Bull or bear market, no investment is a sure thing. Especially in the current financial environment, which remains riddled with uncertainty, finding compelling plays can be challenging for even the most seasoned market watchers. However, this is not to say that investment opportunities with stand-out growth prospects can’t be found.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For the more risk-tolerant investor, penny stocks, or tickers trading for less than $5 per share, can be an enticing option. The appeal is clear; the bargain price tag means you can get more bang for your buck and even what feels like inconsequential share price appreciation can result in huge percentage gains.

What’s the flip side? Minor share price depreciation can fuel major percentage losses. By nature of these massive movements, penny stocks are notoriously volatile.

Bearing this in mind, our focus shifted to two penny stocks backed by investment firm Piper Sandler. Major gains could be in store, as the firm’s analysts believe these tickers trading for less than $5 could climb all the way to $40, or more.

After running the tickers through TipRanks’ database, we found that both have also been cheered by the rest of the Street, as they boast a “Strong Buy” analyst consensus. Let’s take a closer look.

Tenaya Therapeutics (TNYA)

We’ll start with Tenaya Therapeutics, a biopharmaceutical company focused on treatments for cardiac disease. Tenaya is pursuing the development of new therapeutic agents based on gene therapy, cellular regeneration, and/or precision medicine. Using these platforms, the company is fulfilling its mission to ‘discover, develop, and deliver’ drug candidates that will attack heart disease through the underlying drivers of the conditions.

Tenaya’s lead candidate is gene therapy TN-201. Earlier this year, the company got the all clear from the FDA to begin clinical testing and Tenaya plans on initiating a Phase 1b study in Q3 in which symptomatic adults with MYBPC3-associated HCM (Hypertrophic Cardiomyopathy) will be subject to a one-time intravenous infusion of TN-201. An initial data readout is expected in 2024.

The company is also working on TN-301, a small molecule inhibitor of HDAC6 being developed to treat HFpEF (heart failure with preserved ejection fraction). The drug is currently being assessed in a Phase 1 study and the company expects to have a data readout from both the SAD (single ascending) and MAD (multiple-ascending dose) stages of the trial in 2H23.

Also of note here is TN-401, another gene therapy intended to deliver a functional PKP2 gene in adults with ARVC (Arrhythmogenic Right Ventricular Cardiomyopathy) owing to PKP2 gene mutation. Submission of an IND application to the FDA is expected in 2H23.

All of these programs have piqued the interest of Piper Sandler’s Yasmeen Rahimi, who highlights the opportunity and catalysts ahead as key.

“We remain bullish on this name as we believe that the HCM market is growing with the recent Camzyos (BMY) launch, as well as several other key HCM catalysts coming in 2023. Accordingly, we view TNYA as undervalued with several inflection points in the stock with TN-301 (HCA6 inhibitor) for HFpEF Ph1 SAD/MAD HV data reading out in 2H23, lead asset TN-201 (MYBPC3 gene therapy) Ph1b nHCM data on track for 2024, and TN-401 (PKP2 gene therapy) for ARVC with IND submission expected in 2H23. Altogether, the company has a catalyst-rich pipeline, and thus represents an attractive buying opportunity in our view,” Rahimi opined.

You can say that again. Quantifying her stance, Rahimi rates TNYA shares an Overweight (i.e. Buy) while her $40 price target suggests the shares will post growth of a huge 1154% over the next year. (To watch Rahimi’s track record, click here)

That target might seem outlandish but it’s not as if other analysts are shy about making big predictions here, either. The average target stands at $21.50, making room for one-year gains of 574% from the current $3.19 share price. Additionally, based on Buys only – 6, in total – the stock claims a Strong Buy consensus rating. (See TNYA stock forecast)

ALX Oncology Holdings (ALXO)

For our next Piper Sandler-endorsed penny stock pick, we’ll stick with the biotech sector. ALX Oncology is a clinical-stage immuno-oncology firm dedicated to supporting patients in their battle against cancer. They achieve this by developing drugs that inhibit the CD47 checkpoint pathway and connect the innate and adaptive immune systems.

