Analysts are in favor of these four “Strong Buy” stocks — Duolingo (NASDAQ:DUOL), Jazz Pharmaceuticals (NASDAQ:JAZZ), Trade Desk (NASDAQ:TTD), and Zentalis Pharmaceuticals (NASDAQ:ZNTL).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

German economist Karl Otto Pohl once famously compared inflation with toothpaste — “Once it’s out, you can hardly get it back in again,” he had said. However, October’s inflation reading gave us some hope, having cooled to 7.7% year-over-year. Nonetheless, this is far from the Federal Reserve’s target inflation rate of 2%-3%, and the economy still has a long way to go. In such an environment, stocks that Wall Street analysts are rooting for are worth keeping an eye on.

Duolingo (DUOL)

Mobile language learning platform provider Duolingo recently posted revenue and earnings beats. Its net loss per share of $0.46 was narrower than the consensus estimate of $0.55, and revenues of $96.1 million came above the $95.2 million consensus estimate.

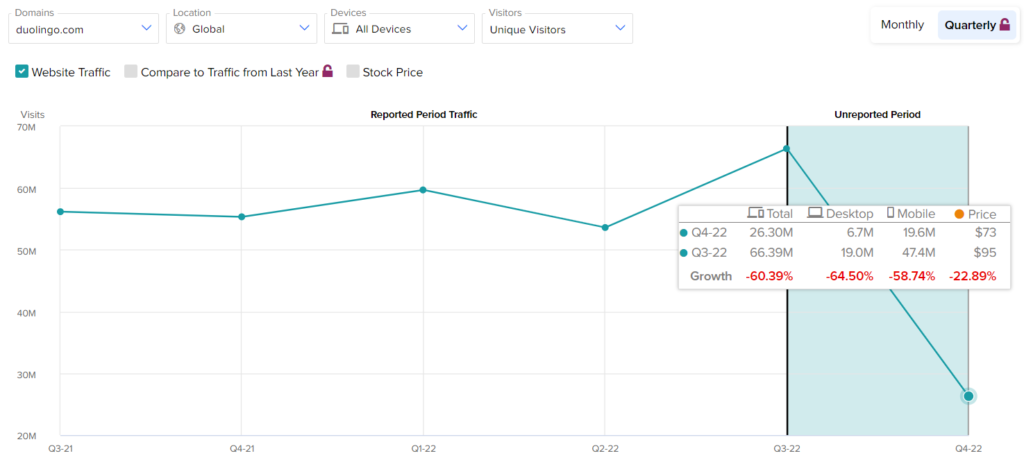

Monthly active users grew 35% year-over-year, while daily active users climbed 51%. This was validated by TipRanks’ website traffic tool, which showed that in Q3, almost 24% more unique visitors visited the company’s website than in Q2.

However, the most interesting part of the print was the outstanding conversion of free users to paid subscribers, which grew 68% year-over-year on the back of consistent additions of new lessons and gamification methods. These conversions will keep supporting the top line and help accelerate Duolingo’s journey to profitability.

What is the Price Target for DUOL Stock?

Five analysts on Wall Street have rated DUOL stock a Buy, whereas one has a Hold rating, giving the stock a Strong Buy consensus rating. The average DUOL price target of $112.83 indicates 53.6% upside potential.

DUOL’s valuation is also attractive currently, at just 8.6x trailing twelve-month sales. This is the lowest its multiple has ever been. Also, for a growth-focused company that is approaching profitability, as understood from the faster growth of gross profits compared to operating expenses in recent quarters, this valuation looks very reasonable right now.

Jazz Pharmaceuticals (JAZZ)

Specialty pharmaceutical company Jazz Pharmaceuticals is riding on the sales of new drugs as well as the drug portfolio of GW Pharmaceuticals, which it acquired last year. The new and recently-acquired drugs constituted 59% of Jazz’s net product sales in 2021. The company expects this cohort to generate 65% of product revenues in 2022. It also expects its total revenue to witness a CAGR of about 17% through 2025 and reach $5 billion.

