Every investor hopes to uncover a growth stock, an equity poised for rapid appreciation and substantial long-term returns. The real challenge lies in spotting the right opportunities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Several research firms are now pointing to medical device companies as promising candidates. According to KPMG, the medical device industry is on a steady upward trajectory, with global annual sales expected to grow by over 5% annually, reaching close to $800 billion by 2030. BCC Research offers an even more optimistic outlook, projecting the market to surpass $953 billion by 2027.

The reason behind this optimism is simple: innovation. Medical device companies are developing new tools that enable healthcare professionals to provide better diagnoses, more effective treatments, and improved patient outcomes. As technological advancements surge and an aging population increases demand for healthcare solutions, the sector stands to benefit from both long-term trends and pressing needs. All of this makes medical device stocks solid choices for investors seeking growth.

That’s exactly why Kyle Bauser, an analyst at B. Riley, recently highlighted two medical device stocks he believes are set for solid gains – specifically, in order of at least 60%.

What’s more, after using TipRanks’ database, we found out that Bauser’s picks have scored enough positive reviews from the broader analyst community to earn a ‘Strong Buy’ consensus rating. Let’s take a closer look.

InfuSystem Holdings (INFU)

The first stock we’ll look at, InfuSystem, is a device company that works with hospitals, surgical centers, and oncology practices, offering a variety of infusion pump products. These devices are designed to calibrate the doses of fluids for intravenous delivery. They are commonly used in the delivery of medications and nutrients – fluids that need to be monitored, and given to the patient in controlled quantities and doses. InfuSystem’s pumps can deliver fluids directly to the patient’s body, and are available in large-volume and ambulatory designs.

Customers can choose to buy or rent the infusion pumps, knowing that InfuSystem can deliver more than 60 different models in the brand names that medical providers trust. Pumps are available as new or pre-owned, and are guaranteed – even the pre-owned pumps are backed by a 90-day warranty. InfuSystem’s rental option gives its customers options for flexible management of their inventory, and allows for turnover when newer models are available.

In addition to providing hardware for infusion pump systems, the company also provides services to back them up. InfuSystem offers both preventative maintenance and repair, and makes devices’ service records available to the customer. This company’s business is a demonstration that a medical device provider does not need to deal in the latest technology to be on the cutting edge – InfuSystem works to smooth out the bumps in one of the medical industry’s most essential items, and its supply chain.

While this may seem like an unassuming business, it brought InfuSystem record-level revenues in the second quarter of this year. The company reported $33.7 million at the top line, for 6% year-over-year growth. Breaking down to the firm’s divisions, revenue from Patient Services came to $20.2 million, while Device Solutions generated $13.5 million. At the bottom line, the company realized earnings of 3 cents per share by GAAP measures. We should note here that InfuSystem has seen a pattern of ‘slow and steady’ revenue growth over the past several years.

This stock’s sound performance, and strong hold in an essential medical niche, caught the eye of B. Riley’s Bauser. “INFU has built a network of over 800 payer contracts, covering more than 96% of lives in the U.S., which creates, in our opinion, a significant competitive advantage and barrier to entry for potential competitors,” Bauser said. “We believe the stock is significantly undervalued due to non-fundamental hiccups (e.g., earnings misses and delayed filing) and should re-rate as the company continues the momentum seen last quarter—INFU is trading at 1.3x sales and 7.1x adjusted EBITDA vs. the peer group at 2.2x and 11.6x, respectively. We expect sales this year to grow in the high-single digits, with an adjusted EBITDA margin in the high teens on a percentage basis. We further expect margins to exceed 20% within the next 12–24 months.”

These comments back up the analyst’s Buy rating, and his $13 price target implies one-year share appreciation of 97.5%. (To watch Bauser’s track record, click here)

Overall, there are 3 recent analyst reviews here, and they are all positive – making the Strong Buy consensus rating unanimous. The stock’s $6.58 selling price and $12.75 average target price together indicate an upside potential of 94% over the next 12 months. (See INFU stock forecast)

Tactile Systems Technology (TCMD)

The next stock on our list, Tactile Systems, does work in leading-edge technology. This company’s focus is on developing devices for the treatment of chronic conditions, especially chronic swelling and/or respiratory difficulties. These are not necessarily diseases in themselves, but are frequently symptoms and can make a hefty impact on the patient’s quality of life.

