Given its massive success, investors around the globe have been searching for the next Amazon (NASDAQ:AMZN) for years. The company has grown into a massive e-commerce powerhouse since its beginning as an online purveyor of books in 1994, and many others are trying to repeat this success. In this piece, we used TipRanks’ Comparison Tool to evaluate two Asian e-commerce stocks — Coupang (NYSE:CPNG) and Alibaba (NYSE:BABA) — to see if either could become the next Amazon.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Coupang, which dominates the e-commerce market in South Korea, and the Chinese e-commerce giant Alibaba, both look promising on a long-term basis, although only one deserves a bullish view right now.

Coupang (CPNG)

Coupang is an unprofitable company in a high-growth stage, although there is some evidence of a path to profitability. Additionally, its stock has shown signs of a reversal. Although Coupang shares are down roughly 34% year-to-date, they are up about 2% in the past six months and up more than 17% over the past month, showing a shift in momentum. For these reasons and others outlined below, a bullish view may be appropriate for Coupang.

As far as valuation, Coupang trades for about 1.5 times price/sales, which is off its peak of 5.2 times at the time of its initial public offering. Of note, Amazon’s price/sales multiple is around 2.4 times, while Alibaba’s is around 1.8 times. All these e-commerce companies’ multiples have trended steadily downward throughout 2022.

While Coupang is still unprofitable, it’s important to point out that its adjusted EBITDA is now positive, a major step in the path to profitability. The company’s management has also made profitability a primary focus in the near term, so investors may not have to wait much longer for Coupang to turn a profit.

During the second quarter of 2022, the company reported that its gross profit margin improved 250 basis points quarter-over-quarter. The company also reported an adjusted EBITDA of $66 million and total net revenue of $5 billion, an increase of 12% year-over-year or 27% in constant currency.

Coupang’s gross profit jumped 75% to $1.2 billion on a year-over-year basis — a new record. Its net loss improved by $134 million quarter-over-quarter to $75 million. In his year-end 2021 letter seen exclusively by ValueWalk, Lee Ainslie of Maverick Capital explained why gross profit is the best metric to evaluate Coupang’s progress. It captures the company’s unit economics and gross merchandise volume: both essential measurements on the march toward profitability.

Profitability is a huge concern for Wall Street right now, so the rebound in Coupang’s stock price despite its lack of profitability is huge. A general consensus of analysts suggests the South Korean e-commerce major could see its final loss in 2023.

Is Coupang the Next Amazon?

One thing that makes Amazon so hugely profitable is the revenue streams in addition to its e-commerce business. Due to those other revenue streams, the razor-thin e-commerce margins are of little consequence. As Coupang has taken a few pages out of Amazon’s playbook, it looks like it could be the next Amazon.

Coupang appears to be following a similar strategy as it diversifies its revenue streams. Not only is it expanding its e-commerce business into other Asian markets, including Singapore and Japan, but it has also launched other services similar to what Amazon has done.

For example, Coupang is becoming vertically integrated by covering delivery, including its Rocket Delivery service, which lands packages on customers’ doorsteps the same day or early in the morning, even if the items were ordered as late as midnight. In fact, Coupang’s average delivery time is less than 12 hours, and 99% of its orders are delivered within a day, putting it ahead of Amazon in this area.

The company’s Rocket Fresh service is South Korea’s biggest grocer and offers fast grocery delivery. Coupang Eats mimics Uber Eats and was South Korea’s most-downloaded app at the height of the pandemic in 2020. Coupang Play is the company’s take on Amazon’s Prime streaming service, including offering its own content, while Coupang Pay covers the fintech angle.

What is the Price Target for CPNG Stock?

