The markets were reeling toward the end of last week as hot CPI figures sent the major indexes into a tailspin. Meanwhile, it remains to be seen how Iran’s missile and drone attack on Israel on Saturday night shapes the war in the Middle East and affects market sentiment in the week ahead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking at the bigger picture on where the markets are heading, according to Chris Harvey, head equity strategist from Wells Fargo, investors shouldn’t worry too much right now. ‘There’s more room for upside,’ he tells us, in a recent note on current market conditions. Harvey expects stocks to keep moving up; he now puts his year-end prediction for the S&P 500 index at 5,535, up from the prior 4,625, implying a gain of 8% from current levels.

“In our view,” Harvey says, explaining his position, “the bull market, AI’s secular growth story, and index concentration have shifted investors’ attention away from traditional valuation measures and toward longer-term growth and discounting metrics. Since the end of 2022, investors’ valuation thresholds seemed to decrease while time horizons increased, a function of this secular optimism. We reduced our equity risk premium to zero more than a year ago, and now the focus shifts out to 2025.”

Building on this, the stock analysts at Wells Fargo are looking for the shares that stand to gain once the bull run resumes. They’ve picked out two stocks for double-digit returns this year, and a look into the TipRanks databanks shows that each gets a Strong Buy rating from the consensus view. Here are the details, and the Wells Fargo comments.

GitLab (GTLB)

First up is GitLab, a DevOps firm that has created an open-source platform for DevSecOps. This sounds like a mouthful, but workers in the field will understand: GitLab offers its customers a specialized platform solution to optimize fast, efficient software development and high returns from the end product. As noted, GitLab’s platform is offered as open-source software; the company’s founding theory was that ‘everyone can contribute.’ The company’s open-source model allows all of its users to, if they desire, become contributors to the platform code; as a result, the model features a fast pace of innovation.

The open-source platform also feeds directly into GitLab’s ‘freemium’ business model, with a base level of access and service available to all users while higher-level functionality and upgrades, as well as larger-scale support, are available for paying subscribers. GitLab claims to have 1 million paying active license users out of some 30 million total users; on the business end, the company employs approximately 2,000 people in 60 countries around the world, and has over 3,300 active contributors making additions to the open-source platform code.

In recent months and weeks, GitLab has begun folding AI technology into its software platform, as part of an overall strategy that will use AI, particularly generative AI, to ‘solve customer pain points,’ that is, to solve users’ most pressing problems and create a seamless experience. GitLab has a partnership with Google, to use the tech giant’s generative AI technology within its own cloud infrastructure; using the tech inside GitLab’s own cloud will allow the company to maintain its own customers’ privacy and security.

In addition to branching into AI, GitLab has also recently moved to acquire Oxeye. The acquisition move, announced last month, will bring Oxeye’s cloud-native security applications and risk management capabilities into GitLab’s platform, and augment GitLab’s abilities in software composition analysis and regulatory compliance. GitLab will also gain functionality in tracing vulnerabilities from the code to the cloud, an important field for an open-source firm.

On its financial side, GitLab last reported results for its fiscal period 4Q24, which ended this past January 31. Revenues for the quarter came to $163.8 million, for a 33% year-over-year gain – and beat the estimates by $5.54 million. GitLab reported earnings of 15 cents per share by non-GAAP measures, beating the forecast by 7 cents per share.

On the negative side, GitLab’s forward guidance for fiscal year 2025 predicted a revenue range of $725 million to $731 million – while the analysts had hoped to see revenue guidance of $732.2 million. Shares in GitLab tumbled by 21% after the miss, and the stock hasn’t recovered since.

However, covering this stock for Wells Fargo, analyst Michael Turrin is impressed by the company’s moves into AI and the opportunity afforded investors by the shares’ current relative discount. He writes, “We believe GTLB is well-positioned to benefit from genAI tailwinds given its code generation use-case in Duo Pro — likely the earliest genAI usecase to see adoption in software, in our view. We est. GTLB’s current opportunity could be as much as $750M ARR, benefiting from both add-ons of the AI SKU as well as incremental customer upgrades… With shares -21% (now -23%) off since 4Q eps, the FY25 model now more conservatively set, and an AI-led product cycle taking shape, we see an opportunistic entry for GTLB shares.”

To quantify his outlook on the stock, Turrin rates the shares as Overweight (Buy), with a $70 price target that indicates room for a 22.5% upside in the coming months. (To watch Turrin’s track record, click here.)

