Whether you love them or you hate them, penny stocks are contentious. These tickers trading for less than $5 per share have earned a reputation on Wall Street for their divisive nature, with investors struggling to find some middle ground on this issue.

The appeal is clear. For the same price as one share of a more well-known company, investors can snap up hundreds of shares of a penny stock. What’s more, the fact that even minor share price appreciation can translate to hefty percentage gains is too enticing for some investors to ignore.

Although penny stocks can deliver massive returns, there could be a reason they are changing hands at such low levels. Finding themselves in challenging times, these names could be bogged down by overwhelming headwinds or poor fundamentals.

The bottom line? Doing some research is necessary before pulling the trigger on any penny stock. Following the recommendations from Wall Street pros can help in the due diligence process.

Bearing this in mind, we used TipRanks’ database to take a look at three penny stocks getting rave reviews from Leerink, with the firm’s analysts projecting triple-digit upside potential for each. The platform revealed that all three boast a “Strong Buy” consensus rating from the rest of the Street.

HTG Molecular Diagnostics (HTGM)

Using its next-generation sequencing (NGS)-adapted chemistry and instrument platforms, HTG Molecular Diagnostics hopes to provide innovative diagnostic solutions. Currently going for $0.30 apiece, Leerink believes that its share price presents investors with an opportunity to get in on the action.

In August, HTGM announced the commercial release and immediate availability of HTG EdgeSeq Reveal version 3.0, which includes new research use only (RUO) oncology applications and software functionalities. The product was originally launched in 2019 as a web-based biostatistical analysis software suite designed to streamline the analysis of samples processed with HTGM’s RUO profiling assays.

This revamped version will feature the first RUO oncology applications specifically built using the HTG EdgeSeq Precision Immuno-Oncology Panel (PIP), including three complementary signatures designed to understand the immune response (inflammation) and biology of the tumor microenvironment.

Weighing in for Leerink, 5-star analyst Puneet Souda noted, “Base RUO business should continue to deliver with a long-term CAGR of ~30%-plus (ex-COVID), with Pharma program readouts coming in the near-term, and additional collaborations likely on the horizon.”

On top of this, Souda sees the development of a comprehensive breast cancer assay (an investigative analytic procedure to detect the disease) as an essential piece of the puzzle. “The 23k gene RNA-based breast and cancer transcriptome assay holds potential to drive a new growth trajectory for the company as it utilizes high plex PCR, low sample usage and high NGS based sensitivity, and the likely potential for multiple products to be developed off of the initial assay longer-term,” he explained. According to management, development is on track, with a concordance study and whitepaper highlighting the assay expected in Q3.

It should be noted that the COVID-induced shift to remote operations caused a substantial disruption. In line with expectations, academic and smaller biotech customers are returning more quickly than larger pharma biomarker-involved clients, but Souda expects an improvement in Q4. Additionally, he argues that the QIAGEN distribution agreement bodes well for HTGM.

To this end, Souda rates HTGM an Outperform (i.e. Buy) along with a $2 price target. This puts the upside potential at a massive 578%. (To watch Souda’s track record, click here)

In general, other analysts echo Souda’s sentiment. 3 Buys and 1 Hold add up to a Strong Buy consensus rating. Based on the average price target of $1.28, the upside potential comes in at 333%. (See HTGM stock analysis on TipRanks)

T2 Biosystems (TTOO)

Moving on to another player in the diagnostic space, T2 Biosystems manufactures molecular diagnostic instruments and test panels. While the company has struggled in the past, Leerink argues that its $1.33 share price presents an opportunity to get in on this turnaround story.

Firm analyst Puneet Souda, who also covers HTGM, points out that part of the excitement surrounding this name is related to its COVID-19 testing solution (sepsis rule-out test). During its Q2 2020 earnings call, TTOO stated that there has been serious demand for the test, with it specifically seeing increased use from hospitalized patients who have a greater risk of developing secondary co-infections such as sepsis.

It should be noted that TTOO has partnered with Hackensack Meridian Health to develop and validate the COVID-19 assay on the T2Dx platform. The system can provide results in less than two hours, with clinical data demonstrating a sensitivity of 95% and specificity of 100%. As for the daily throughput, it lands at 60-80 tests. With all of the necessary filings submitted to the FDA for Emergency Use Authorization (EUA) approval, TTOO has started selling the test to clinical labs.

Expounding on this, Souda commented, “Management expects all 60 placements in the 2020 financial guidance to be entirely driven by COVID demand and has solid visibility into 2H – impressive in our view given the lack of instrument adoption in 1H20. TTOO hopes to leverage current COVID-19 demand to increase T2Dx install base and expand sepsis-related revenue over time – as the pandemic inevitably subsides.”

Given that the COVID test is expected to provide a significant near-term revenue boost, management reinstated its FY20 revenue guidance of $18-$20 million, which is above the consensus estimate.

If that wasn’t enough, Souda calls the efforts of newly appointed CEO John Sperzel encouraging, who is working to execute on his top priorities. These include accelerating sales growth through a focus on utilization, reducing TTOO’s cost structure and advancing the product pipeline.

Specifically looking at utilization, in Q2, TTOO’s U.S. annuity per system increased 51% quarter-over-quarter, from $50,000 per system to over $75,000 per system, due to rising demand for its FDA-approved fungal candida test. This doesn’t factor in any benefit from the COVID tests.

