ASX tech stocks have been taking a hit ahead of the Reserve Bank of Australia’s (RBA) meeting tomorrow, where it’s set to raise its benchmark interest rate for a sixth consecutive time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The technology sector is among those that tend to be sensitive to interest rate changes. The S&P/ASX 200 Information Technology (XIJ) index fell more than 1.30% today, extending its year-to-date losses to over 36%. The notable decliners in the index were Xero Limited (ASX:XRO) and Nextdc Limited (ASX:NXT).

Why are RBA rate hikes adverse to technology companies?

The RBA is predicted to raise its interest rate by as much as 0.50% as it attempts to tame inflation that has hit record levels. Rising rates mean more expensive loans for borrowers. When borrowing becomes more expensive, technology companies can face difficulties when trying to raise additional capital, which is needed to meet growth expectations.

Moreover, more expensive loans can diminish sales for technology companies if their customers cannot access the funding they require for IT projects. Aside from worries about increasing rates making borrowing more expensive, recession concerns have also caused some investors to sour on tech stocks.

Xero shares sink but analysts keep faith in the stock

Xero provides online solutions to small businesses. Its shares fell as much as 4% today to hit a new 52-week low of AU$70.71. They settled at AU$71.60, down 2.6% for the day. The decline extended the stock’s year-to-date losses to over 50%. According to TipRanks’ analyst rating consensus, Xero stock is a Strong Buy. The average Xero share price target of AU$100.55 implies over 40% upside potential.

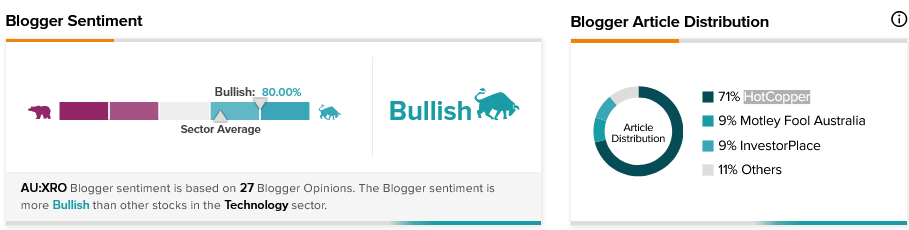

TipRanks insights further show that financial blogger opinions are 80% Bullish on Xero stock, compared to a sector average of 64%.

Nextdc shares plunge but analysts remain strongly bullish on the stock

Nextdc develops and operates data centres. Its share dropped as much as 3% today, hitting a new 52-week low of AU$8.57. The stock settled at AU$8.65, down 1.7% for the day. Nextdc shares have declined more than 30% since the beginning of 2022. According to TipRanks’ analyst rating consensus, Nextdc stock is a Strong Buy. The average Nextdc share price forecast of AU$12.79 implies about 48% upside potential.

TipRanks insights also show that financial blogger opinions are 92% Bullish on Nextdc stock, compared to a sector average of 65%.

Concluding remarks

While rising interest rates and recession concerns have kept many investors on edge, those investing for the longer term may choose to look past these headwinds. The impacts of rate hikes and even recessions often smooth out over long term investment strategies.