The software sector is becoming increasingly important as our world becomes more digitized. With more processes moving online, there is a growing demand for software to control them. This, in turn, opens up opportunities for investors in the DevOps field.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DevOps, which combines software development and IT operations, focuses on accelerating the software creation lifecycle, enabling companies to respond more rapidly to changing conditions. DevOps is a growing sector, evident from the expected growth in the platform market, projected to increase by as much as $25 billion for the period between 2022 to 2027, according to Technavio. This translates to a compound annual growth rate exceeding 24%, and savvy investors are already starting to take notice.

KeyBanc’s 5-star analyst Jason Celino covers this high-potential segment, and lays out the case for investing now: “In today’s world, every company must become a software company to effectively compete and meet increasingly demanding customer needs. We believe this places increased focus on faster software delivery cycles, because faster delivery leads to faster time to market, shorter product and feature development cycles, and a better ability to drive differentiation and a competitive edge.”

“We believe these factors are enabled by, and increase the need for, DevOps processes and tools,” Celino goes on to add. “Most importantly, through generative AI, we see the potential for the democratization of software development, potentially further accelerating software delivery cycles. We view DevOps as a critical subsector of software and a must own category for software investors.”

Celino goes on to recommend two particular stocks, and the TipRanks platform shows that his colleagues on Wall Street agree with his picks; they see them both as Strong Buys. Celino describes them as ‘must-owns’ for software investors, and the data shows that they have double-digit upside potential. Here are the details.

GitLab (GTLB)

We’ll start with GitLab, a specialist firm in DevOps whose DevSecOps platform offers users an open-source solution for fast and efficient software development geared toward creating the highest possible return from the end product. GitLab was founded in 2014, on the theory that ‘everyone can contribute;’ its open-source model allows every user to become a contributor, making a model that permits the fastest possible pace of innovation.

The open-source platform is available to everyone, as the base of a ‘freemium’ product model that makes high-level upgrades and increased functionality available to paying subscribers. Per the company, GitLab has over 30 million users, and 1 million paying active license users. The company was a pioneer in remote work, and currently employs more than 2,000 people across 60 countries. More than 3,300 contributors worldwide are adding to the platform’s open-source code.

Earlier this month, GitLab announced its acquisition of the cloud-native application security and risk management firm, Oxeye. The move will allow GitLab to accelerate the Static Application Security Testing (SAST) roadmap, and to augment its capabilities in software composition analysis and compliance. In addition, GitLab will gain capabilities in tracing vulnerabilities from ‘code to cloud,’ through use of runtime context and varying types of data collection and analysis.

GitLab recently reported its financial results for fiscal 4Q24, the quarter that ended on January 31 of this calendar year. The company’s top line for the period hit $163.8 million, up more than 33% year-over-year and beating the forecast by $5.54 million. The company’s bottom line came in as an EPS of 15 cents by non-GAAP measures, a figure that was 7 cents better than had been expected.

For the past 12 months, shares in GitLab are up more than 73%, but the stock has fallen in recent weeks, since the fiscal 4Q24 release, for a year-to-date loss of ~6.5%; investors have drawn back as the company’s guidance for fiscal ’25 came in below expectations. Analysts had predicted full-year 2025 EPS of 37 cents and revenues of $732.2 million, but the company issued guidance for an EPS range of 19 cents to 23 cents based on a revenue range of $725 million to $731 million.

For KeyBanc’s Celino, however, that hasn’t affected the bull case as GTLB represents a company with plenty to offer. He writes, “We believe GitLab is well positioned as the broadest independent DevSecOps platform in a +$120B TAM with room for multiple players. Underpinned by the LT opportunity to expand into adjacencies outside of core SCM/CI and consolidate a traditionally fragmented developer tools market, we see opportunity for sustained mid-20% growth. However, with a stable-to-improving spend environment and multiple NT catalysts (Duo Pro, GitLab Dedicated, Premium Tier Pricing Increase, and free-to-paid conversions), we could see potential growth upside to +30% in FY25 and FY26.”

Celino goes on to put an Overweight (Buy) rating on the stock, with a $70 price target that points toward a 19% upside for the next 12 months. (To watch Celino’s track record, click here)

Tech firms like GitLab never lack for analyst interest, and there are 19 recent reviews on record for this stock. These include 16 Buys against just 3 Holds, for the Strong Buy consensus rating, and the $73.35 average price target implies a 25% one-year gain from the $58.75 current trading price. (See GitLab’s stock forecast)

JFrog (FROG)

Next, we’ll look at JFrog, a DevOps company that has focused its work on what it calls ‘liquid software,’ the creation of a seamless path of regular and invisible software updates designed to enable a secure and hassle-free flow direct from the developers’ keyboard to the end-use device. The company’s platform is scalable and allows for the automated updates, allowing business clients to maintain their systems with the best possible speed and efficiency. It is fit for use by a wide-ranging clientele, including DevOps, SecOps, and IoT organizations. JFrog bills its platform as ‘universal, hybrid, and multi-cloud,’ optimized to bring the next generation of secure software delivery into the present.