To help improve that quality of life, Tactile Systems offers a range of wearable products designed for intermittent pneumatic compression, that is, a regular and gentle squeezing action to counteract swelling, or lymphedema. The company offers these device solutions for three distinct areas of the patient’s body: the head and neck; the upper body; and the lower body. The company reports that its Flexitouch system achieved a 96% patient satisfaction rate, and provided a 37% reduction in the cost of lymphedema-related expenses per patient.

Chronic respiratory problems are also associated with multiple health conditions, and Tactile Systems has designed the AffloVest as a mobile airway clearance therapy. The vest can be worn over ordinary clothing, and has been shown to help loosen and clear build-ups of mucus in the lungs, allowing patients to breathe more easily.

Tactile Systems has recognized an important medical need – and built a business to meet it. In its 2Q24 report, the company showed revenues of $73.2 million, up more than 7% year-over-year and a modest $390,000 better than had been expected. The firm’s net income came to 18 cents per share, and it, too, beat expectations – by 6 cents per share.

Checking in again with analyst Bauser, we find him upbeat here, noting that the company has targeted a large total addressable market. Bauser says of Tactile Systems, “Lymphedema and airway clearance disorders remain highly underdiagnosed, undertreated, and underserved. We believe that TCMD has several opportunities to capitalize on these markets via investment in products, patient services, and sales and order operations. Simplifying the sales process and continued scale improvements will likely drive market access and, ultimately, earnings.”

“There are nearly 2M patients diagnosed with lymphedema in the U.S., with another ~20M undiagnosed cases. Within the bronchiectasis patient population, there are roughly 500K diagnosed cases and 4.4M undiagnosed patients,” Bauser goes on to say. “We believe the enhanced margin profile remains significantly underappreciated, as does the current valuation.”

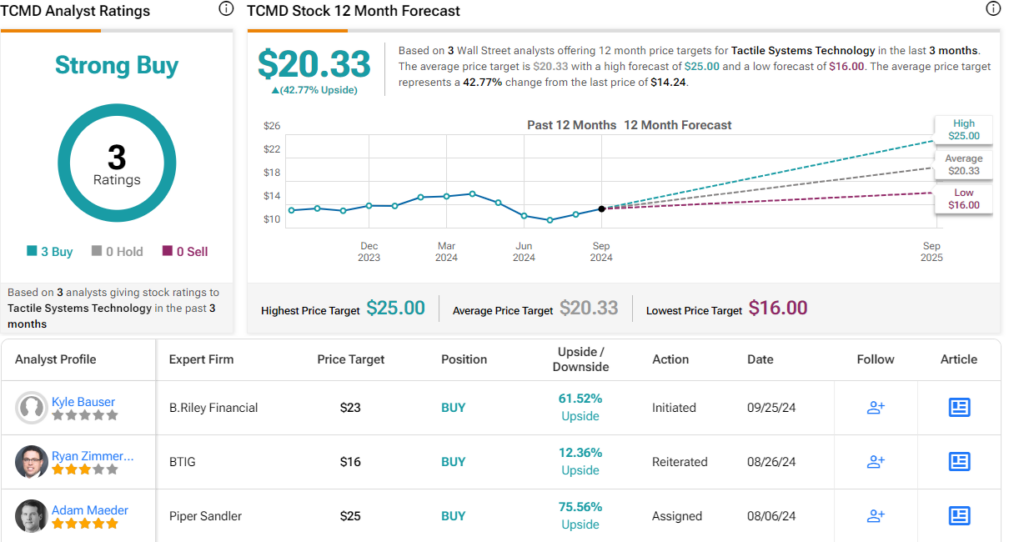

Looking ahead, the B. Riley analyst rates the shares a Buy, with a price target of $23 to imply a 61.5% upside on the one-year horizon.

The Wall Street consensus rating here is a Strong Buy, based on 3 recent positive reviews. The shares are trading for $14.24 and have an average price target of $20.33, suggesting a one-year upside potential of 43%. (See TCMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.