As part of stimulus measures that started with the onset of the Covid-19 pandemic, federal student loan payments have been in a moratorium. But now, for the first time in more than 3 years, interest has started to build up and payments are set to resume in October.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One company that stands to benefit from this development is SoFi Technologies (NASDAQ:SOFI), with the student loan refinance segment making up a big part of its business. In fact, its overall share of the market has grown from 40% in 2019 to 60% today.

So, the company stands to gain here in a significant way and with student loan volumes down by ~75% from pre-moratorium levels, Jefferies analyst John Hecht notes that “even a modest recovery would be a catalyst for loan growth.”

After mortgages, with $1.5 trillion in balances outstanding, the student loan market is the US’s 2nd biggest consumer lending industry. In this market, a significant number of borrowers are eager to refinance their loans with the goal of reducing or controlling their monthly payments. According to Hecht’s analysis and conversations with industry experts, the 5-star analyst estimates that the present TAM (total addressable market) is approximately $200 billion. That takes into account the potential for rate and term refinancing, with Hecht reckoning many borrowers would be willing to accept a slightly higher interest rate if it allowed for a longer loan term, resulting in a reduced overall monthly payment.

SoFi management has already noticed a significant increase in refinancing activity. This uptick has occurred from a relatively low starting point and is primarily driven by individuals who have available funds and want to prevent the accumulation of interest. Moving forward, Hecht thinks this trend is set to continue. “We expect this activity to pick up over 3Q23 and start to accelerate in 4Q23, and normalizing to pre-COVID levels next year,” he summed up.

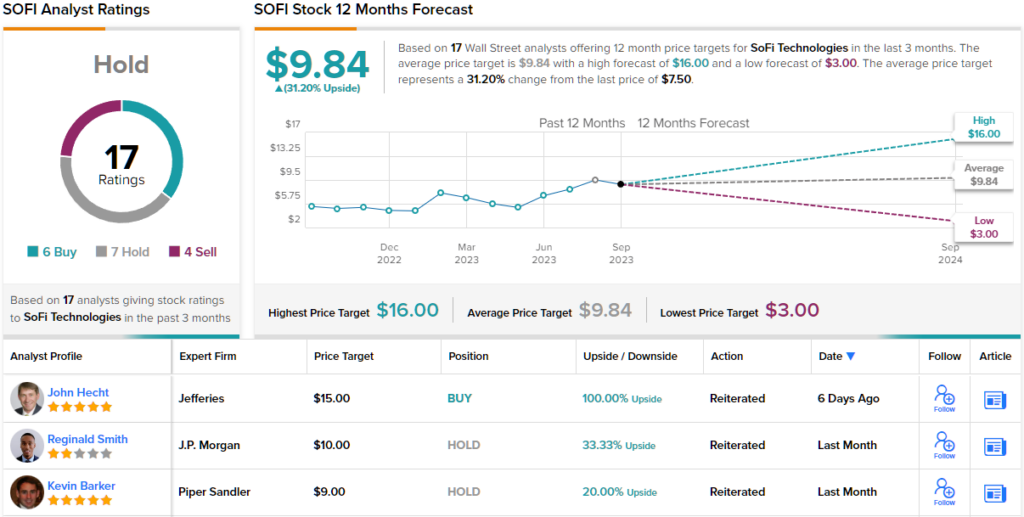

So, down to business, what does it all mean for investors? Hecht maintained a Buy rating on the shares, backed by a $15 price target. There’s potential upside of 100% from current levels. (To watch Hecht’s track record, click here)

However, not all on the Street are quite as upbeat; based on a mix of 7 Holds, 6 Buys and 4 Sells, the stock claims a Hold consensus rating. Nevertheless, the $9.84 average target makes room for one-year returns of 31%. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.