We may be living in the digital age, but the world remains physical – and that truth underlies the long-term resilience of industrial stocks. As a group, these shares are prone to cycles of boom and bust, but several positive factors appear to be lining up.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For starters, the inventory destocking cycle prompted by the COVID shutdowns appears to have finally run its course. With stock shelves finally free of the goods that piled up during the pandemic, we should expect some companies to increase their stock orders – a plus for manufacturing and industry. In addition, the slowing rate of inflation has increased the chances that the Federal Reserve will start cutting back interest rates this year – and lower rates are positive for spending and demand.

These factors have informed Truist’s industrial expert Jamie Cook, a 5-star analyst rated in the top 2% of the Street’s stock pros, who sees plenty of potential upside in industrials.

“We are constructive on the group as we believe broad-based industrial growth could surprise on the upside in the second half of 2024,” Cook opined. “We believe the group is in a unique situation as earnings are proving more resilient despite channel destocking and softening demand trends, helped by backlogs near record levels although recently moderating. Furthermore, the group is benefiting from aggressive price actions taken over the past several years to offset inflation, and the market’s fear of industrial companies giving price back is not playing out. In fact, industrial companies are increasing prices again in 2024 albeit back to more normalized levels.”

Being ‘constructive on the group,’ Cook has tapped several industrial stocks as winners moving toward the second half of 2024, believing there’s an opportunity brewing in these names. Are other analysts equally optimistic? We used the TipRanks database to find out.

Deere & Company (DE)

The first stock on our list is one of the best-known companies in the world of agricultural and construction machinery. Even if you don’t work in the farming or building sectors, you’ll probably recognize John Deere’s green and yellow livery and the company’s old ad slogan, ‘Nothing runs like a Deere.’ The company has ridden a proven combination of quality products and solid marketing to a market-leading position, and a $106.7 billion market cap.

The company’s product lines are wide and varied. Deere is best known for its heavy agricultural equipment, the lines of harvesters, planters, spreaders and sprayers, loaders, utility vehicles, and tractors of all sizes relied on by farmers around the world. The company also produces both heavy and compact construction equipment, such as bulldozers, backhoes, excavators, and articulated dump trucks. For smaller scale uses, the company is known for its compact tractors and landscaping equipment, including riding mowers in various sizes.

Deere hasn’t built this niche overnight; the company was established in the first half of the 19th century and has been in operation for 187 years. It has its headquarters, logically enough, in Illinois, at the heart of the US prairie farm belt.

On the financial side, Deere reported $12.19 billion in its last quarterly release, for fiscal 1Q24 (January quarter). This was down 3.6% from the prior year, but it was $1.86 billion better than had been expected. At the bottom line, Deere reported a net income of $1.75 billion for the first quarter, supporting a GAAP earnings-per-share of $6.23, beating the forecast by $1.02 per share.

Deere caught analyst Jamie Cook’s attention, for its combination of strong products and good management. Cook wrote of the company, “In our view, Deere is among the best-run industrial machinery companies with a growing technology story and earnings stream. Deere continues to improve through-cycle margins, returns, and cash flow and there is more opportunity ahead to outpace peers, in our view. We expect DE’s performance in the 2024 farm equipment downturn to demonstrate that the company’s earnings and margins are structurally higher and more resilient relative to its history.”

Tracking forward from this, Cook gives the stock a Buy rating, with a $494 price target that points toward a 12-month upside of 29%. (To watch Cook’s track record, click here)

Overall, Deere gets a Moderate Buy rating from the Street consensus, based on 19 reviews that include 11 Buys to 8 Holds. The shares are priced at $383.39 and their $425 average target price suggests a gain of 11% on the one-year horizon. (See Deere’s stock forecast)

CNH Industrial (CNHI)

For the second stock on our list, we’ll stick with heavy machinery. CNH Industrial works in the same space as Deere, above, manufacturing lines of equipment for the construction and agribusiness sectors. CNH is another old name in the business, tracing its origins to 1842. The company has a solid reputation among its customer base of working farmers and builders, who appreciate the firm’s high-quality tractors, combines, tillers, and other high-end niche equipment.

CNH operates on a multinational level, with its incorporation in the Netherlands, its global headquarters in the UK, industrial and financial ops in 32 countries, and sales and marketing in 170 countries. The company markets and distributes its machinery lines through several well-known brands, including New Holland, Case IH, and Steyr. These brands can be found in CNH’s four large geographic regions, North America, South America, Asia Pacifica, and Europe-Middle East-Africa.

We saw CNH’s 4Q23 results last month, when the company reported $6.79 billion in consolidated revenues. This missed the forecast by $60 million, and was down 2.2% year-over-year. The company reported a steeper decline, of 5% year-over-year, in its net sales of industrial activities, which made up $6.02 billion of the total top line. Net income in the quarter came to $617 million, and the non-GAAP EPS of 46 cents was in-line with expectations.

Despite the slip in revenues, the company showed strong cash generation for the quarter. Industrial free cash flow came to $1.63 billion, and net cash from operating activities was listed as $1.51 billion.

In an interesting announcement last month, CNH revealed that its investment arm had taken a minority stake in the Brazilian startup firm Bem Agro. This company is an existing supplier to CNH, and is known for its AI imaging capabilities, which are designed to enable better optimization of agricultural field use.

