A Wall Street analyst’s job requires in-depth knowledge of their subject, but in essence, the objective is simple – to find out which stocks investors should load up on or stay away from. As Goldman Sachs’ Director of Americas Equity Research Steven Kron recently put it, a sector analyst can “identify top ideas that offer a combination of conviction, a differentiated view and high risk-adjusted returns.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Kron reckons this is especially true in the current market environment. He adds, “After a couple of years of macro driven markets, we believe stock picking has become more important.”

In fact, during a time in which Goldman’s strategists see “little index returns,” the focus shifts to alpha investing, which evaluates an investment’s performance relative to a benchmark index.

Keeping this in mind, the firm’s stock-picking experts have compiled a select list that includes the best alpha investing opportunities at the given time. Using the TipRanks database, we’ve tracked down two names that currently make the grade not only in the Goldman analysts’ books, but also receive Strong Buy ratings from the analyst consensus.

Let’s see why they are drawing plaudits from all directions right now.

Shift4 Payments (FOUR)

We’ll first head to the digital payment sphere and look at Shift4 Payments. The company is a leading provider of integrated payment processing solutions, catering to a range of industries, but with a strong emphasis on restaurants – which represent around 40% of payment volume. The company offers a comprehensive suite of services, including payment processing, point-of-sale systems, and secure payment technologies. With its platform, Shift4 Payments enables businesses of all sizes to streamline their payment operations and enhance the overall customer experience.

The digital payments acceptance space is a crowded one, but with its straightforward tools for accepting payments and its affordable prices, Shift4 is staking its claim as a strong industry player. This was evident in the firm’s latest quarterly results – for the first quarter of 2023.

The company posted year-over-year revenue growth of 36.1% to reach a total of $547 million, while beating Street expectations by $18.61 million. Adj. EPS of $0.51 also trumped the analysts’ forecast of $0.37.

For the outlook, Shift4 raised its FY23 gross revenue guidance from the prior range between $2.50 billion -$2.70 billion to the range between $2.55 billion – $2.70 billion. The consensus estimate stands at $2.66 billion.

Shares fell badly in the aftermath of the report’s release, which Goldman Sachs analyst Will Nance attributes to the guide falling short of investors’ high expectations.

Not that Nance is bothered by that issue. Explaining his bullish stance, the analyst writes: “FOUR is one of our top ideas across our payments coverage, as we see a highly attractive combination of: 1) strong growth, as a function of both its expansion into new verticals and its idiosyncratic gateway conversion strategy 2) attractive margins and expanding FCF conversion and 3) strong valuation support.”

“While we acknowledge the uncertainty around the macro, we remain highly constructive on FOUR as a result of the company’s idiosyncratic levers to maintain elevated levels of growth as a result of gateway conversions, while executing on what we see as a compelling strategic vision to transition FOUR from a legacy integrated payments provider to an omni channel, direct sales led payment processor,” the analyst went on to add.

Bottom-line, Nance rates FOUR shares a Buy, while his $90 price target implies the stock will surge 34% over the coming months. (To watch Nance’s track record, click here)

Most on Wall Street agree with Nance’s thesis. With a total of 10 Buys and 1 Hold and Sell, each, the stock claims a Strong Buy consensus rating. Going by the $79.42 average target, the shares will grow ~18% in the year ahead. (See FOUR stock forecast)

Warner Bros Discovery (WBD)

Let’s shift now from the payment sphere to the entertainment world and Warner Bros. Discovery (WBD), a global entertainment firm formed through a merger between AT&T subsidiary WarnerMedia, and Discovery. This mega-merger, which was completed in April 2022, brought together two of the biggest names in the entertainment industry to create a powerhouse that spans film, television, streaming, and content production.

The company boasts an extensive portfolio of iconic brands, including Warner Bros., HBO, CNN, DC Comics, Cartoon Network, TLC, Animal Planet, amongst others. It also owns several of the most successful franchises in the world, including Harry Potter, Lord of the Rings and Friends.

In April, the company also finally brought together its HBO Max and Discovery+ streaming services, launching a combined offering called Max. It remains to be seen how the new entity performs, but in the meantime, the DTC (direct-to-consumer) segment put in a strong showing in Q1, making up for underwhelming results elsewhere.

On a pro forma basis (accounting for the combination of WarnerMedia and Discovery), revenue dropped by 6.5% from the same period a year ago to $10.7 billion, whilst falling short of the Street’s forecast by $70 million. Likewise, EPS of -$0.44 missed the -$0.12 consensus estimate.

However, with the addition of 1.6 million customers to its U.S. streaming segment, the DTC unit posted adjusted EBITDA of $50 million. The company only expected to break even by next year.

The display drew applause from Goldman analyst Brett Feldman, who counts WBD as a ‘top pick in Media.’

“We believe WBD’s 1Q23 results support our thesis that it is the most attractive media stock owing to its opportunity to drive strong EBITDA growth and cash flow in 2023 as it achieves material synergies from its merger with WarnerMedia,” Feldman expounded. “While we expect investors to continue to debate the long-term outlook for traditional media companies, we see the risk/reward skew for WBD as most attractive vs. its peer group with key execution catalysts (merger milestones, Max relaunch, improved franchise management) largely within management’s control.”

These comments form the basis for Feldman’s Buy rating and $21 price target. The implication for investors? Potential upside of 73% from current levels. (To watch Feldman’s track record, click here)

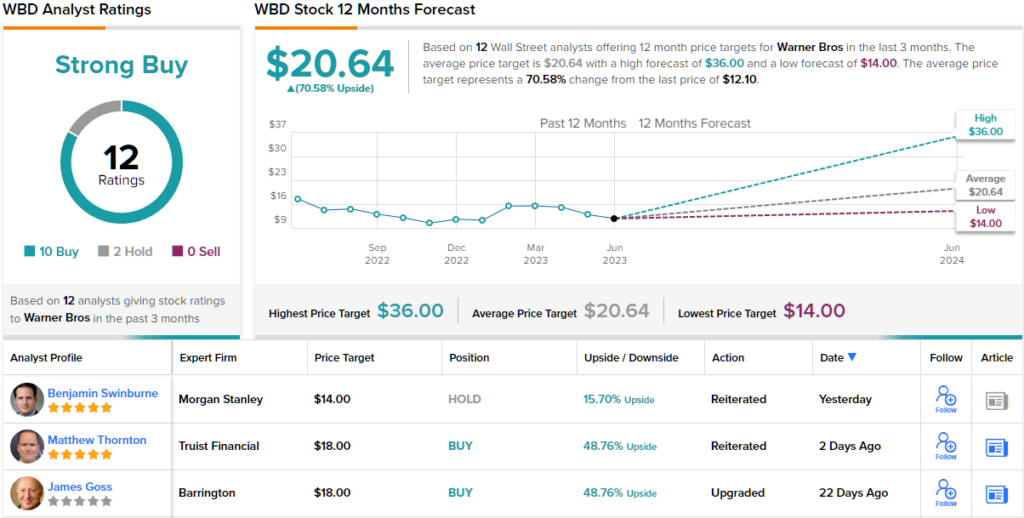

The majority on the Street concur. While 2 analysts remain on the sidelines, with an additional 10 Buys, the consensus view is that this stock is a Strong Buy. The forecast calls for one-year returns of ~71%, considering the average target stands at $20.64. (See WBD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.