The fear of a recession and rising interest rates keep the stock market volatile. Nonetheless, dividend-paying stocks continue to generate steady income for their investors amid volatility. While dividend stocks attract investors, finding the best ones is a tedious job. Thus, we leveraged TipRanks’ Best High Yield Dividend Stocks tool and focused on shares that are analysts’ favorites (sport a Strong Buy rating consensus). Further, these stocks offer at least a 7% yield. Let’s begin.

Energy Transfer (NYSE:ET)

Energy Transfer is a leading midstream energy company that transports oil and gas products. Its diversified portfolio and fee-based assets remain relatively resilient to the volatility in commodity prices and help the company generate strong earnings to support payouts.

It pays a quarterly dividend of $0.3075 per share ($1.23 on an annualized basis), reflecting a solid forward yield of approximately 10%. Moreover, the company targets 3-5% annual dividend growth in the future.

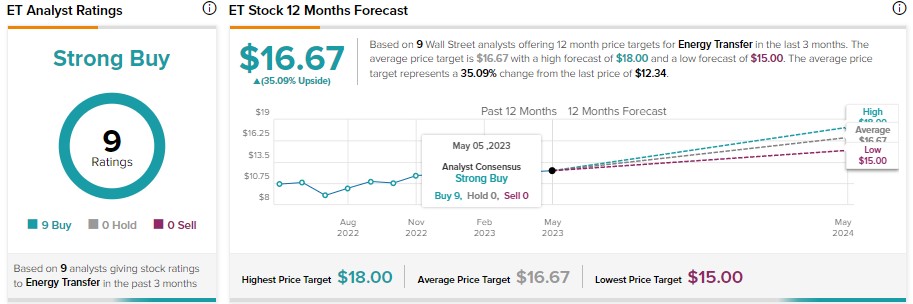

ET stock has received nine unanimous Buys for a Strong Buy consensus rating. Further, analysts’ average price forecast of $16.67 implies 35.09% upside potential from current levels.

Enterprise Products Partners (NYSE:EPD)

EPD Resources is an energy infrastructure company servicing natural gas and crude oil producers and refiners. It pays a quarterly dividend of $0.49 ($1.96 on an annualized basis). This reflects a stellar forward dividend yield of 7.61%.

EPD’s diversified revenue base, low leverage, and strong pipeline of growth projects augur well for earnings and cash flows. EPD raised its dividend at a CAGR of 7% in the last 24 consecutive years. Analysts are bullish on EPD stock. It has a Strong Buy consensus rating, reflecting seven Buy and one Hold recommendations. These analysts’ average price target of $32 implies 24.22% upside potential.

Ares Capital (NASDAQ:ARCC)

Ares Capital is a leading middle-market lender. It offers financing and debt to mid-sized businesses. ARCC has maintained and increased its dividend for 13 years. It pays a quarterly dividend of $0.48 ($1.92 annually), reflecting a high yield of 10.53%.

ARCC stock carries a Strong Buy consensus rating based on five Buy and one Hold recommendations. The average price target of $19.67 suggests 7.90% upside potential from current levels.

Bottom Line

These stocks have a solid dividend history. While these dividend-paying stocks offer high yields, each sports a Strong Buy analysts’ consensus rating, making them attractive at their current levels.