Year-to-date, markets are up – some 12% for the S&P 500, and 28% for the NASDAQ, even after recent volatility and pullbacks. But there’s worry in the air, and the red flags are flying. A combination of persistently high inflation and interest rates, along with an increasingly dangerous geopolitical situation, has more and more experts calling out warnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the domestic policy side, Federal Reserve chairman Jerome Powell said in recent comments, “Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.” He went on to add that monetary policy is not too tight, a clear indication that the Fed will maintain high interest rates.

Meanwhile, Jamie Dimon, CEO of JPMorgan, has sounded a stern warning on the geopolitical front. He’s closely monitoring ongoing conflicts, such as Ukraine and Russia, intensifying tensions like those between Israel and Hamas, and China’s assertive posturing regarding Taiwan. Dimon says, “My caution is that we are facing so many uncertainties out there,” and he closes by reminding us, “this may be the most dangerous time the world has seen in decades.”

The confluence of risks should rekindle interest in strong defensive plays, particularly high-yield dividend stocks. These stocks offer both protection and passive income during these challenging times.

Wall Street analysts seem to concur, as they have identified high-yield dividend payers as attractive buys right now. Let’s delve into two of these picks: Buy-rated stocks with at least 12% dividend yields.

Hercules Capital (HTGC)

Let’s start with Hercules Capital, a unique business development company (BDC). What sets Hercules apart is its specialized focus on emerging companies. Instead of following the traditional BDC model, Hercules primarily offers venture debt, providing pre-IPO firms with an attractive alternative to traditional venture capital for funding and financing.

Hercules has been successful in this niche, and over the years has compiled an impressive set of statistics. Since its inception, this BDC has funded more than 600 companies, to the tune of more than $17 billion. In the last reported quarter, 2Q23, Hercules made $541.5 million in new debt and equity commitments and had $4 billion in assets under management.

The company’s second quarter results showed several other strong metrics. At the top line, Hercules reported a total investment income of $116.2 million and a net investment income of $75.7 million. Both of these were company quarterly records, and the total investment income was up 61% year-over-year while beating the forecast by $7.5 million. At the bottom line, Hercules’ NII per share, at 53 cents, exceeded expectations by 4 cents per share.

Hercules has seen rising revenues and income over the past several quarters and has been increasing the dividend in response. The company pays both a regular quarterly and a supplemental common share dividend. The last declaration, made in August of this year and paid on August 25th, included a regular dividend of 40 cents per share, which was up 2.6% from the prior quarter, along with a supplemental payment of 8 cents per share. The regular dividend yields 10%, and when combined with the supplemental payment, the total yield is 12.1%.

For JMP analyst Devin Ryan, who holds a 5-star rating from TipRanks, Hercules presents investors with an all-around solid opportunity. He writes, “Given Hercules’ position as the leading platform and impressive long-term track record within venture lending, we expect ongoing equity market volatility will continue to drive strong demand for debt solutions (coupled with broader trends within the banking sector – i.e., banks pulling back on lending, etc.), ultimately positioning the company even better longer term.”

Looking ahead at that longer term, Ryan gives HTGC shares an Outperform (i.e. Buy) rating, and an $18 price target implies a one-year upside potential of 13.5%. Add in the dividend yield, and this stock’s one-year return can reach 25% or more. (To watch Ryan’s track record, click here)

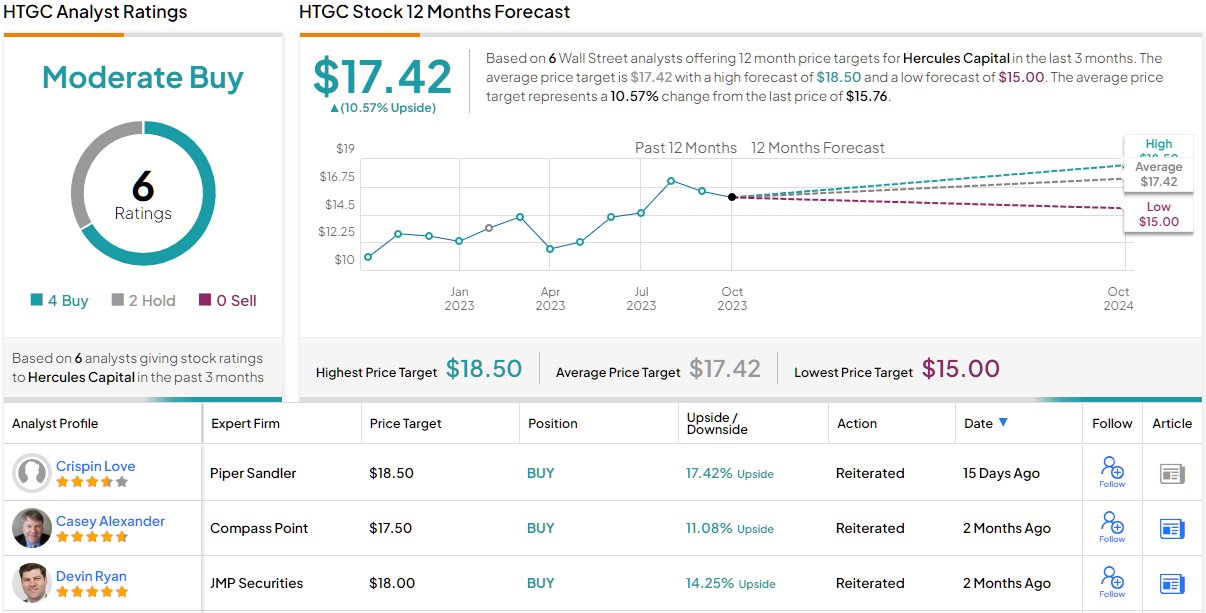

Overall, there is a Moderate Buy consensus rating on HTGC shares, based on 6 recent analyst reviews with a breakdown of 4 Buys and 2 Holds. The stock’s $15.77 trading price and $17.42 average target price suggest an upside of 10.5% in the next 12 months. (See HTGC stock forecast)