On top of this, TTOO strengthened its balance sheet, with its pro-forma cash position now coming in at $69 million. As its pipeline also includes a Lyme disease test, a testing instrument and several other test panels, Souda likes what he’s seeing.

To this end, Souda sides with the bulls. Along with an Outperform (i.e. Buy) rating, he keeps a $3 price target on the stock. This target puts the upside potential at 123%.

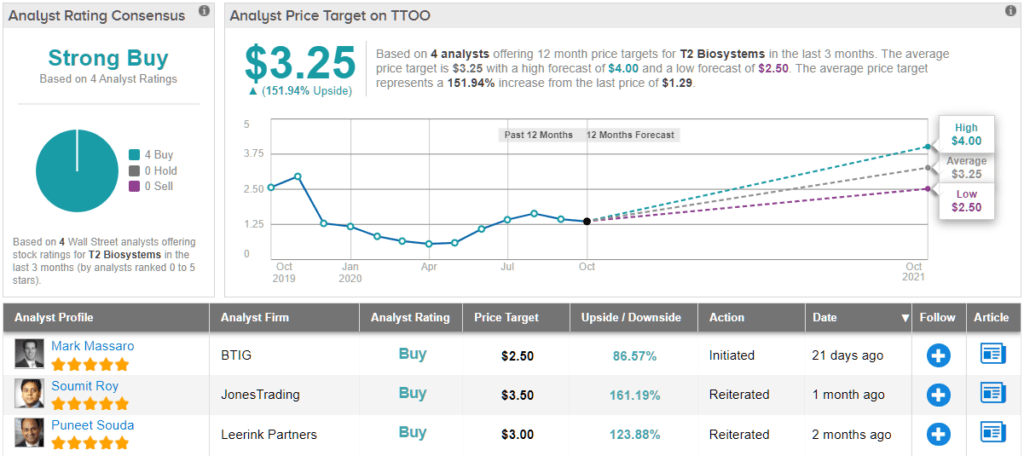

Are other analysts in agreement? They are. Only Buy ratings, 4 to be exact, have been published in the last three months. Therefore, the message is clear: TTOO is a Strong Buy. With a $3.25 average price target, shares could soar 152% in the next year. (See TTOO stock analysis on TipRanks)

Genocea Biosciences (GNCA)

Last but not least we have Genocea Biosciences, which uses its ATLAS platform to develop cancer-targeting vaccines and immunotherapies. Currently going for $2.30 apiece, Leerink believes that big things are in store.

Writing for the firm, analyst Daina Graybosch tells clients that the ATLAS platform “has potential to be the most accurate approach to identify neoantigens for vaccine and cell therapy.”

To back this up, she points out that the platform is “alone in its ability to identify inhibitory neoantigens.” Neo-antigens could have an immuno-suppressive effect that negates the benefit from stimulatory T-cell responses. “As the only clinical-stage neoantigen vaccine company using empiric selection of neo-antigens, Genocea has no exposure to the risk that comes with reliance on in silico prediction platforms,” Graybosch commented.

As for its neo-antigen, peptide vaccine on top of anti-PD1 based therapy (PD1-SoC), GEN-009, Graybosch remains optimistic. In Part B of the Phase 1/2 trial evaluating GEN-009 in cutaneous melanoma, non-small cell lung cancer (NSCLC), squamous cell carcinoma of the head and neck (SCCHN), urothelial carcinoma and renal cell carcinoma patients, initial clinical demonstrated some positive signals.

Of the five patients enrolled in the study, with combination therapy, two had a complete response (CR), two had a partial response (PR) and one progressed but then had a PR after salvage and GEN-009 therapy. It should be noted that as one patient reached CR before vaccination, that patient’s clinical data is irrelevant, reducing the patient subset for analysis to four.

Graybosch highlights the fact that additional tumor shrinkage after GEN-009 dosing was consistently witnessed by the next scan, with a clear change in shrinkage rate seen in two of three patients. “While late deepening with PD1-SoC is possible in all these tumor types, we would expect timing of deepening / rate change to be inconsistent,” Graybosch explained.

Expounding on this, the analyst said, “It is relatively rare to see late responses in non-small cell lung cancer (NSCLC) and urothelial cancer and objective response rate is low with pembrolizumab alone in squamous cell carcinoma of the head and neck (SCCHN), reducing the likelihood that late response to PD1-SoC alone is contributing to late benefit.”

Even though some investors were disappointed that the data didn’t provide a clear proof-of-concept for the ATLAS neoantigen selection assay and GEN-009, Graybosch believes “this is novel territory Genocea is exploring and early results (including larger patient data at ESMO) would be unlikely to provide a high level of confidence.” She added, “With shares trading near cash, we see GNCA as having a favorable risk/reward for the patient investor.”

All of the above convinced Graybosch to rate GNCA an Outperform (i.e. Buy). In addition to the call, she set a $5 price target, suggesting 128% upside potential. (To watch Graybosch’s track record, click here)

Judging by the consensus breakdown, opinions are anything but mixed. With 5 Buys and no Holds or Sells assigned in the last three months, the word on the Street is that GNCA is a Strong Buy. At $9.40, the average price target implies 329% upside potential. (See GNCA stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.