Coinbase (NASDAQ:COIN) has two potential opportunities ahead that could add significant value to the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

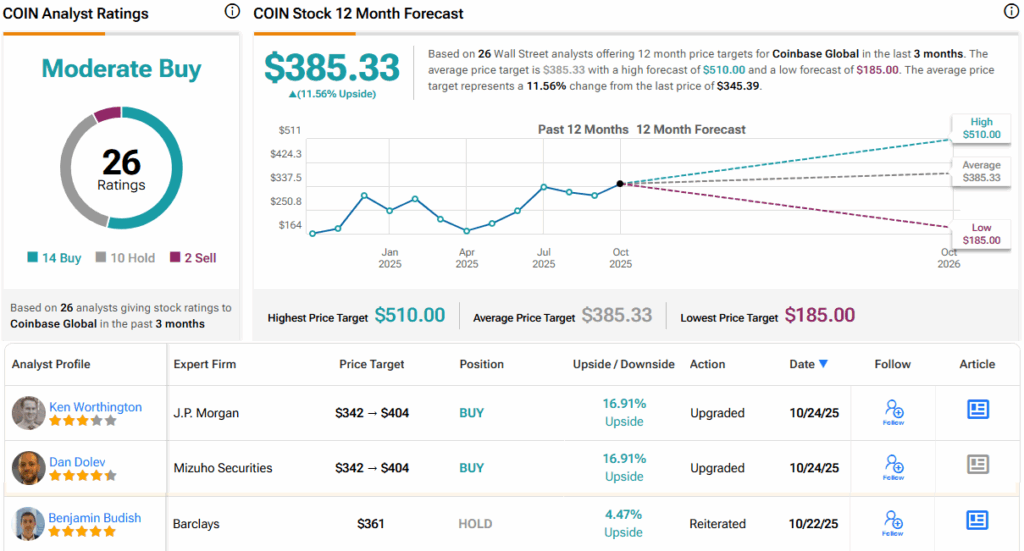

That is the reasoning behind a change to J.P. Morgan analyst Ken Worthington’s COIN model. The analyst has upgraded his rating from Neutral to Overweight (i.e., Buy) while also raising his price target from $342 to $404, implying the stock will gain 17% over the coming year. (To watch Worthington’s track record, click here)

So, what are these “emerging monetization opportunities” Worthington is excited about? Well, for one, Coinbase is reportedly exploring the launch of a Base token – a move that could “generate significant value.” Base, Coinbase’s proprietary Layer 2 blockchain introduced in August 2023, has quickly become one of the biggest L2s by several metrics. So far, Coinbase has monetized Base through sequencer fees, but Worthington thinks there’s an opportunity for Coinbase to “equitize Base via a token.”

A Base token, says the analyst, would benefit both shareholders and the crypto community by encouraging ecosystem development, boosting engagement, and supporting infrastructure growth. Based on current TVL (total value locked) and revenue, Worthington sees room for a sizable market cap in the $12 billion to $34 billion range, supported by “lofty token economics.” While most tokens would likely be distributed among developers, validators, and the Base community, the analyst expects Coinbase to keep a portion for itself, potentially generating $4 billion to $12 billion over time.

The other opportunity has to do with “experimenting with USDC Rewards – segmenting

customers and promoting Coinbase One.” Worthington sees Coinbase testing different USDC yields, both to encourage more adoption of Coinbase One and to generate more revenue from USDC held on its platform. Although USDC deposits generate a 100% gross margin for Coinbase, Worthington estimates operating margins are at 10–20%, with recent quarters likely showing some improvement.

Coinbase could potentially attract more users to Coinbase One, which provides subscription-based trading fees along with other perks, including a higher yield on USDC. The platform currently provides a 4% yield to members compared with 0% for non-subscribers, effectively making the subscription worthwhile for accounts holding around $1,500 in USDC. Through this segmentation strategy, Worthington believes Coinbase could add up to $1.00 in incremental annual earnings per user at the outset, though he eventually sees a “less extreme outcome.”

While Worthington is “incrementally more positive” about Coinbase’s position in the crypto ecosystem, he highlights the ongoing risks noted by investors, particularly regarding competition and pricing, with concerns including both fee compression and potential market share declines. However, he still thinks Coinbase’s value proposition is unique. “While we see the potential for prices to come down over time, we see Coinbase vertical integration and its operations as a broker, a market maker, and exchange and a custodian as supporting profitability even as pricing in US cash equities has gone towards zero for many equity-focused brokers,” Worthington summed up. “We see Coinbase better positioned than peers focused in different asset classes.”

Elsewhere on the Street, COIN claims an additional 13 Buys, 10 Holds and 2 Sells, for a Moderate Buy consensus rating. Going by the $385.33 average target, a year from now, shares will be changing hands for an 11.5% premium. (See COIN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.