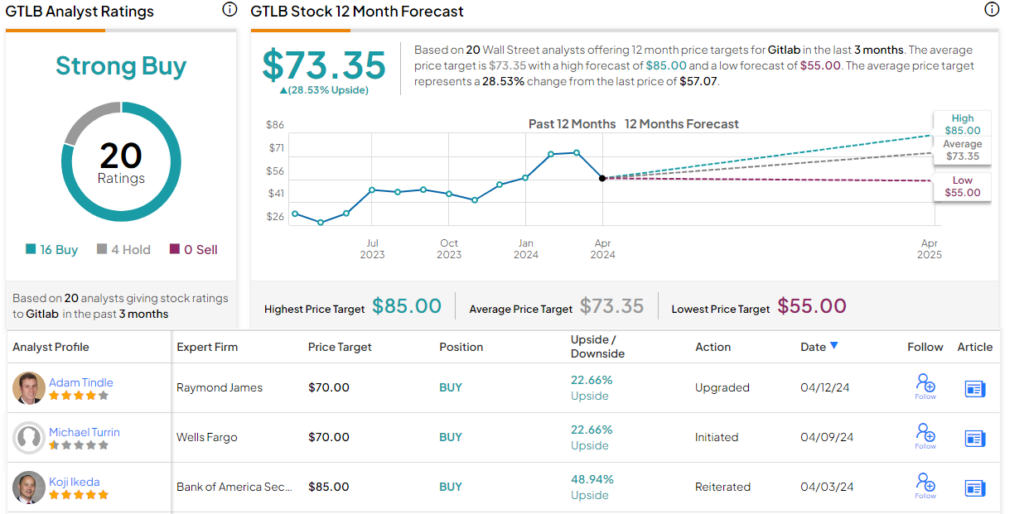

GitLab’s 20 recent analyst reviews break down to 16 Buys and 4 Holds, for a Strong Buy consensus rating. The shares are priced at $57.07 and their $73.35 average target price implies a 28.5% one-year upside potential. (See GitLab’s stock forecast.)

monday.com (MNDY)

Sticking with the tech sector, we’ll turn our sights on monday.com, a cloud software firm that offers customers a range of work management products. These include office system optimization tools, project management and CRM, and marketing and sales ops tools, all offered on a cloud-based platform. monday.com targets its products at enterprise clients of every scale, making the platform available to subscribers on the software-as-a-service model. The company can count names such as Coca-Cola and Uber among its customer base.

monday.com was founded in 2012, and in its first decade of operation, the company earned widespread acceptance based on its reputation for quality and support – and its easy-to-use, ‘low-code, no-code’ platform. Customers can quickly adapt monday’s work management systems to fit their own needs, based on idiosyncratic business models, personnel practices, and operational scales.

Since launching its product in 2014, this company has built itself into the go-to place for work management software. The company has over 1,800 employees, maintaining a product line available in some 200 countries – and is used by over 225,000 enterprise customers every day. We should note that 2,295 of monday’s customers generate more than $50,000 in annual recurring revenue each.

That last metric, from the company’s 4Q23 report, was up 56% year-over-year, complemented by 833 customers with over $100,000 in annual recurring revenue, a y/y increase of 58%. Altogether, monday.com generated $202.6 million in the quarter, up 35% y/y and $4.83 million better than had been expected. The bottom line, of 65 cents per share in non-GAAP measures, was 35 cents ahead of the forecasts.

Turning back to Wells Fargo, the firm’s position is clearly stated by analyst Michael Berg, who sees plenty of potential in this company and its stock. Berg writes, “We view monday.com as a leader in a large, $150Bn+ market. With a differentiated work mgmt platform, MNDY has a number of robust growth levers to capture market share to drive durable growth, including: 1) move up-market into the enterprise; 2) a rapidly expanding product set to drive up and cross-sell; 3) leveraging a growing partner network to drive awareness and strategic relationships; and 4) pricing changes.”

These comments support the analyst’s initiation of coverage at an Overweight (Buy) rating, and his price target, set at $260, implies a 34.5% share appreciation over the next 12 months. (To watch Berg’s track record, click here.)

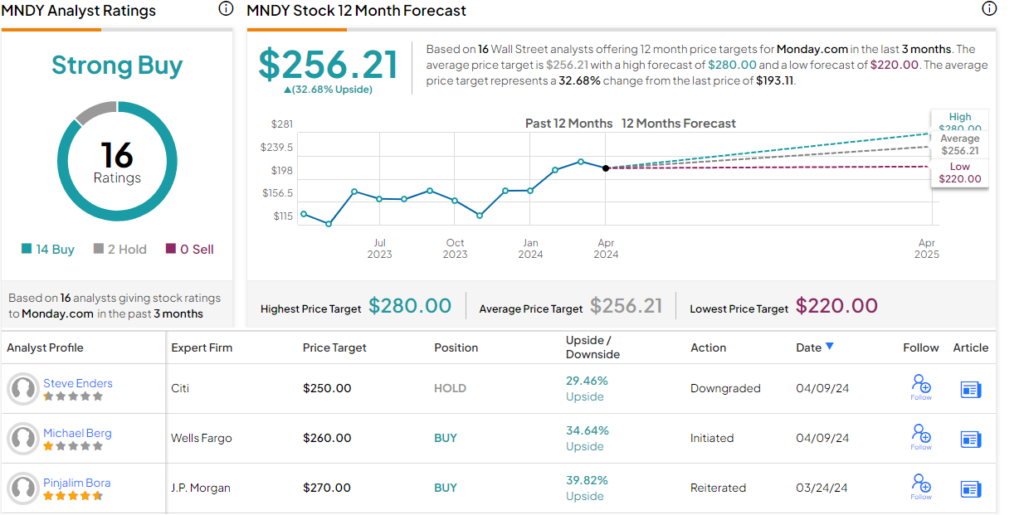

Overall, monday.com has 16 recent recommendations, including 14 to Buy and 2 to Hold, for a Strong Buy consensus rating. The shares are priced at $193.11 and their $256.21 average price target is almost as bullish as the WF take, suggesting a 33% upside on the one-year horizon. (See monday.com’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.