Looking at the major indexes’ performances, U.S. stocks had a great year in 2023. However, that doesn’t really tell the full story as most of the gains were driven by the so-called “Magnificent Seven” stocks, the big tech names that caught a ride on the year’s AI-flavored theme.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The thing is, as Citi’s investment strategy team, led by CIO David Bailin, recently noted, the gains came against a backdrop in which “most S&P 500 firms saw EPS declines while employment and wages grew solidly.”

However, starting this year, Bailin foresees a “reversal in favor” of corporate profits and that should help other, less heralded names push ahead. “While we don’t expect another 20% surge for the S&P 500,” Bailin expounded on the issue, “we expect returns to broaden, with larger gains for the ‘average’ stock… We look for many others to participate in the gains we anticipate in 2024.”

Ok, then, but which names are best positioned to join the rally? Bailin’s Citi colleague, analyst Peter Christiansen, has an idea about that and is pointing investors toward two stocks he believes currently offer an attractive opportunity. We ran these tickers through the TipRanks database to see what other Street experts make of their prospects – turns out both are Buy-rated by the analyst community. Let’s check the details.

Global Business Travel Group (GBTG)

The first ‘Citi pick’ we’ll look at, Global Business Travel Group, spun off from American Express back in 2014, taking the parent company’s business travel management services public as an independent firm. Global Business Travel Group has since become a world leader as a business-to-business travel platform, offering its customers everything they need to smooth out the processes of business travel, with solutions for booking trips, managing trip expenses, and looking after the travelers’ needs.

This company, as its name implies, maintains a global footprint – a necessity in the world of business travel. The firm has operations in 140 countries around the world, allowing customers to choose from a wide range of services – travel consulting, travel management, and meeting & event management – wherever they need them, be it corporate offices or conferences abroad or company trips.

Building from its roots in Amex, one of the world’s long-known providers of travel services which continues to hold a minority interest in the daughter firm, GBTG can claim more than 100 years working in business travel, and over 90 years’ experience managing meetings and events. The company’s long-term success has brought it some 40 industry awards, and the company has invested $1.5 billion into relevant business travel technology.

In an interesting note, and a comment on the company’s overall strength, GBTG announced in December 2023 that it had received a credit upgrade from S&P Global Ratings. The credit ratings firm raised its issuer credit rating from B- to B+, based on a combination of a stable outlook, rapid deleveraging, and positive cash flows. In conjunction with the upgrade, S&P also raised its issue-level ratings by two notches.

A look at the company’s last financial release – from 3Q23 – shows that GBTG brought in $571 million at the top line for the quarter, a total revenue that was up 17% year-over-year and beat the forecast by nearly $15.4 million. The firm’s earnings came to a net loss of 2 cents per share. While negative, the 3Q23 EPS was a distinct improvement over the 43-cent per share loss from 3Q22 – and it came in 2 cents per share better than had been anticipated.

With these beats, GBTG also reported $107 million in free cash flow for the quarter. This figure represented a sharp turnaround from the $112 million FCF loss in the prior-year quarter.

For Citibank’s Peter Christiansen, this company presents investors with a sound choice going forward through this new year. He writes, “While Amex GBT’s recent survey suggests 2024 travel budgets will grow ~5%, ~200bps above last year’s measure, we remain confident in our estimate for 11% YoY growth given the company’s continued new wins momentum – $3.3bn in LTM TTV (total transaction value) wins alone translates to 4%-5% growth in FY’24. While not baking in, improving return-to-office trends and an elevated global political activity could represent upside vs. growth expectations. With the TTV run rate now ~75% of pre-pandemic levels and 2-3 quarters of ‘ahead of schedule’ execution, our confidence has increased for inflecting profitability (and FCF) in FY’24… we believe the stock’s risk/reward profile offers an attractive opportunity.”

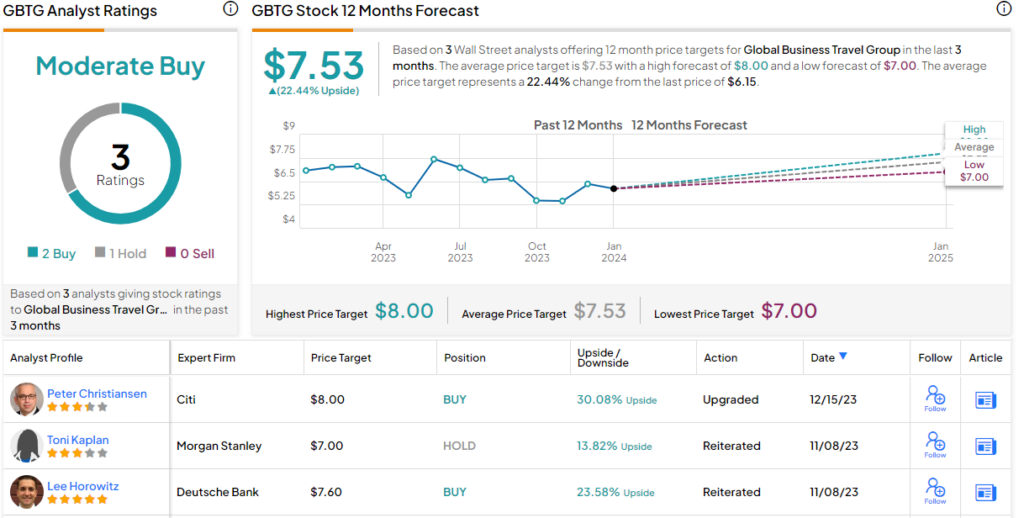

These comments add up to a Buy rating for GBTG shares, while Christiansen’s price target, at $8, implies the stock will gain 30% in the next 12 months. (To watch Christiansen’s track record, click here)

