Everyone has their crystal ball out, trying to figure out where stocks are going. The market’s recent performance is no guide – stocks rose sharply through most of this year, but this August has seen several weeks of consecutive declines. Looking forward, both the bulls and bears can present solid arguments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Marko Kolanovic, J.P. Morgan’s Chief Global Market Strategist, sides with the latter, as he believes the market is on the verge of a downturn. Kolanovic notes that US households built up more than $2 trillion in savings during the COVID period, but they have since burned through those savings. Household liquidity, which is near $1.4 trillion, is losing value due to persistent inflation. Without support from these cash assets, Kolanovic says consumer spending is certain to trail off.

“We remain of the view that lower-income cohorts are increasingly coming under pressure with fewer offsets and little sign of relief from the high cost of the capital environment,” Kolanovic said. He also pointed out gathering headwinds, including “an aging business cycle with very restrictive monetary policy, still rising cost of capital, lapping of very easy fiscal policy, [and] eroding consumer savings and household liquidity.”

Putting his view into numbers, Kolanovic believes that the S&P 500 will close out this year near 4,200, reflecting a decline of 4.5% from current levels.

If Kolanovic is right, then now is the time to take defensive measures. The Street’s analysts are moving in that direction, tagging several high-yield dividend stocks as attractive buys right now. We’ve used the TipRanks platform to pull the details on two recent picks – Buy-rated shares with dividend yields exceeding 15%. Let’s take a closer look.

AGNC Investment (AGNC)

The first dividend stock we’re looking at is AGNC, a real estate investment trust. REITs are perennial dividend champions, and AGNC is particularly well-known for being a high-yield payer. The company focuses its operations on mortgage-backed security investments, specifically in the MBS niche. As of June 30th, its portfolio was valued at $58 billion, including $46.7 billion in residential mortgage-backed securities and $10.2 billion in to-be-announced positions.

The largest part of AGNC’s portfolio is based on 30-year fixed mortgages, which constitute around 92% of the company’s portfolio value, equivalent to $53.4 billion.

In its 2Q23 financial results, reported last month, AGNC showed net interest income loss of $69 million. This represented a 121% decline year-over-year, and worse, came in $436 million below the forecasts. The company’s total net income, however, remained positive at $255 million. On a per share basis, the non-GAAP income was reported at 67 cents, or 4 cents better than had been anticipated.

The positive non-GAAP EPS more than covers the company’s dividend, which is distributed monthly. The most recent dividend was declared at 12 cents per share and is scheduled to be paid on September 12. This common share dividend annualizes to $1.44 and provides a forward yield of 15.2%.

This company’s high-yield dividend caught the attention of BTIG analyst Eric Hagen, who writes, “In the near term, we think the $0.12 monthly dividend has support with nominal MBS spreads above +150 bps and leverage around 7x… We still like it on a near-term basis because it’s an effective way to be short interest-rate volatility, with upside if volatility moderates and spreads tighten. We think the common stock is the most attractive part of the capital structure, although there could be less downside in the fixed-to-floating rate preferred if spreads revisit the wides around +190 bps, or if the yield curve becomes materially more inverted.”

Hagen complements his positive stance with a Buy rating on AGNC shares and an $11.25 price target that suggests an 19% upside potential for the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~34% potential total return profile. (To watch Hagen’s track record, click here)

