Many view Warren Buffett as one of the greatest stock pickers of all time, if not the greatest, so you might be surprised to learn that he owns two ETFs in his Berkshire Hathaway (NYSE:BRK.B) portfolio. Not only that, but the only two ETFs that he owns are broad market ETFs — the Vanguard S&P 500 ETF (NYSEARCA:VOO) and the SPDR S&P 500 ETF Trust (NYSEARCA:SPY).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on these ETFs based on their fantastic long-term track records and their low fees. Plus, if they are worthy of a spot in Buffett’s portfolio, they are likely worth a spot in the portfolio of the everyday investor as well. Here are the likely reasons why the Oracle of Omaha owns these ETFs and why they could be good fits for your portfolio as well.

Buffett and Index Funds

VOO is a $347.2 billion low-cost ETF from Vanguard that simply invests in the S&P 500 (SPX), an index representing 500 of the largest publicly-traded companies in the U.S. SPY employs the same strategy and is the largest ETF in the market, with $414.2 billion in assets under management (AUM).

While Buffett’s acumen for picking undervalued stocks is legendary, he has long espoused the virtues of low-cost index funds like VOO and SPY.

In 2008, Buffett famously placed a bet with a hedge fund manager that a simple S&P 500 index fund from Vanguard would beat a portfolio of five actively-managed hedge funds over the next 10 years, and Buffett won by a country mile. The S&P 500 fund returned over 125%, while the five actively-managed funds returned an average of just 36.3% net of fees.

Research from Standard & Poor’s shows that this likely wasn’t a fluke — after five years, 84% of actively-managed large-cap funds underperform their benchmarks, and by 10 years, 90% underperform.

Buffett wrote, “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

In fact, Buffett is such a proponent of index funds that he has even reportedly instructed that 90% of the money that his family inherits after he passes away will be invested in low-cost index funds.

Thanks to public data from 13F filings, we can see that Buffett owns about $16.8 million worth of SPY and $16.9 million worth of VOO in Berkshire Hathaway’s portfolio. To be clear, these are relatively small investments for Berkshire Hathaway, given that its portfolio of public equities is worth $313.2 billion, but Buffett clearly likes these ETFs.

VOO and SPY’s Top Holdings

The nice thing about these S&P 500 ETFs is that they allow investors to harness the power of 500 of the largest U.S. companies in their portfolios with one simple investment vehicle. This gives investors plenty of diversification as well as exposure to the dynamism of top U.S. companies from all sectors of the economy.

Because they both passively invest in the S&P 500 index, the holdings for VOO and SPY are more or less the same. VOO owns 506 stocks, and its top 10 holdings account for 31.1% of the fund. SPY owns 503 stocks, and its top 10 holdings make up 32.0% of the fund.

Below, you’ll find an overview of VOO’s top 10 holdings using TipRanks’ holdings tool, as well as an overview of SPY’s top 10 holdings.

VOO’s Top 10 Holdings

SPY’s Top 10 Holdings

As you can see, both funds own many of the U.S.’s top companies. The holdings for both portfolios feature a strong assortment of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Each fund features eight top 10 holdings with Outperform-equivalent Smart Scores of 8 or above, and holdings like Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL), and Meta Platforms (NASDAQ:META), all score 10 out of 10.

VOO and SPY both boast Outperform-equivalent ETF Smart Scores of 8 out of 10.

Solid Long-Term Performances

In addition to these strong portfolios of top U.S. companies, both VOO and SPY have compiled impressive track records of long-term performance for many years.

VOO has returned 10.3% on an annualized basis over the past three years (as of October 31), 11.0% over the past five, and 11.1% over the past 10. Since its inception in 2010, it has provided annualized returns of 12.9%.

Unsurprisingly, because they both invest in the same index, SPY has produced similar results. Over the past three years, SPY has generated an annualized return of 10.2%. Over the past five years, its annualized return stands at 10.9%, while its 10-year annualized return comes in at 11.0%. SPY is much older than VOO, having launched in 1993, but it has returned an excellent 9.6% on an annualized basis since then.

This return since 1993 is especially impressive when considering that the ETF has gone through the dot-com bubble, the Global Financial Crisis, and the COVID-19 crash all happened within this multi-decade time frame. The fact that SPY has generated such positive results, even with these periods of steep market declines taken into account, truly illustrates the power of long-term investing.

Both ETFs have generated excellent returns over time, highlighting why it has been difficult for the majority of active managers to beat the S&P 500 over the long run.

Low Fees

A stickler for value, Buffett is likely a fan of the low fees that both of these ETFs feature. VOO has an expense ratio of just 0.03%, while SPY charges 0.09%. Both are extremely low fees, but it has to be said that VOO is cheaper.

An investor putting $10,000 into VOO would pay just $3 in fees in year one, while an investor in SPY would pay $9.

Are VOO and SPY Shares Buys, According to Analysts?

Turning to Wall Street, VOO earns a Moderate Buy consensus rating based on 403 Buys, 96 Holds, and eight Sell ratings assigned in the past three months. The average VOO stock price target of $465.86 implies 12.5% upside potential.

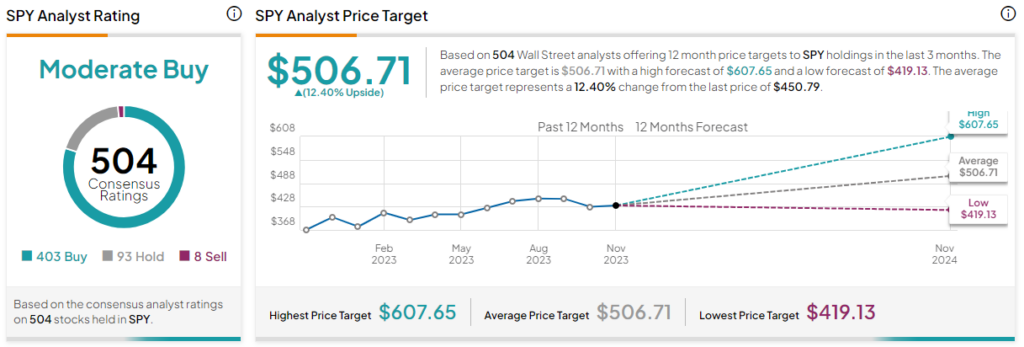

Meanwhile, SPY also earns a Moderate Buy consensus rating based on a nearly identical 403 Buys, 93 Holds, and eight Sell ratings assigned in the past three months. The average SPY stock price target of $506.71 implies 12.4% upside potential.

The Takeaway: If They’re Good Enough for Buffett…

Both VOO and SPY employ simple strategies of investing in the S&P 500 index, but both have produced excellent results for investors over the long term. They offer diversified exposure to the top stocks in the U.S. market for a minuscule fee. Warren Buffett is a big believer in the power of index funds and likes them enough to include them in his own portfolio, and that’s good enough for me. Of the two funds, I like VOO better because of its lower expense ratio.