The company even raised its earnings outlook for 2022, which buoyed investor confidence.

A favorable debt profile gives another strong point to the company. Even with high long-term debt of $6 billion, it has cash ($899.36 million) to finance its short-term obligations of $813 million.

What is the Price Target for JAZZ Stock?

JAZZ stock is a Strong Buy overall based on the opinions of nine analysts with a Buy rating and one with a Hold rating. JAZZ’s average price target of $195.40 also indicates 31.6% upside potential over the next year.

Trade Desk (TTD)

Technology company Trade Desk is within the sector most affected by the Federal Reserve’s monetary policy this year. Despite this, the company, which provides a platform for advertising buyers in the U.S., Europe, and Asia, has continued to deliver impressive results. For the third quarter, revenues grew 31% year-over-year, while adjusted earnings per share jumped 44%. Meanwhile, metrics from large tech peers crumbled around the company.

Taking near-term headwinds like reduced ad spending, higher costs, and higher interest rates into perspective, Susquehanna analyst Shyam Patil recently cut the stock’s price target to $90 from $95. Nonetheless, he reiterated his Buy rating on the stock. Despite the weak macroeconomic backdrop, Patil is upbeat about the 24% revenue growth projection for 2022 and sees healthy share gains. He placed Trade Desk in his must-own list of stocks.

Again, several secular tailwinds and consistent performance justify Trade Desk’s premium valuation of around 16x price/sales and should not deter investors from buying the stock.

What is the Target Price for TTD Stock?

The average price target for TTD stock stands at $67.45, reflecting 41.2% upside potential. Moreover, Wall Street’s bullishness is supported by 10 Buys and two Hold ratings.

Zentalis Pharmaceuticals (ZNTL)

Zentalis Pharmaceuticals is a clinical-stage biopharmaceutical company focused on cancer therapy development. The company expects its development plan for ZN-c3 (its potentially first-in-class Wee1 inhibitor) to benefit a wide range of cancer patients and maximize value for company stakeholders.

Moreover, Zentalis has an impressive cash runway, which can support its operations for more than two years. The company ended its most recent quarter with cash, cash equivalents, and marketable securities of $421.7 million, which it expects to cover capital expenditures into the first quarter of 2025.

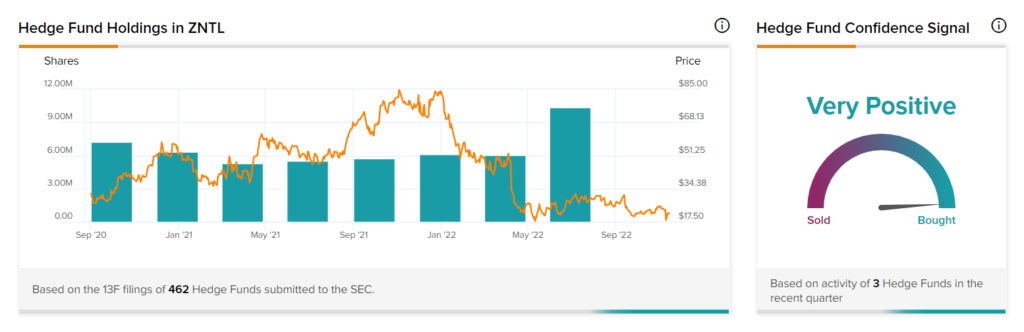

Moreover, hedge fund activity also improved in the June-end quarter, which saw an increase in buying activity by 4.3 million shares.

What is the Target Price for ZNTL Stock?

Wall Street’s six unanimous Buys are also a testimony to the long-term potential of the stock. The average price target is $45.50, meaning the stock can appreciate 101.7% over the next year.

The Takeaway

This year, the bear has been mauling the shares of all of the above companies. Additionally, for the rest of the year and into the next, several challenges are awaiting them as well. However, Wall Street pros are not bothered by the noise and are looking at strong fundamentals and bright long-term demand, and the companies seem to be checking all the boxes.