For investors, the stock market is always a game of risk and reward, and no segment exemplifies that better than the penny stocks. Defined as stocks trading at a price of less than $5, the pennies bring an ultra-low cost of entry to the table, along with a powerful potential for strong gains.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

At these low initial prices, even a small incremental increase in share price will quickly translate into a high-percentage gain on the initial investment – and for penny stocks’ fans, gains of 200% or even 300% are not unheard of. Of course, the risk factor is also amplified, for the same reasons.

As the nature of these investments makes it difficult to gauge the strength of their long-term growth prospects, one effective stock selecting strategy is to follow the analysts’ advice. Wall Street’s pros have built careers and reputations on the quality of their stock choices, giving them some extra skin in the game.

Taking this into account, we used TipRanks’ database to identify two penny stocks that have earned a “Strong Buy” consensus rating from the analyst community. Not to mention massive upside potential is on the table.

Galera Therapeutics (GRTX)

The first penny stock we’ll look at is Galera Therapeutics, a clinical-stage biopharma company working on improving the lives of cancer patients, and the outcomes of their treatment regimens. Galera has two leading drug candidates, avasopasem, which is designed to treat side effects of radiotherapies, and rucosopasem, which is a radiosensitizer designed to improve the efficacy of SBRT treatments.

On the first track, Galera drug candidate avasopasem has been making headlines for the company. The drug, which is a treatment for severe oral mucositis (SOM) as a side effect of radiation therapy in patients with head and neck cancer, has received both Breakthrough Therapy and Fast Track designations from the FDA, and recently completed a Phase 3 clinical trial, meeting clinical endpoints. The company submitted a New Drug Application (NDA) to the FDA in December, based on the positive results of the Phase 3 trial. Last month, the company received notice from the FDA that the NDA had been accepted for review, with a PDUFA date of August 9.

Also highly important for Galera are the two ongoing clinical trials of rucosopasem. This drug candidate is a radiosensitizer – that is, it is designed to render tumor cells more susceptible to radiation treatments – and is currently the subject of the Phase 1/2 GRECO-1 and the Phase 2b GRECO-2 trials. The GRECO-1 trial is testing rucosopasem in the treatment of peripheral or centrally located non-small cell lung cancer, while the GRECO-2 trial is testing the drug in the treatment of nonmetastatic pancreatic cancer.

These forward steps, in the regulatory process and the clinical trials, are important catalysts for Galera, and form the core of Piper Sandler analyst Edward Tenthoff’s upbeat view of this stock.

“We look for Galera to create shareholder value by gaining FDA approval and launching avasopasem in the U.S… We are confident that avasopasem could be the first FDA approved drug for radiotherapy-induced SOM in head and neck cancer with peak U.S. sales of $342 million in 2032. Galera may partner avasopasem overseas and may pursue additional cancer indications through compendium listings,” Tenthoff opined.

“We value avasopasem for the prevention of SOM in head & neck cancer patients who receive IMRT at $304 million… We add $50 million in value for rucosopasem in lung and pancreatic cancer patients who receive SBRT. We anticipate this value could be adjusted on Phase II GRECO-1 next year and Phase IIb GRECO-2 data to follow,” the 5-star analyst added.

Assuming the best from these catalysts, Tenthoff rates GRTX an Overweight (i.e. Buy), and gives the stock a $6 price target, implying a whopping upside potential of 233%. (To watch Tenthoff’s track record, click here)

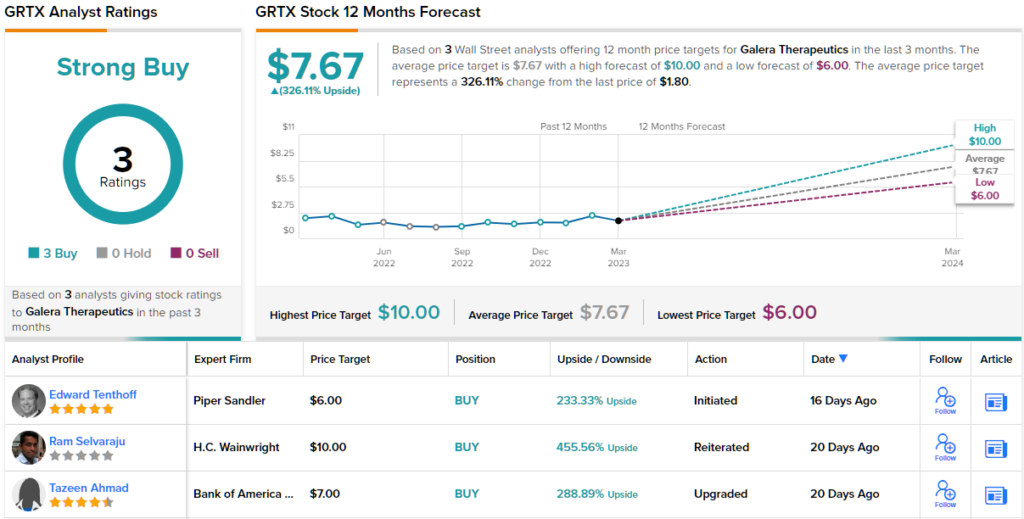

Tenthoff is not the only analyst to see a solid upside here; all three of GRTX’s recent reviews are positive, for a Strong Buy consensus rating. The shares are priced at $1.81 and the $7.67 average target suggests an upside of 326% from that level. (See GRTX stock forecast on TipRanks)