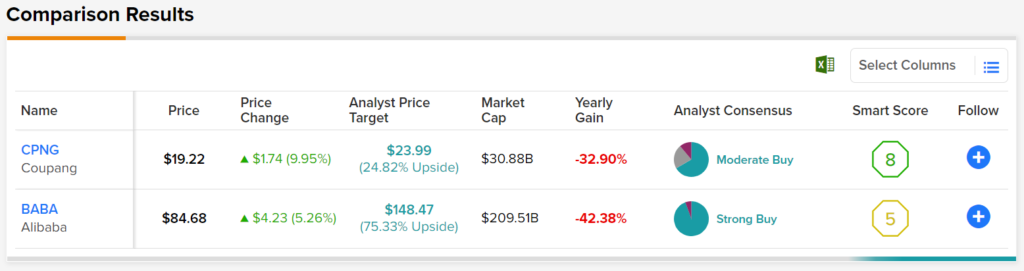

Coupang has a Moderate Buy consensus rating based on six Buys, two Holds, and one Sell assigned over the last three months. At $23.99, the average price target for Coupang implies upside potential of 24.9%.

Alibaba (BABA)

While Alibaba is significantly larger than Coupang, it shares many similarities with its smaller South Korean peer. As a result, a bullish view would be appropriate for the long term, but since China’s zero COVID policy is taking a bite out of Alibaba’s current results, a neutral view appears appropriate for now.

A review of Alibaba’s stock price action reveals Wall Street’s hesitancy on it versus the momentum Coupang has picked up. Shares of Alibaba are off almost 30% year-to-date, with most of that coming in the last six months and more than one-third of that decline coming in the last 30 days.

In terms of valuation, Alibaba trades at a forward P/E of 11.1 times and a price/sales multiple of around 1.8. Like Coupang’s, Alibaba’s P/S multiple has been marching steadily downward since its IPO in late 2017, when it stood at around 12 times.

The e-commerce giant’s P/E enjoyed a recent peak of around 21.7 times in July 2022, following its previous peak of around 35 times in October 2020. As a result, this could be an attractive entry point for Alibaba, but the stock could continue to decline in the near term, presenting even better entry points.

Is Alibaba the Next Amazon?

In some ways, Alibaba has already arrived. With $30.7 billion in revenue for the June 2022 quarter, Alibaba is already a monster-size e-commerce name, although not as big as its U.S. peer. Unfortunately, it faces an uphill battle right now due to China’s zero COVID policy, which has taken a bite out of the e-commerce giant’s earnings numbers.

What is the Price Target for BABA Stock?

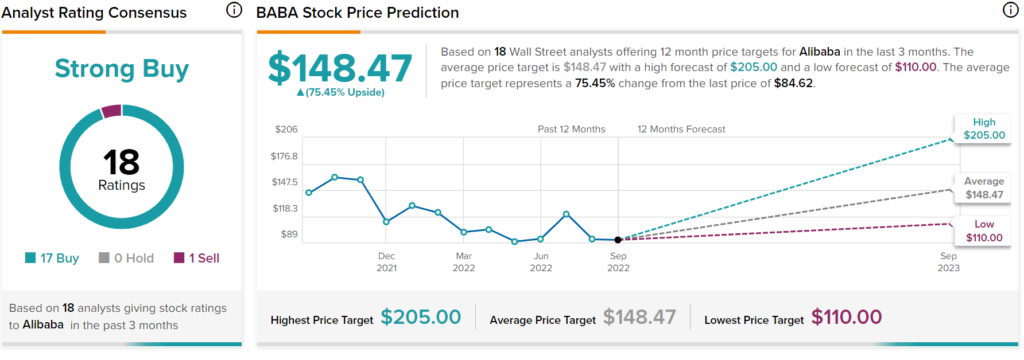

Alibaba has a Moderate Buy consensus rating based on 18 Buys and one Sell sell assigned over the last three months. At $148.47, the average price target for Alibaba implies upside potential of 75.5%.

Conclusion: Bullish on CPNG Now, Bullish on BABA Later

Alibaba and Coupang have both taken some pages out of Amazon’s playbook, diversifying into many of the same revenue streams. Clearly, this business model with these specific revenue streams works well for e-commerce companies. Given current valuations and momentum trends in the market, a bullish view looks appropriate for Coupang now, with a neutral view for Alibaba for now—probably developing into a bullish view whenever China’s economy recovers.