We all like a good meal, but the rampant inflation of the last few years has crimped budgets and forced a cutback in dining out. The near-term horizon is still cloudy, but it’s possible that the restaurant industry may see clearer skies farther out – the rate of inflation has been slowing in recent months, and the Federal Reserve has indicated that it will likely start cutting interest rates next year. An easier credit environment, along with a moderation in prices, bodes well not only for consumer spending generally but also for leisure in particular.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Covering the restaurant sector for investment firm Wedbush, analyst Nick Setyan writes of current conditions, “As food cost inflation continues to moderate, we expect restaurants’ unfavorable gap vs. grocery to continue. The Fast Act in California will exacerbate this gap starting in April. We also expect the normalization in consumer spending observed in 2H:23 to continue through 2024: each income level will see healthy income growth, but the aspirational trade up is gone for every household income level.”

At the bottom line, Setyan lays out an optimistic path, saying, “As margins for casual dining expand and building costs stabilize, we expect an uptick in ‘24 unit growth towards the ~2% current expectation. We also expect an uptick in fast casual/snack in ‘24, particularly as recently public growth restaurants contribute and increasing CoC returns of mature names result in accelerating unit growth.”

Translating this to specifics, the analyst is picking out potential winners among the restaurant stocks. We’ve used the TipRanks platform to look up the Street consensus on two of Setyan’s attractive picks, and here’s what we found.

Dutch Bros, Inc. (BROS)

Founded in 1992, the first stock on our list is Dutch Bros, a chain of drive-through coffee shops based in Oregon and prevalent west of the Mississippi, although the company does have locations in Kentucky, Tennessee, and northern Alabama. The company started out as a coffee bar, specializing in espresso-based drinks; over the years, its menu has expanded to include a much wider range of beverages, including seasonal drinks, cold brew coffees, smoothies, teas, energy drinks, and lemonade. While the shops are still beverage-based, they also offer snacks such as muffin tops and granola bars.

Overall, Dutch Bros now has 794 locations in 16 states, a far cry from its original pushcart-based espresso machine. The company is one of the fastest-growing brands in the US restaurant and food service sector, basing its growth on a commitment to quality that keeps customers coming back. Some simple numbers show the pace of the company’s growth: in the last quarter, 3Q23, Dutch Bros opened a net of 39 shops system-wide, representing a 5.2% quarterly increase.

The company’s rapid expansion, and the fact that its stores tend to be concentrated in relatively narrow geographical areas, leads to what the chain calls ‘sales transfer,’ where new stores attract new customers while also taking existing customers from older stores. Overall, the company gains customers, but same-store comps may suffer. This factor was a drag on Dutch Bros’ growth in recent years, but the company is now just a stone’s throw from the 800-store goal it has been working towards since 2018 and the ‘sales transfer’ effect is slowing. The company plans to open another 200 stores by the end of 2025.

When we turn to the company’s financial performance, we find that BROS has seen a rapid run-up in revenues over the last few years. In the most recent quarter reported, 3Q23, Dutch Bros brought in $265 million in revenue. This was a quarterly record for the company, up 33% year-over-year and $6.15 million better than expected. The company’s earnings figure, the non-GAAP EPS of 14 cents per diluted share, showed a strong increase of 5 cents per share from the 3Q22 figure and beat the pre-release forecast by 7 cents per share.

Since bottoming out at the end of September this year, BROS stock has been buoyed by several pieces of good news. The 3Q report, with its solid beats, was one; additionally, several Wall Street analysts have recently turned bullish on the stock, including Wedbush’s Setyan.

Laying out the Wedbush take on BROS, which includes naming the chain as a ‘top pick,’ Setyan points out that the chain has multiple drivers for success, and writes, “We believe the magnitude of sales transfer to have peaked in 2023, and to gradually decline in 2024 and thereafter. Concurrently, management has focused on a number of company-specific transaction drivers: throughput, rewards, marketing, store manager bonus structure, etc. that we believe are in the very early innings. Additionally, we would not be surprised if pricing, inclusive of CA, is similar in 2024 as in 2023. As such, we view current 2024 SSS growth expectations as realistic. We also view margin expectations as realistic, and expect Q4 results and 2024 guidance to act as a positive NT catalyst to drive an expanding valuation…”

Quantifying this stance, the Wedbush analyst gives BROS shares an Outperform (i.e. Buy) rating, and a $37 price target to show his confidence in a one-year upside of 17%. (To watch Setyan’s track record, click here)