OmniAb, Inc. (OABI)

The next penny stock we’re looking at, OmniAb, is another biotechnology company – but with a twist. OmniAb is developing new platforms for the discovery of therapeutic antibodies. This new technology is based on a series of proprietary transgenic animals, including the company’s OmniRat, OmniChicken, and OmniMouse, all of which have been genetically modified human genome sequence fragments for the development of therapeutic antibody candidates for human use.

OmniAb’s technologies derive from the company’s biological intelligence repertoire, and its antibody discovery solutions are designed for efficiency in meeting customizable discovery needs across the global pharma sector. The company is working independently on these tracks, but also in partnerships with other biopharma firms. OmniAb’s partnerships allow it to create antibodies that are more finely tailored to specific needs, allowing optimal discovery based on particular targets and desired drug profiles.

This is a potentially lucrative realm of medical biotech, and to raise the capital needed to take full advantage of it, OmniAb entered the public trading markets this past fall. The company spun off of Ligand Pharmaceuticals late last year, and on November 1 it completed both the spin-off and the business combination transaction with Avista Public Acquisition Corporation II. The OABI ticker made its start on the NASDAQ on November 2, and OmniAb realized some $96 million in net cash at the transaction closing.

Also in November, OmniAb released its first – and so far, only – set of quarterly financial results, for 3Q22. In that quarter, the company saw $6.9 million in revenue, up from $6.3 million one year earlier. The company’s revenues are mainly derived from milestone and royalty payments from partner firms. The company’s cash position, mainly the $95 million from the business combination, plus its revenue stream are considered sufficient to fund operations into the ‘foreseeable future.’

Analyst Steven Mah covers this stock for Cowen, and he comes down on the bullish side, writing: “OABI is a highly scalable discovery engine with a broad partnership and program base relative to peers in the data-driven drug discovery space. The focus on upstream discovery workflows enables scale that results in a significant number of ‘shots on goal’ for their antibodies to eventually be commercialized. We expect additional partner and program growth to drive near-term revenues with high margin milestone and royalty revenues to drive platform value long term. In our view, their large partner and program base helps lower the risk profile of the company, which also has a healthy cash runway through FY25.”

“We expect OABI to trade at a premium to peers as the platform continues to be validated with clinical and commercial successes,” the analyst summed up.

Looking forward, Mah gives OABI shares an Outperform (i.e. Buy) rating, along with a $10 price target suggesting a 182% upside on the one-year time horizon. (To watch Mah’s track record, click here)

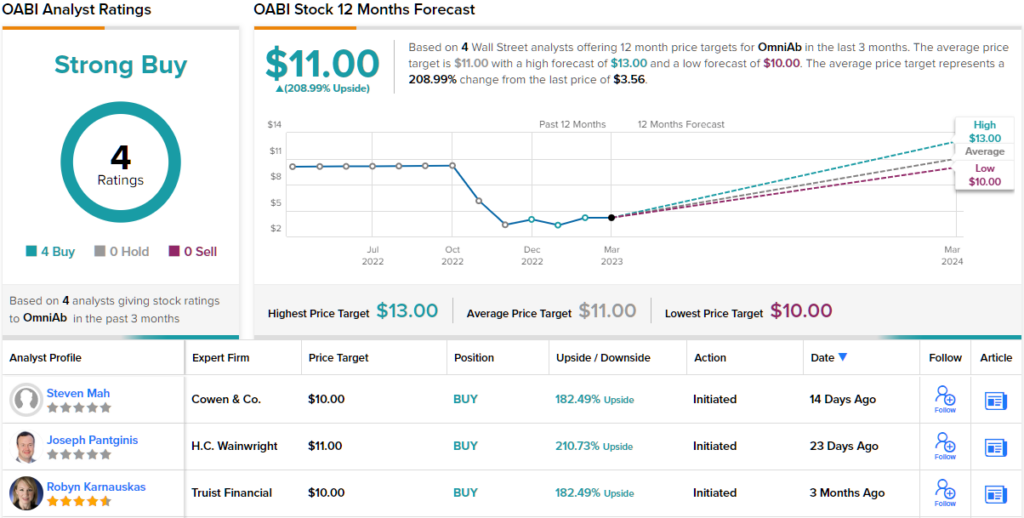

Overall, this penny stock has a unanimous Strong Buy consensus rating, with 4 positive analyst reviews. Given the $11 average price target, shares could soar ~209% from current levels. (See OABI stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.