A lot of recession-induced earnings decay is already baked into markets today. While it’s impossible to tell how corporate earnings will hold up as the economy flirts with a recession, I do think it’s wise to invest with careful consideration for downside risks. Indeed, there has been a rush to defensive stocks throughout the year. However, it may not be too late to get in, given valuations aren’t too absurd, given the steadiness (low beta and secure dividends) you’ll get in a recession year. In this piece, I compared three recession-tested companies that remain “Strong Buys,” according to analysts on Wall Street.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

TJX Companies (NYSE:TJX)

TJX is an off-price retailer behind big-box stores such as T.J. Maxx, Marshalls, HomeSense, and Winners. Undoubtedly, the retail space has taken big hits to the chin of late. Inflation and recession worries are mostly to blame. TJX is a strange name in that it tends to be a defensive play in discretionary retail due to its ability to offer nice discounts on brand-name apparel and home goods offered in its stores.

Given the off-price nature of TJX and the rise of the bargain-hunting mentality, TJX seems just as good as a consumer staple. With that in mind, it should be no mystery to see TJX stock near its all-time high amid the market’s recent troubles.

Last month, TJX clocked in another solid quarter (Q3 EPS of $0.86 vs. $0.80 estimate on $12.2 billion revenue). Management noted strong availability across the board, with elevated foot traffic.

As inventory gluts rise in the retail space, TJX stands to be a major beneficiary. More high-end apparel in stores means TJX can enjoy a bit of padding to its margins, all while sales remain steady.

Sure, the consumer is challenged, but they’ll make moves when the price is right. A strong Black Friday, I believe, shows the consumer is robust but more selective with pricing.

At 27.5 times trailing earnings and 1.8 times sales, TJX stock still seems too cheap to ignore. High foot traffic and product availability make for one of the most intriguing plays in the face of a recession year. The 1.5% dividend yield is a nice bonus.

What is the Price Target for TJX Stock?

Analysts have been busy upgrading price targets on the name of late. The average TJX stock price target of $86.60 implies 9.4% upside potential based on 12 Buys and three Hold ratings.

Coca-Cola (NYSE:KO)

Coke is one of Warren Buffett‘s favorite companies. Its recession-resilient characteristics, stable dividend growth profile, and powerful brand make it a stock that one need never sell.

2022 was a tough year, but Coke shares eked out a nice 11% gain year-to-date. With a low 0.59 beta, I expect KO stock to continue creeping higher in 2023, even if the bear market continues to damage the broader market.

Coke has done a great job of dealing with inflation. The brand is so strong that people don’t think twice about modest price hikes. Certainly, few people are switching to generic cola to save a buck or two.

With a steady, growing 2.8% dividend yield and new innovative flavors coming out of the pipeline, KO stock will make for a smooth and likely profitable ride through a recession year. Analysts agree.

My biggest concern with Coke is its valuation. Arguably, the flock to defensives has already happened. At 28 times trailing earnings, KO stock is not cheap. If prices retreat, I’d gladly step in as a buyer.

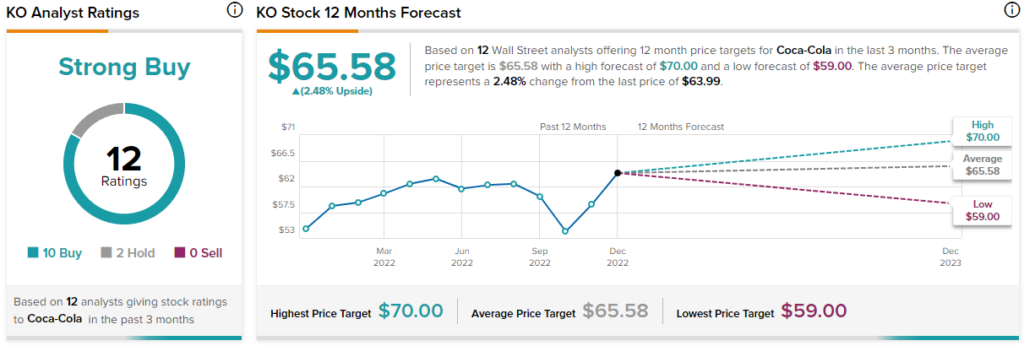

What is the Price Target for KO Stock?

Despite minimal upside potential, Wall Street continues to love Coke stock. The average KO stock price target of $65.58 implies 2.5% upside potential from here.

Mondelez (NASDAQ:MDLZ)

Mondelez is a confectionary firm that’s served up sweet gains for investors over the past year (9%, not including dividends). With a 2.3% dividend yield and a commitment to invest in new products, MDLZ makes for one of the higher-growth players within the low-growth consumer packaged goods (CPG) space.

Like Coke, MDLZ stock trades at a rich multiple due to a rush to stable dividend payers. The stock trades at 30 times trailing earnings, which is on the high end of the food-processing industry average (25.9 times).

The company has done a fine job of moving through this inflationary environment. Still, I find it hard to justify the multiple, given the mere 3%-5% long-term growth rate target.

What is the Price Target for MDLZ Stock?

Wall Street is a fan of Mondelez going into recession based on 12 Buys and two Holds assigned in the past three months. The average MDLZ stock price target of $70.71 implies 4.6% in gains from here.

Conclusion: Wall Street is Most Bullish on TJX Stock

Indeed, it takes one resilient company to retain such a consensus recommendation in an environment where lowering the bar has become the norm in the analyst community. Of the three names, Wall Street expects the biggest gains from TJX stock.