Stocks have started 2023 with a 7% gain on the S&P 500, and 13.5% gain on the NASDAQ. It’s a solid performance to start the year, but will it last?

According to Emmanuel Cau, the head of European equity strategy at Barclays, we might not be fully out of the woods yet.

“Despite a still sticky labor market, softening US data (ISM down further below 50, weaker housing data) seem to matter for central banks’ reaction function, which now appears more balanced between fighting inflation and preserving growth. One should not get carried away, as CBs made it clear that rates hikes are not over and will be data dependent,” Cau opined.

Taking a cautious approach could prove to be a prudent solution; investors can seek shelter in a defensive play that will provide some income padding in the portfolio. Dividend stocks are a common choice; if the yield is high enough, it can offset losses elsewhere.

Barclays’ 5-star analyst Theresa Chen has found two such names that deserve a second look. These are stocks with dividend yields of 8% or better and, according to Chen, they both stand out as potential winners in the months ahead. Let’s take a closer look.

Magellan Midstream Partners (MMP)

The first stock we’ll look at, Magellan Midstream Partners, operates in the North American hydrocarbon sector, the vital heart of the energy industry. Midstream companies, like Magellan, exist to move the petroleum and natural gas products from the production wells into the distribution and storage networks that span the continent. Magellan’s assets include some 12,000 miles of pipelines, tank farms and other storage facilities, and marine terminals. The company’s network stretches from the Great Lakes and Rocky Mountains into the great Mississippi Valley and down to the Gulf of Mexico.

Magellan has just reported its 4Q22 results, and showed a quarterly net income of $187 million to finish off the year. This was down from $244 million in the year-ago quarter, for a year-over-year decline of 23%. The current net income result was negatively impacted by a non-cash impairment charge of $58 million, related to the company’s investment in the Double Eagle pipeline. EPS came in at 91 cents per diluted share, down 20% from the $1.14 reported in 4Q21.

Of immediate interest to dividend investors, Magellan reported an increase in its distributable cash flow (DCF). This is a non-GAAP metric that indicates the company’s resources to cover the dividends, and in 4Q22 it increased y/y from $297 million to $345 million.

And that brings us to the dividend. Magellan announced a 4Q div payment of $1.0475 per common share, for payment on February 7. At the current payment, the dividend yields 8%, a point and a half above the last inflation data. That’s enough to ensure a real rate of return, but Magellan also offers investors a couple of other treats in the dividend bag: the company keeps a reliable payment, and management has a long-term habit of raising the annual dividend.

For Barclay’s Chen, this adds up to a stock that’s worth an investor’s time and money. She writes: “We continue to view MMP as a quality MLP with 85%+ fee-based cash flows, a strategically located footprint, a resilient asset base, a proven execution track record of organic growth, a healthy balance sheet, and one of the most competitive costs of capital in our coverage… We think MMP will benefit from both the mid-2023 tariff uplift across its refined products pipelines… MMP also pays a healthy 8% yield and is one of the few midstream companies within our coverage that regularly deploys FCF towards unit repurchases.”

Chen goes on to rate MMP stock as Overweight (i.e. Buy), with a $59 price target that suggests an 12% upside for the coming months. Based on the current dividend yield and the expected price appreciation, the stock has ~20% potential total return profile. (To watch Chen’s track record, click here)

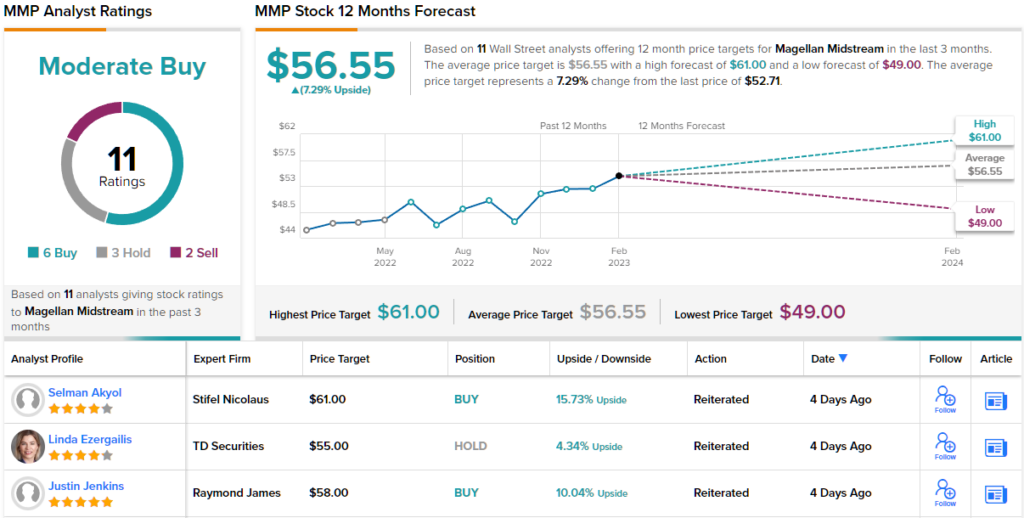

What does the rest of the Street think? Over the past 3 months, there have been 11 analyst reviews for this stock, and they show a breakdown of 6 Buys, 3 Holds, and 2 Sells, for a Moderate Buy consensus rating. (See Magellan stock forecast)

NuStar Energy LP (NS)

Next on our list is NuStar Energy, a master limited partnership company that operates pipelines and liquids storage for hydrocarbons, and other dangerous chemicals, in the US energy industry and in Mexico. NuStar boasts around 10,000 pipeline miles and 63 terminal and storage facilities for crude oil and its refined products, renewable fuels, ammonia, and other specialty liquids. The company’s storage farms can handle up to 49 million barrels.

For NuStar, this adds up to big business. The company consistently reports well over $400 million in quarterly revenues. In the last reported quarter, 4Q22, NuStar’s top line came in at $430 million, compared to $417 million in the year-ago period. For the full year 2022, revenues hit $1.68 billion, up from $1.62 billion in 2021.

While top line growth was modest, quarterly net income in Q4 of $91.6 million was up 59% year-over-year, and a company record. Diluted EPS was reported at 18 cents, down from 19 cents in 4Q21. For all of 2022, NuStar had a net income of $222.7 million, a tremendous y/y increase from 2021’s $38.2 million.

Turning to the dividend, we’ll look first at distributable cash flow. The DCF here was $89 million for 4Q22, a sharp increase of 41% from the $63 million in 4Q21. The solid cash flow permitted the company to maintain its 40-cent per common share quarterly dividend payout, a rate the company has held to since 2020. The annualized payment rate, of $1.60 per share, gives this stock a dividend yield of 9.5%, 3 points above the last inflation reading.

Covering the stock for Barclay, Chen writes that she remains optimistic about NuStar’s potential to generate profits going forward.

Barclay’s Chen is impressed with NuStar’s execution in recent months, writing: “We continue to like NS based on its offensive and defensive fundamental qualities. Demand remains resilient across NS’ refined products infrastructure assets in the Mid-Con and Texas where driving is often the only mode of transportation… Over the medium-to-long term, NS looks to be an active participant in the energy transition through its West Coast biofuels terminals and its ammonia pipeline system as potential to service renewable fuels.”

Chen uses these comments to back up her Overweight (i.e. Buy) rating on this stock, while her $19 price target implies an upside potential of 12% for the year ahead.

Generally, the Street’s tone is more cautious here. Based on 1 Buy, 2 Holds, and 1 Sell, the analysts currently rate this stock a Hold (i.e. Neutral). (See NuStar stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.