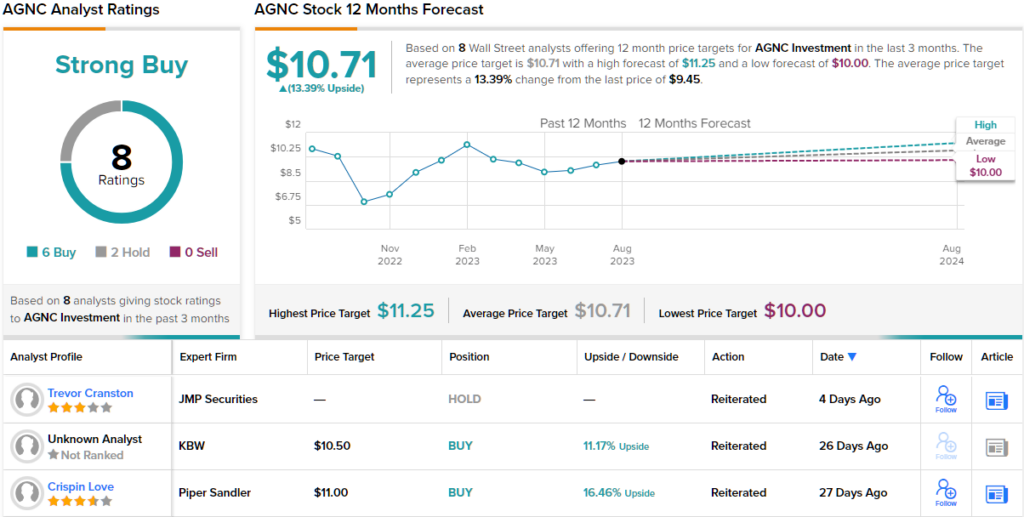

Overall, AGNC gets a Strong Buy consensus rating from the Street, based on 8 recent analyst reviews that include 6 Buys and 2 Holds. The shares are trading for $9.45 and have an average price target of $10.71, implying ~13% one-year upside. (See AGNC stock forecast)

AFC Gamma (AFCG)

Next up is AFC Gamma, another real estate investment trust – but with a twist. AFC Gamma’s primary focus is on the cannabis industry. Cannabis companies face high overhead costs, partially due to the substantial land requirements for their growing operations, whether indoor or outdoor. AFC Gamma specializes in offering a range of commercial real estate loans tailored to cannabis firms, along with other financial solutions such as loan underwriting and financing. The company provides direct lending and bridge loans spanning from $5 million to $100 million, or even higher.

Headquartered in Florida, AFC Gamma holds a significant advantage when dealing with the cannabis industry. Despite remaining illegal under Federal law, cannabis has been legalized for either medical or medical/recreational use in 38 states, with Florida being a prominent leader among them. Operating from its Florida base, AFC Gamma can offer financial services to an industry navigating a complex and varying legal landscape.

The company’s success in meeting the needs of its target audience and leveraging that success for earnings is evident in its second-quarter 2023 results. AFC Gamma reported a Q2 GAAP net income of $12.1 million, translating to 59 cents per common share. This exceeded estimates by 6 cents per share. Digging deeper, the company achieved a distributable income of $9.9 million, or 49 cents per common share. This is noteworthy for dividend investors, as it directly supports the dividend payments.

That common share dividend was last declared for 48 cents per share, giving an annualized rate of 15.7%. AFC Gamma paid out a total of $9.8 million in dividend distributions for Q2, although it is important to note that the Q2 payment was reduced from the previous quarter.

Despite the reduction in the dividend, the high yield and the company’s overall soundness attracted 5-star analyst Mark Smith. Covering the stock for Lake Street, Smith says of AFC Gamma, “We think the company remains in a healthy state with high yield to maturity (21% at quarter end) and a healthy balance sheet. We think the company is currently cleaning up and de-risking the portfolio which may take another quarter or two, but we think there are growth opportunities on the horizon.”

Describing those opportunities, Smith adds, “We think the company will get more active in lending into the cannabis industry as well as the commercial real estate markets over the next few quarters. However, we trimmed our estimates due to the smaller size of the portfolio today. We think yields are strong and the company is beginning to see better opportunities. We like that management is focused on producing strong risk-adjusted returns and has ample capital available to produce strong growth… We think the dividend will return to growth and think the shares are attractively priced given the current yield.”

The extent of Smith’s optimism here can be seen in his Buy rating and the $25 price target that indicates his confidence in a robust 104% upside lying in wait for the stock. (To watch Smith’s track record, click here)

Smith represents the bullish end of opinion on AFCG; overall, AFC Gamma has a Moderate Buy rating from the Street, based on 2 Buys and 1 Hold set in recent weeks. The shares are trading for $12.20 and the average price target is $19.50, suggesting a one-year gain of ~60%. With the high dividend yield, this stock’s total return potential can approach 75%.(See AFCG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.