ALX’s lead candidate, evorpacept, is a next generation CD47 blocking drug being assessed as a treatment for various cancers, with the company focused on hematologic malignancies and solid tumor indications where it can potentially cater to big unmet medical needs.

Evorpacept is currently being evaluated in a total of 10 research tracks. We’ll specifically focus on the ones that have catalysts on the horizon.

In the second half of 2023, the company expects to present data from the Phase 2 study of evorpacept, in combination with trastuzumab, ramucirumab, and paclitaxel, indicated for the treatment of patients with HER2-positive gastric/GEJ cancer (ASPEN-06). Also in 2H23, ALX will announce dose optimization results from the Phase 1b clinical study of evorpacept in combination with azacytidine. This trial (ASPEN-02) is targeting patients with MDS (myelodysplastic syndromes).

A Phase 1b dose optimization clinical trial (ASPEN-05) of evorpacept combined with azacitidine and venetoclax for the treatment of patients with relapsed or refractory (r/r) or newly diagnosed acute myeloid leukemia, should also kick off in the year’s latter half. Lastly, 1H23 should also see the filing of an IND (investigational new drug) for ALTA-002, a SIRPα Toll-like receptor agonist antibody conjugate being worked on together with Tallac Therapeutics.

It’s the combined potential of the upcoming updates that has drawn Piper Sandler’s Christopher Raymond’s attention. He writes, “The catalyst flow remains on track with important clinical updates in gastric/GEJ cancer (ASPEN-06, P2 update) and MDS (ASPEN-02, P1b dose expansion data) expected in 2H23. Outside of this, development continues across the pipeline, with HNSCC studies ongoing (ASPEN-03, ASPEN-04; data in 2024) and IND filing for ALTA-002 expected in the first half of 2023. Overall, we continue to see evorpacept as a best-in-class CD47-targeting agent, and remain buyers to $48/sh.”

That $48 price target suggests the shares will deliver returns of a huge 930% over the coming year. Unsurprisingly, Raymond rates ALXO shares an Overweight (i.e. Buy). (To watch Raymond’s track record, click here)

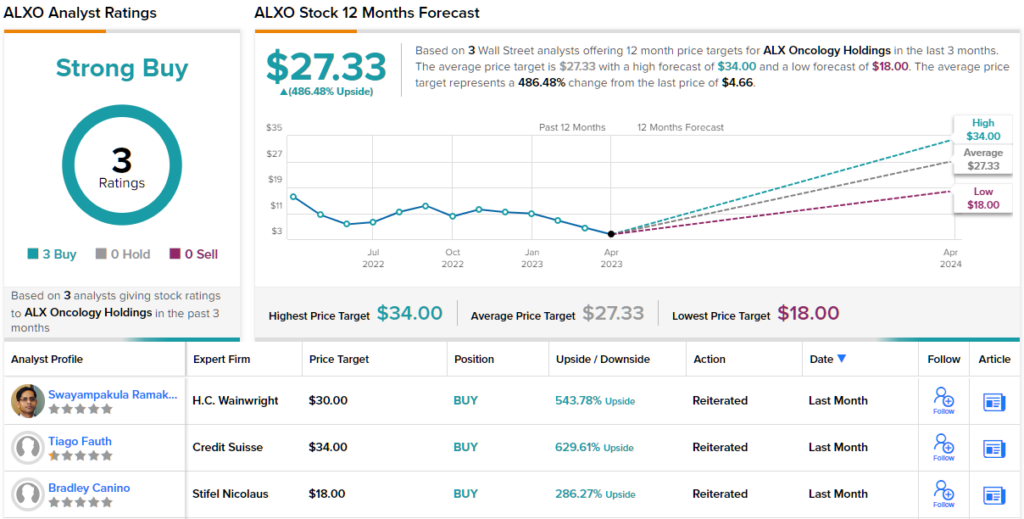

Two other analysts have been following this biotech’s development, and both also take a bullish stance, making the consensus view here a Strong Buy. There are big gains projected here, too. The $27.33 average target provided room for 12-month growth of 486% from the current $4.66 share price. (See ALXO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.