Risk and reward often travel hand-in-hand, making the stock market both lucrative and dangerous. Among the best exemplars of this axiom are the penny stocks, those equities priced at $5 or less. With that low price comes the potential for extreme gains, as even an incrementally small price increase will translate to a high percentage gain.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, before jumping right into an investment in a penny stock, Wall Street pros advise looking at the bigger picture and considering other factors beyond just the price tag. For some names that fall into this category, you really do get what you pay for, offering little in the way of long-term growth prospects thanks to weak fundamentals, recent headwinds or even large outstanding share counts.

As the nature of these investments makes it difficult to gauge the strength of their long-term growth prospects, one effective stock selecting strategy is to follow the analysts’ advice.

Using TipRanks’ database, we locked in on two penny stocks that have garnered glowing reviews from the Street, enough to earn a “Strong Buy” consensus rating. Not to mention each offers massive upside potential. Let’s take a closer look.

Daré Bioscience, Inc. (DARE)

We will start with Daré Biosciences, a clinical stage biopharmaceutical company focused solely on issues of women’s reproductive health. The company’s research program features a portfolio of programs dedicated to improving contraception, fertility, vaginal health, and sexual function. In addition to this pipeline, the company has one approved drug, Xaciato, a clindamycin phosphate vaginal gel for the treatment of bacterial vaginosis.

Xaciato brought Daré its first revenue, with a $10 million cash payment from Organon in 3Q22, pursuant to the two firms’ license agreement. The two companies are working to coordinate the launch of Xaciato this year.

On the pipeline side, Daré has seen several recent positive developments. In November of last year, the company announced positive topline results from the DARE-VVA1 Phase 1/2 clinical study of tamoxifen, a proprietary drug formulation designed for vaginal application to treat vulvar and vaginal atrophy in patients with ER/PR+ breast cancer. The company plans to report the results in a peer-reviewed publication.

In a second Phase 1/2 study, DARE-HRT1, the company reported positive pharmacokinetic results earlier this month. This study focuses on a monthly intravaginal ring to deliver estrogen and progestogen hormones for the treatment of vasomotor symptoms due to menopause. Based on this successful trial, the company plans to advance to a Phase 3 efficacy trial.

On the contraceptive track, Daré has received FDA approval of an IDE application for a pivotal study of Ovaprene, a hormone-free monthly intravaginal contraceptive device. This approval clears the way for a Phase 3 clinical trial, which is targeted for initiation in the middle of this year. Daré is working on Ovaprene in combination with Bayer, and the drug candidate has potential to become the first monthly dosed intravaginal contraceptive on the market.

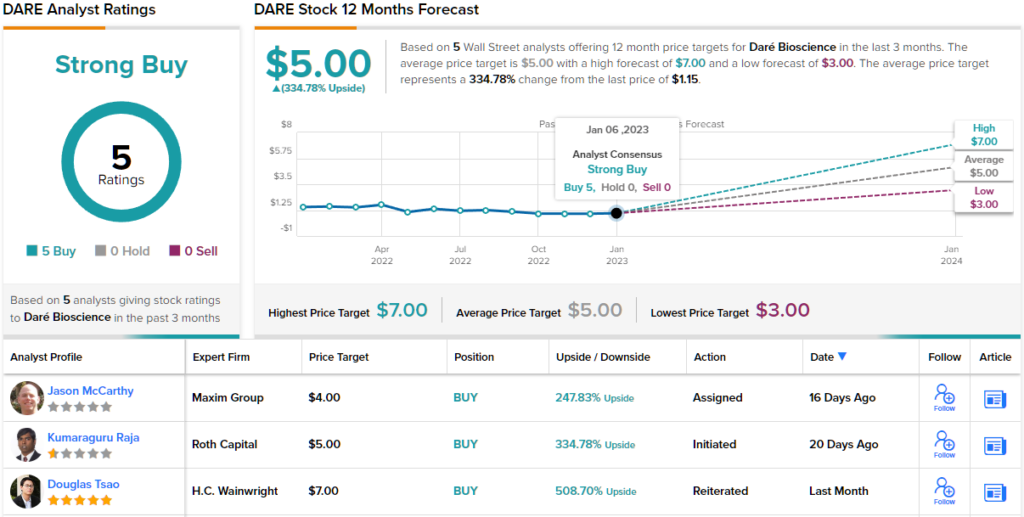

Based on potentially significant catalysts as well as its $1.15 share price, several members of the Street think that now is the right time to pull the trigger.