Trinity Capital (TRIN)

Next on our list of high-yielding dividend payers is Trinity Capital, another BDC. Trinity, like Hercules, works in the venture debt segment. The company’s portfolio strategy is based on developing current income and capital appreciation through its combination of debt and equipment financings, along with equity-related investments and working capital loans.

By the numbers, Trinity has made 298 investments since its founding. Through the end of this year’s second quarter, the company’s fundings have totaled $2.6 billion, and Trinity currently has $1.2 billion in assets under management. The company’s portfolio currently includes investments in aviation and aerospace, energy and hardware, information technology and services, and life sciences.

Digging into Trinity’s most recent reported quarter, 2Q23, we find that the company beat expectations on both revenues and earnings. On its top line, Trinity’s revenue, reported as total investment income, was $46 million; this was $4.7 million ahead of the estimates, and up more than 37% year-over-year. The firm’s bottom-line net investment income came to 61 cents per share, 9 cents better than the forecast.

These results supported Trinity’s strong dividend, which was last set on September 13. The common share payment included both a regular and supplemental dividend, with the combination totaling $0.54 per share. At an annualized rate of $2.16 per common share, the combined dividend yields nearly 16%.

The combination of profitable growth and solid dividends caught the attention of 5-star analyst Casey Alexander, from Compass Point. Alexander writes of Trinity, “We expect incremental growth will come from increasing fees and income from the Trinity JV. We see a continuance of dividend increases as TRIN has a nice buffer between the earnings power and the current dividend. In the meantime, TRIN’s legacy portfolio has to navigate the VC cycle without further distress. Given the pullback in TRIN share price and the accretive equity offering, we now judge the risk reward as favorable…”

Alexander goes on to give Trinity’s stock a Buy rating along with a $15.50 price target that points toward a gain, over the next 12 months, of ~15%. Together with the dividend, the return here can exceed 30%. (To watch Alexander’s track record, click here)

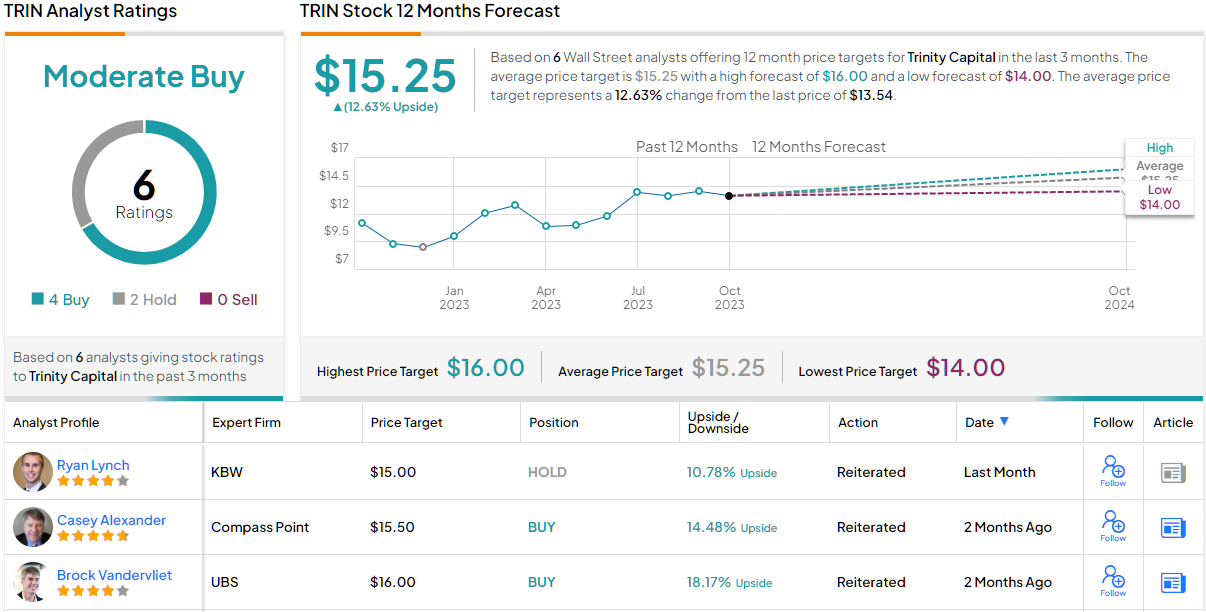

Like Hercules above, Trinity’s Moderate Buy consensus rating is based on 6 reviews with a 4 to 2 breakdown of Buys to Holds. The shares have a trading price of $13.54 and the average target price, now at $15.25, suggests it has an upside of ~13% for the coming year. (See TRIN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.