Solar power forms a large part of the renewable energy sector, and like renewables generally, solar stocks have felt pressure in the last few years. Supply chain disruptions forced a decline in new installations during 2022, and the sector’s recent 3Q23 earnings showed evidence of demand weakness. SolarEdge, which has a large market share in the California solar sector, announced major layoffs in response.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On the positive side, the industry is still on the receiving end of Federal largesse, and the Biden Administration has consistently backed up its stated commitment to renewable energy. And, while 3Q23 was weak overall, a deeper dive into the numbers showed that demand began to perk up in the latter half of the quarter.

So, there is reason to look for a positive turn in solar stocks going forward. Truist analyst Jordan Levy would agree, and has tapped residential solar companies as the place to look for those upside opportunities. “It will come as no surprise that 2023/start of 2024 have been challenging for the Sustainability space. Up & to the right growth expectations driven by low rates & a global focus on energy availability have fallen back to earth, taking shares with it. While we’ve surely not seen the end of volatility in the group, we see meaningful upside opportunity moving into the fed rate cut cycle particularly for the resi solar group,” Levy opined.

Levy doesn’t leave us with a macro view of the industry. The analyst goes on to give a drill-down to the micro level, and picks out two solar stocks that he sees as potential winners for the long haul. We ran them through the TipRanks database for some additional color. Let’s take a closer look.

Sunnova Energy International (NOVA)

First on our Truist-backed list is Sunnova, one of the leading firms in the US residential solar industry. Sunnova has built its solid position by putting itself into all aspects of the solar installation process. The company sets up the rooftop panels, but it also connects the installation to the home’s power system, installs power storage batteries as needed, based on the size and power requirements of the location, and provides ongoing service and support for the installation, including repairs, provision of spare parts, and system modifications and upgrades as needed.

Earlier this month, Sunnova announced that it will be opening, during this 1Q24, an Adaptive Technology Center. The ATC will allow the company to develop and test new solar installation technologies, including microgrid systems and inverter and battery test beds. The test facility will be comprehensive, and will even include a full-scale functioning model home, complete with appliances and an HVAC system, to allow full testing of residential solar technological developments.

Solar installations are not cheap – while large parts of the technology are not new, it still relies on expensive raw materials and components, particularly the battery systems. Sunnova smooths this over for clients by providing financing options for its customers. The company states its goal as ‘providing energy independence,’ and it has put over 386,000 customers on that road since the company got started in 2012. Currently, Sunnova operates in 48 US states and territories, and has over 1,900 dealers, sub-dealers, and builders.

The company has been expanding, even against the recent industry headwinds. In the second and third quarters of last year, the company grew its customer base by a net of 76,000, and its total customer base, as of September 30, 2023, was up 38%. Sunnova’s 2024 new customer guidance stands in the range between 185,000 and 195,000.

In its last reported quarter, 3Q23, Sunnova missed forecasts on both revenues and earnings. The top line, of $198.4 million, was $3.6 million below expectations – although it was up 33% year-over-year. The company’s earnings were reported as a 53-cent per share GAAP loss, a loss that was 16 cents per share deeper than had been anticipated. However, the company offered a strong guide, initiating its FY 2024 adjusted EBITDA forecast at $350-$450 million, some distance above consensus at $332 million.

For Truist’s Levy, Sunnova presents a clear opportunity for investors, based on the stock’s relative discount – the shares are down approximately 45% in the last 12 months – and its potential for improving market share. He says of the stock, “We upgrade the stock to Buy from Hold on the stock as we see NOVA continuing to generate above peer-avg growth/mkt share gains while benefiting from further margin improvement and gradual fed rate cuts. With shares trading at a nearly 60% discount to NOVA’s Net Contracted Customer Value per Share (NCCV/sh), we additionally see the current valuation as an attractive entry point for a gradual recovery in resi solar markets.”

Levy’s upgrade comes along with a new price target of $18 (up from $10) that implies a robust 75% share appreciation for the coming year. (To watch Levy’s track record, click here)