Among the DARE bulls is Jones Trading analyst Catherine Novack, who writes, “We see Daré as an undervalued player in the women’s health space, and are bullish on the name because: 1) Contraception is a blockbuster indication, and Daré’s Ovaprene will potentially be the only monthly non-hormonal option on the market; 2) Daré’s portfolio assets are approvable via the 505(b)(2) pathway, de-risking regulatory approval; 3) Commercial partnerships with big players in the women’s health space (Organon and Bayer) eliminate the need for a sales team and provide non-dilutive sources of funding; and 4) Attractive risk/benefit profile of pipeline products for sexual dysfunction, vulvovaginal atrophy, and pregnancy maintenance.”

Novack backs up her bullish stance with a Buy rating on the stock, while her $6 price target suggests a whopping upside potential of 422%. (To watch Novack’s track record, click here)

The Street is clearly optimistic on this penny stock, as all 5 recent analyst reviews are positive – for a unanimous Strong Buy consensus rating. With an average price target of $5, the upside potential comes in at ~335%. (See DARE stock forecast on TipRanks)

Xilio Therapeutics, Inc. (XLO)

Next up is Xilio, a biotech firm working on advanced, next-generation immunotherapies for the treatment of cancer. Specifically, the company develops drug candidates with potential to improve patient outcome by focusing the immune system’s activity directly and selectively to the site of the tumor. Xilio has a proprietary development platform and is building novel, tumor-activated molecules for optimal effect in the tumor microenvironment. The company’s three active clinical trial programs are all at early stages – but have been showing promising results.

The first trial, an ongoing Phase 1 study of XTX202, is testing the tumor-activated against interleukin-2, or IL-2, as a treatment for advanced solid tumors. The study has successfully reached the target dose range, and showed preliminary evidence of increased CD8+ effector T cells and NK cells. Xilio plan to start enrollment in a Phase 2 monotherapy study during 1H23, and to report preliminary data on safety and anti-tumor activity from the Phase 1/2 trial in 3Q23.

On the second trial, of XTX301, a tumor-activated IL-12 drug candidate, the company has received FDA clearance of the IND application to conduct an active clinical study. Xilio plans to initiate patient dosing in a Phase 1 clinical trial during this quarter and expects to report preliminary data from the Phase 1 trial during 4Q23.

The final clinical study focuses on XTX101, a tumor-activated anti-CTLA-4. This drug candidate is part of the company’s cytokine program. Xilio has this drug candidate in a Phase 1 trial against advanced solid tumors, and is currently seeking a partner in order to conduct further testing.

In a review of Xilio for Chardan, analyst Matthew Barcus writes: “We see strong potential with the company’s two lead cytokine programs XTX202 and XTX301… We currently model XLO’s assets achieving $320 mm in projected risk-adjusted 2030 sales. We believe XLO is well-positioned to become a leader in the field of immuno-oncology and we look forward to multiple key catalysts in 2023 from the company’s programs.

Looking forward, Barcus rates XLO shares a Buy, and his price target of $7 implies that the stock has a 12-month upside potential of 143%. (To watch Barcus’ track record, click here)

That’s a bullish take – but the Street is even more optimistic. XLO has a Strong Buy consensus based on 4 unanimously positive analyst reviews, and the average price target of $12.25 suggests a one-year gain of ~326% from the current share price of $2.88. (See XLO stock forecast at TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.