JFrog presents this platform as the key to end-to-end DevOps acceleration. The company boasts that millions of software developers use its tools to smooth out the upgrade process – for the end users, there’s no more ‘restart your computer in the next 10 minutes,’ and better, the computer won’t restart itself. The company’s platform allows for the automated updates, allowing business clients to maintain their systems with the best possible speed and efficiency – essential in keeping their own customers and users happy. And for JFrog, the best part is when ordinary software users simply don’t know that this is happening; that’s the proof of a truly seamless experience.

The company has leveraged this, resulting in a customer base 7,400 strong as of December 31, 2023. This represents a gain of 200 customers, or 2.8%, year-over-year. Even better for JFrog, its customers are willing to pay top dollar for the service, on a continuing basis. At the end of 2023, the company had 886 customers with more than $100,000 in annual recurring revenue, a y/y gain of 20%, and 37 customers with more than $1 million in ARR, up 94% y/y.

These are just some of the numbers that stand behind JFrog’s success. The company has seen its share price rise by a robust 134% in the last 12 months, and by 27% in 2024 so far. Meanwhile, both revenues and earnings have been trending upwards. In the last quarter reported, 4Q23, the company’s top-line revenue was $97.3 million, up 27% y/y and $4.4 million better than had been anticipated. The quarterly bottom line, of 19 cents per share by non-GAAP measures, was 7 cents per share ahead of the estimates.

KeyBanc’s Celino sees JFrog’s quality products as supportive for continued revenue growth, and says in his write-up on the stock, “Given JFrog’s core product leadership with Artifactory, opportunity to consolidate the post build software supply chain through new product add-ons and platform sale, and what we expect to be a benefit from gen AI-assisted coding tools increasing the volume of software artifacts, we believe FROG can sustain low-20% revenue growth through FY27. That said, with signs of stabilizing/improving consumption, return of more migration activity, and encouraging progress in security, we see catalysts that could drive growth upside toward the mid-20s% in 2024 and 2025. With improved execution, and expanding OM profile, we believe continued execution and growth estimate upside could provide modest multiple expansion.”

The high-rated analyst goes on to rate FROG shares as Overweight (Buy), with a $52 price target implying an upside potential of 18% on the one-year horizon.

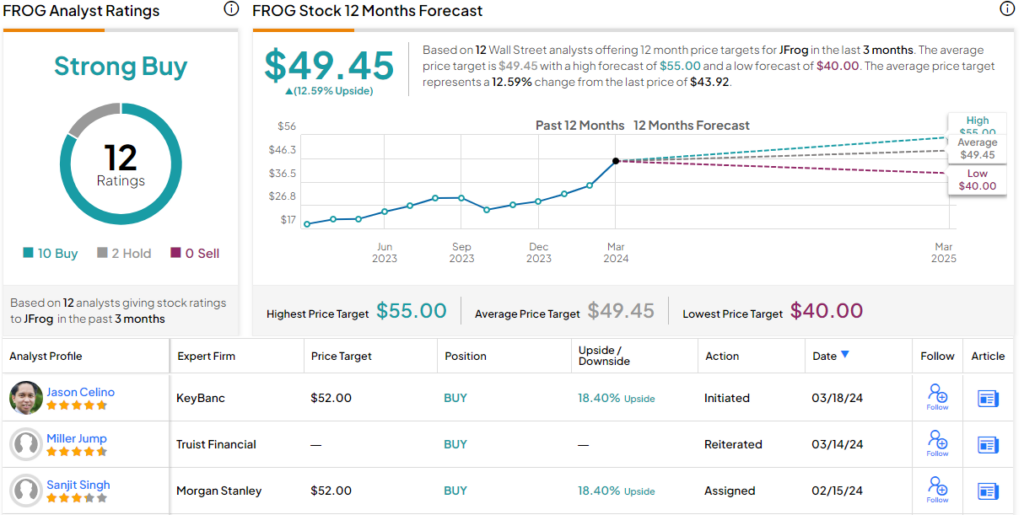

From the Street as a whole, JFrog’s stock gets a Strong Buy consensus rating based on 12 reviews with a 10 to 2 split favoring Buy over Hold. The stock is trading for $43.92 and its $49.45 average price target suggests a share appreciation of 12.5% in the coming year. (See JFrog’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.