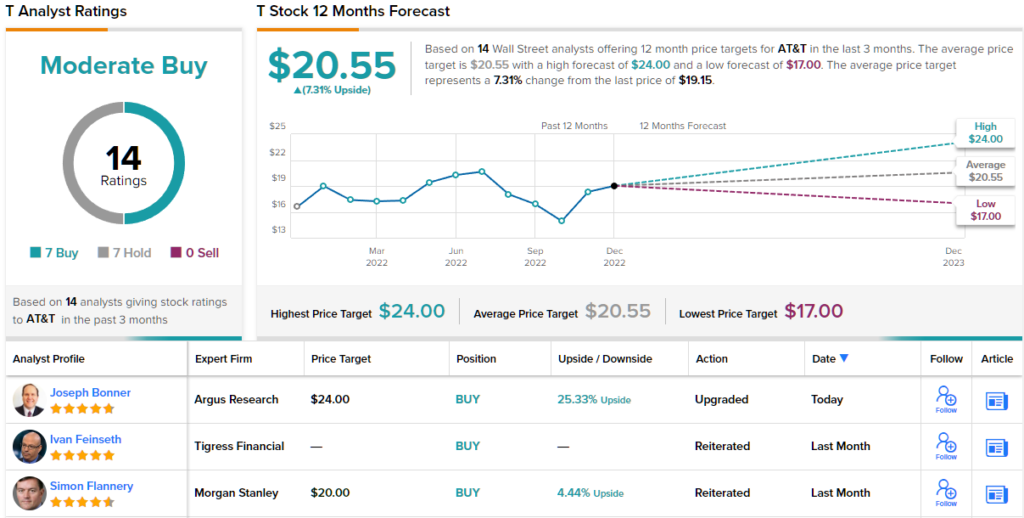

Bonner is confident a more “focused pure-play telecommunications company” is the right way to go. As such, the analyst upgraded AT&T’s rating from Hold (i.e. Neutral) to Buy, backed by a $24 price target. Should the analyst’s thesis go according to plan, investors in AT&T stand to rake in 25% gains over the next year — and a 5.75% dividend yield besides

Overall, the Street is evenly split on this one; over the past 3 months, the stock has received 14 reviews which break down into 7 Buys and Holds, each, all culminating in a Moderate Buy consensus rating. (See AT&T stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.