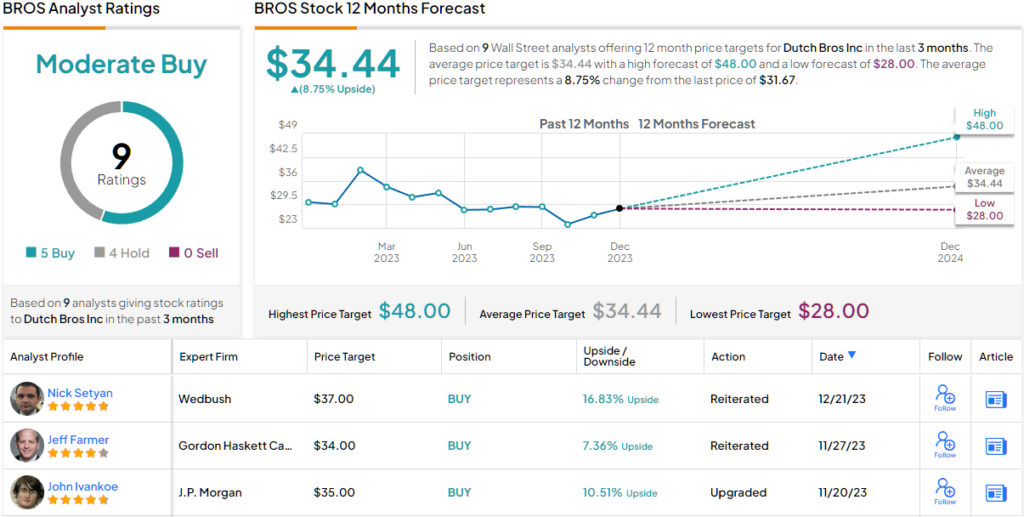

Overall, the 9 recent analyst reviews on Dutch Bros’ shares break down 5 to 4 favoring Buys over Holds, giving the stock a Moderate Buy consensus rating. Shares are trading now for $31.67 and their $34.44 average target price suggests an upside of ~9% in the next 12 months. (See BROS stock forecast)

CAVA Group (CAVA)

Next up on our list of Wedbush’s ‘top picks’ from the restaurant sector is Cava, a fast-casual chain specializing in Mediterranean food and based in Washington, DC. The chain opened its first location in Bethesda, Maryland, in 2011 and now has 290 locations. Cava bought out the competing Mediterranean restaurant chain Zoe’s Kitchen in 2018, paying $300 million for the acquisition, and has since been converting Zoe’s locations to the Cava brand.

CAVA Group was a privately held company until earlier this year when it launched itself into the public markets through an IPO. The offering, held in June, was stronger than had been anticipated. The company’s initial pricing called for 14,444,444 shares to go on the market at $22 each, with the underwriters having an option to buy 2,166,666 additional shares. In the actual event, which saw the shares open on June 15, the initial price was $42 per share.

When the offering closed on June 20, CAVA shares were trading for $38.43. The company announced that it had sold a total of 16,611,110 shares through the IPO and raised more than $318 million in gross proceeds. Since then, the shares have seen volatile trading, rising as high as $57 and falling as low as $30.

The company has released two earnings reports since going public, for 2Q and 3Q of this year. The second release, 3Q23, covers the company’s first full quarter as a public entity and is worth a closer look. Cava’s revenues in 3Q came to $175.55 million, beating the forecast by $4.11 million. The company reported earnings of 6 cents per share, 9 cents ahead of the estimates. We noted above that Cava finished the quarter with 290 active locations; this figure represents a 35% increase year-over-year. For the full year 2023, Cava expects to have as many as 73 new openings in total and to see same-restaurant sales growth of 15% to 16% as well as a 24% restaurant-level profit margin.

Checking in again with analyst Nick Setyan, we find him upbeat on Cava’s prospects, noting that Q4 should show continued upside. He writes, in his recent note, “We expect another quarter of upside vs. conservative guidance and consensus estimates in Q4 to validate a comp trajectory towards the MSD range in 2H:24, inclusive of positive transactions. While we view lower grocery inflation as an incremental threat to the fast casual category in 2024, we also believe CAVA’s relative value proposition and maturation cycle contribution to comp positions it to overcome the incremental headwind. Should our SSS growth expectation materialize, we view current 2024 margin estimates as overly conservative.”

These comments back up Setyan’s upgrade of CAVA shares from Neutral to Outperform (i.e. Buy), and his $48 price target implies a gain of ~12% on the one-year horizon.

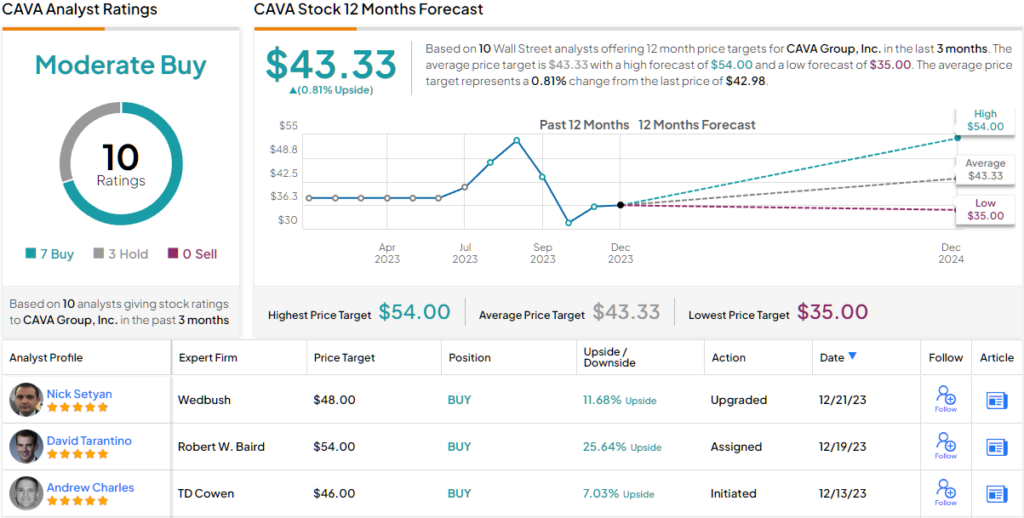

Wall Street, generally, is also willing to buy this stock – as shown by the Moderate Buy consensus rating backed up by 7 Buys and 3 Holds. (See CAVA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.