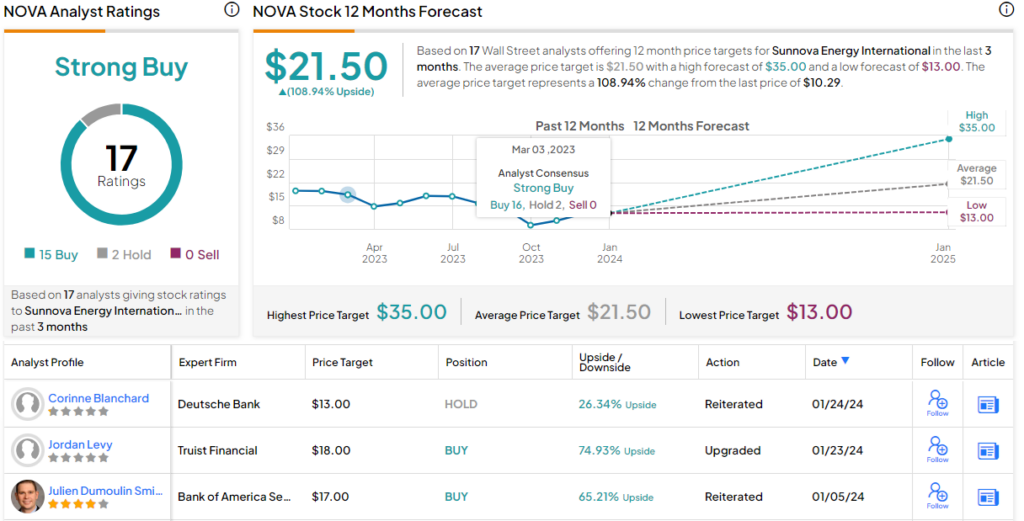

Overall, it’s clear that Wall Street is bulilsh on NOVA. The 16 recent analyst reviews include 15 to Buy and 2 to Hold, for a Strong Buy consensus rating, while the $21.5 average price target suggests a powerful 109% upside potential from the current share price of $10.29. (See NOVA stock forecast)

Enphase Energy, Inc. (ENPH)

The second stock on our list, Enphase Energy, is another well-known player in the US solar installation market. The company markets its products and services for both the residential and commercial sectors, and can build out custom installations at small- and mid-scales. Enphase designs its solar systems in-house, and offers full lines of the ancillary products needed to keep solar systems working at optimal capacity. The company’s products include semiconductor-based power inverters, battery systems for power storage, and smart home power management systems, in addition to the actual solar power installations.

In recent months, Enphase has been launching the latest versions of its IQ8 microinverters in multiple international markets. Microinverters are an essential technology in the solar industry, and are used to convert the direct current electricity generated by the panels into the alternating current flow that can be used in the building (either home or commercial) power grid. Enphase’s IQ8 series, its most modern microinverters, can also enable seamless switches from on-grid to off-grid power usage. Enphase’s microinverter tech features all-weather operation and over-the-air software updates.

In addition to its high-end microinverter technology, Enphase also offers its customers a mobile app, making system monitoring easy – and easily accessible. The app allows system users to see how much power is being generated, what the savings are on the electric bill, and to get regular reports in real time. The app also allows users to change the system settings and receive service messages. It’s a full control panel, in hand-held form.

Last month, Enphase announced reductions in its production level, as well as a 10% layoff of personnel. These cutbacks are in response to lower demand in recent quarters – although they are not as large-scale as the SolarEdge reductions referenced above. Enphase will still be producing 7.25 million microinverters per quarter when the changes are fully implemented. We should note here that shares in ENPH are down by about 49% since this time last year.

The cutbacks came after Enphase missed on revenues in its last reported quarter, 3Q23. The company reported $551.1 million at the top line, a drop of 13% y/y – and missing the forecast by $15.72 million. Earnings, however, beat expectations; the company’s non-GAAP EPS of $1.02 per diluted share was 2 cents better than was expected.

Turning again to Jordan Levy’s view, we find the Truist analyst getting ready for a bullish turn on the stock. He acknowledges the difficulties that the company has faced, but believes that they have all been factored into the share price by now, and that the sector will return to growth on higher utility prices and continued governmental support: “While the magnitude and duration of current downcycle still remains a key concern for investors, with massive selloff on headwinds in both US and European markets, we see downside risks largely priced in at this point. In the domestic market, more recently, we have witnessed utility rate hike announcements in various states (CA, NC, WI, KY, etc., most effective Jan this year), which could boost demand for solar installations over the next few quarters. In EU, despite still ongoing channel destocking, we noted from our channel checks both US and Chinese manufacturers have been under-shipping to EU since mid-last year and expect resi installations to gradually return to normalized levels.”

“Therefore,” Levy summed up, “we become more constructive with our view that underlying demand will start to recover in mid-this year. W/shares trading at ~12x our ’25E EBITDA, we see more upside potential than downside risk in the name in our opinion. We upgrade the stock to Buy from Hold…”

The Hold-to-Buy upgrade here is accompanied by a price target hike from $85 to $145. This now shows the analyst’s confidence in a 34% one-year gain for the shares.

Overall, the Street isn’t quite as willing to go all-in, although it is willing to Buy. This stock’s Moderate Buy consensus rating is based on 25 recent reviews that break down to 15 Buys, 9 Holds, and 1 Sell. The shares are trading for $108.07 and the $126.77 average price target implies a 17% increase in the next 12 months. (See Enphase stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.