Cook’s note on CNH is an initiation-of-coverage report, and she points out the company’s forward opportunities, its ability to conduct M&As, and its potential for capital returns, writing of the firm, “We believe there are opportunities for the company to structurally improve through-cycle margins through simplification and self-help initiatives (including existing COGS and SG&A cost reduction programs), investment in higher return products, and as precision agriculture adoption grows. CNHI has a strong balance sheet with ample capacity to return cash back to shareholders and further augment the portfolio through strategic M&A. Last, while we remain constructive on the medium-term outlook for farm and construction equipment, we believe CNHI can continue to improve margins in a muted topline environment.”

These comments back up Cook’s Buy rating on CNHI, while her $18 price target implies a one-year gain of 46% for the stock.

The Moderate Buy consensus rating on these shares is derived from 13 recent analyst reviews, with a breakdown of 6 Buys to 7 Holds. The average price target of $15.91 suggests the stock will appreciate by 29% over the coming year. (See CNHI stock forecast)

AGCO Corporation (AGCO)

Last on the list is AGCO Corp, a Georgia-based agricultural equipment producer. Like CNH, AGCO operates through several brands, and its machinery lines, featuring combine harvesters, seeding and tillagers, protein systems, engines, silos, and tractors of all sizes, are sold under such recognized nameplates as Challenger, Fendt, Valtra, and Massey Ferguson. AGCO is a full-service agribusiness machinery company, providing the tools and gear that farmers of all scales need, for everything from working their land to shipping out their produce.

AGCO is intent on keeping its products at the cutting edge of industrial tech, and to that end the company in 2022 acquired JCA Industries, a developer of autonomous software for use in agricultural machinery, as well as implementation controls and electronic systems. AGCO followed up this acquisition with its move, in September of last year, to enter a joint venture with the technology company Trimble. The joint venture move, which will give AGCO access to Trimble’s modeling, connectivity and data analytics technologies, will give AGCO an 85% interest in Trimble, for which it will pay $2 billion and bring JCA’s technologies to the table.

Closing out 2023, AGCO finished the year with $14.4 billion in total revenues, for a company record, and a 13.9% increase from the previous year. Drilling down, we find the company reporting $3.8 billion in the 4Q23 top line, a result that was down 2.5% year-over-year and came in $230 million less than had been anticipated. At the bottom line, AGCO’s non-GAAP earnings-per-share came in at $3.78, missing the forecast by 25 cents.

Despite the Q4 misses, analyst Cook thinks highly of this stock. She opens her Truist coverage of AGCO shares by noting the stock’s potential for solid margins and its ability to improve its product lines with new technologies. As she writes, “AGCO is extremely attractive, in our view, trading at 8x forward earnings and 5x forward EBITDA, on 2024 earnings estimates that assume a 15% earnings decline y/y as farm equipment demand is expected to decline 10-15% this year. We believe the market is not giving AGCO credit for the growing margin story associated with precision agriculture and actions to improve the earnings power including portfolio changes and operational initiatives.”

Quantifying her stance, Cook starts her coverage with a Buy rating and a $142 price target that show her confidence in a 22% potential upside for the coming year.

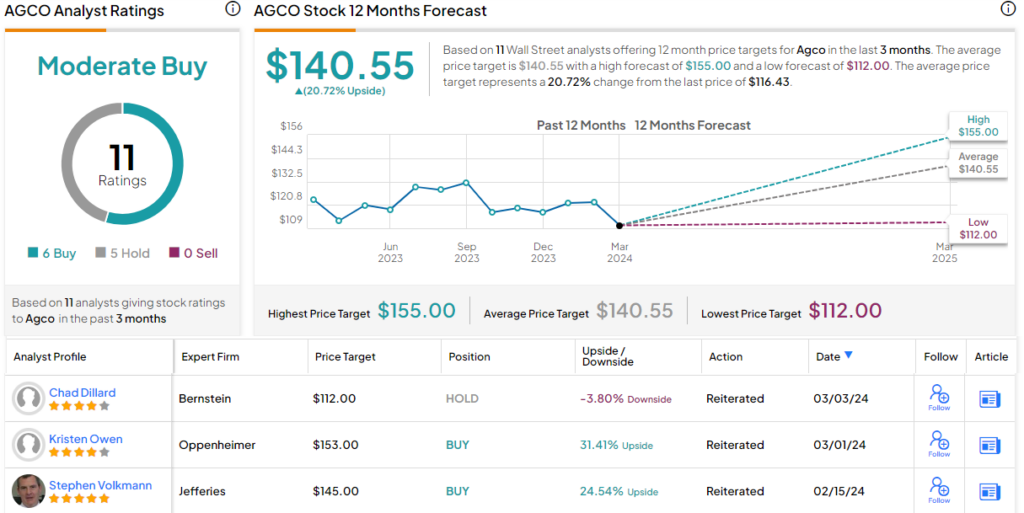

Once again, we’re looking at a stock with a Moderate Buy consensus rating from the Street. The 11 reviews on this stock include 6 Buys over 5 Holds, and the $140.55 average price target suggests an upside of 21% from the current trading price of $116.43. (See AGCO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.