There are three recent analyst reviews on GBTG, breaking down 2 to 1 in favor of Buy over Hold, providing the stock with a Moderate Buy consensus rating. The current trading price is $6.15, and its $7.53 average target price points toward a 22% increase on the one-year horizon. (See GBTG stock forecast)

Alight, Inc. (ALIT)

Next up is a software company, Alight, that offers enterprise clients a set of business process software products. The company describes its focus as ‘human capital,’ partnering with its customers so that they can reap the rewards of their benefits programs, accurate payroll, and attentive HR departments. Alight uses data technology to help its clients connect the dots between employees’ lives and work.

Alight makes its products available to client companies by subscription, turning business process into business-process-as-a-service, BPaaS. Use of the subscription model makes it easy for client firms to adopt the software products, which Alight bills as ‘mission critical’ for them, by smoothing out the processes of everyday business.

Alight’s boasts some 4,300 client firms, using the company’s Worklife platform to bring these improvements to more than 36 million employees and dependents. The company’s clients represent 70% of the Fortune 100 firms, and operate in over 100 countries. Business on this scale brings tangible results, and for Alight those results are clear from the top line; the company generated $3.13 billion in revenue in 2022.

The company’s last quarterly report covered 3Q23, and the company’s top line for that quarter, $813 million, was up more than 8% year-over-year, although it missed the forecast by $16.48 million. The company’s non-GAAP earnings per share came to 14 cents. Year-over-year, this represented a 2-cent gain and compared to the forecast, it was a penny better than expected. BPaaS bookings in the quarter came to $262 million, for a 26% increase y/y, and pushed the company’s total bookings, since the beginning of 2021, to almost $2 billion. Alight management also noted that it already had $2.7 billion worth of revenue under contract for 2024.

Turning again to Citi’s analyst Christiansen, we find that he lays out a compelling case for buying into ALIT shares, saying of the stock, “We remain bullish on Alight given its compelling pathway to margin expansion through expense base improvements and ongoing scaling of its BPaaS solutions amidst a strong and growing pipeline. Investor sentiment appears likely to improve near-term as Blackstone’s recent block trade supports liquidity improvements for the stock, and management commentary around HCM (human capital management) demand, backed up by 3Q bookings numbers, are likely to temper fears around slower pipeline conversion.”

“Given our bullish view,” Christiansen adds, “the company’s ‘self-help’ narrative amidst the slowing job growth backdrop for other HR plays, and current valuation at 8.6x our FY24E Adj EBITDA, we reinstate ALIT as our top HR services pick.”

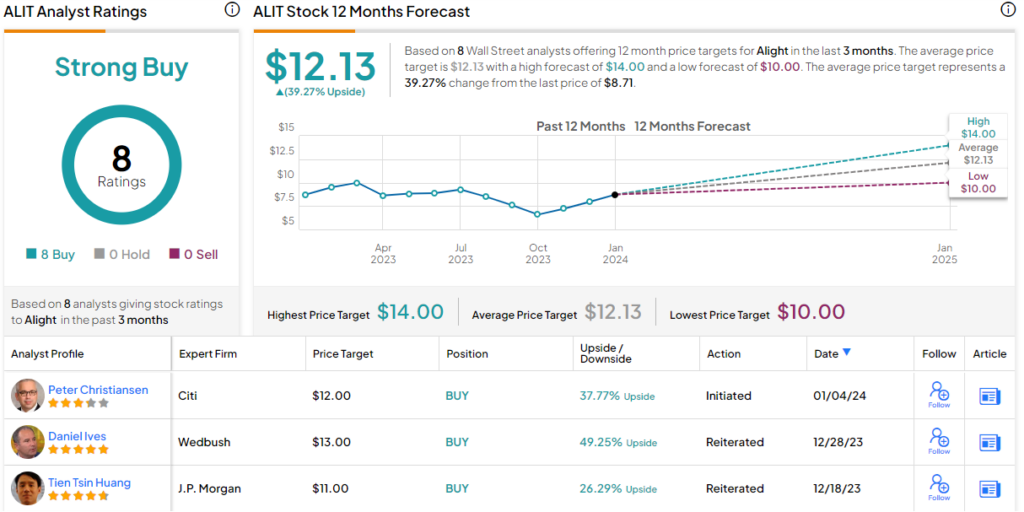

For the analyst, the bottom line here is a Buy rating and a price target of $12, implying a 38% increase for the stock over the course of 2024.

When the Street’s analysts all agree, investors should know that they’re onto something good – and the Strong Buy consensus rating here is unanimous, based on 8 recent positive analyst reviews. The shares are trading for $8.71 and have an average price target of $12.13, suggesting a 39% one-year upside potential. (See Alight stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.