Who wouldn’t like to be ‘present at the creation,’ as a new world takes shape? We all have that rare opportunity right now, as the digital economy is undergoing a series of fundamental changes. Artificial intelligence technology, including machine learning and natural language processing, has hit the world of information technology like a bolt of lightning, and neither AI nor IT will ever be the same.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AI, particularly generative AI, is altering the ways in which we interact with machines, and the ways that machines respond to us. One day soon, it will be possible to just tell computers what you need, and watch them go. For now, however, specialist IT companies are still necessary, and are at ‘the tip of the spear’ in the AI-driven tech cycle.

Covering this sea-change for the Guggenheim financial services firm, analyst Jonathan Lee sees plenty of room for IT service stocks to reap gains. This sector is poised to benefit as AI takes an ever-larger hold on the digital world.

“We believe we are in the early innings of an AI-driven technology cycle,” Lee opined. “IT Services providers are often ‘tip of the spear’ for innovation, as those indexed to consulting capabilities help plan, roadmap, develop, and implement new technology for enterprise customers. Adept at recruiting and upskilling engineers, as well as staying abreast on emerging technology, IT Services companies with strong talent pools should be able to capture a meaningful portion of global spending on AI software and platforms, estimated to grow to $251bn by 2027 (per IDC).”

Against this backdrop, the analyst makes some specific stock calls, IT service stocks that investors should consider. We’ve looked at the TipRanks data for the scoop on both; these are shares with ‘Buy’ ratings and solid upside potential. Here’s a closer look.

Globant SA (GLOB)

First on the list is Globant, an IT services firm with a truly global profile. The company was founded back in 2003 in Buenos Aires, but today its headquarters are in Luxembourg, and it operates everywhere from Costa Rica to Belarus to India, with the largest customer bases in the US and the UK. Globant boasts a market cap of ~$8.5 billion, and employs more than 29,000 people, working on projects for such major client companies as Google, Electronic Arts, and Santander Bank.

Globant has always been at the forefront of IT, advancing multiple technologies and projects, and in recent years has become closely tied to the expansion of AI tech. The company makes use of AI in its own back office, applying that to the needs of its clients.

In a move related to its AI work, Globant last month launched a new project, the company’s Loyalty Studio. Globant’s Loyalty Studio uses AI tech integrations to create and deliver comprehensive loyalty strategies to its customers, giving them end-to-end solutions for their customer engagement efforts.

Also this year, in January, Globant announced the opening of its Innovation Hub Office in Berlin. This office expands Globant’s presence in Germany, and makes the company’s digital solutions available to a more extensive client base in one of Europe’s largest economies.

Looking at Globant’s financial results, we find the company recording gains in revenue and earnings in the last quarterly report, from 4Q23. At the top line, the revenue figure of $580.7 million was up more than 18% year-over-year and came in $1.34 million over the estimates. The bottom-line figure, the non-GAAP EPS of $1.62, was a penny better than the forecast. For 2023 as a whole, Globant had revenues of $2.1 billion, up more than 17% y/y, and a non-GAAP EPS of $5.74, up 66 cents from the previous year.

These results came from serving 1,610 active customers during the year. For the 12 months ending in December 2023, Globant counted 311 customers with over $1 million in annual revenue.

For Guggenheim’s Lee, this company is attractive for its proven ability to deliver results to its customers. As he writes, “A Latin American-based digital pure-play showing resilience amidst macroeconomic uncertainty, GLOB has demonstrated the strengths and differentiation of its customer relationships and Studio model, which we believe will continue to underpin double-digit growth in the medium term.”

Looking ahead, Lee goes on to explain why GLOB shares should bring solid appreciation: “Consistent with other digital pure-play providers, we expect GLOB to remain at the leading edge of emerging technology, inclusive of AI. GLOB has completed over 500 AI-centric projects (as of 4Q23), including work on predictive analytics, natural language programming, computer vision, and custom neural networks… Nearly 100% of GLOB’s pods are certified in AI.”

Lee wraps his review of the stock with a Buy rating, and a $250 price target that predicts a 26% upside on the one-year horizon. (To watch Lee’s track record, click here)

GLOB’s Strong Buy consensus rating comes from 15 recent analyst reviews that break down 13 to 2 in favor of Buy over Hold. The shares are trading for $197.90 and the average target price of $264.53 implies a potential one-year upside of almost 34%. (See GLOB stock forecast)

Endava, Ltd. (DAVA)

Endava, the next stock we’re looking at, is an IT outsource firm that offers a range of tech services, from IT strategies to business analysis and program management, to digital advisory, to product design and UX, to AI and machine learning integrations. The company is based in London, has been in business since 2000, and serves an enterprise client base in Europe and the Americas.

The company’s customers come from a wide range of economic sectors. Endava provides tech services for businesses in government and finance, in the energy and automotive sectors, in healthcare, in media, in online payment processing, in telecom, in the supply and logistic sectors. Endava brings a high level of expertise to solving problems, with solutions frequently based on a potent combination of data and AI.

Data and AI are expanding their roles across the business world, and Endava can help its customers integrate this developing tech into current systems. The company brings an outcome-focused approach to the table, to identify the ways that AI-powered data science can smooth out wrinkles in all sorts of businesses. The possibilities in AI technology are nearly endless, and Endava has built up a track record of success, based on the integration of industrial-grade AI solutions to customers’ specifications.

That said, DAVA shares collapsed at the end of February, falling more than 40% in the wake of the company’s fiscal 2Q24 financial release. Endava reported results that were weaker than had been expected. Revenue for the fiscal second quarter came to GBP183.6 million, falling more than 10% year-over-year and missing the forecast by more than 1 million pounds. At the bottom line, EPS of £0.14 fell from £0.26 in 2Q23 and missed the forecast by 18%.

This leaves the stock soft for now, but analyst Lee sees that softness as a buying opportunity into an otherwise sound option. He says of Endava, “Near-term growth has been challenged by the combination of vertical concentration and macroeconomic uncertainty, but we see weakness as largely cyclical, particularly as DAVA expands vertical exposure, and believe the company is well-positioned to capture discretionary project work as the environment improves…”

“As DAVA’s transformational services are deemed to be largely discretionary,” Lee continues, “we see near-term softness in revenue growth as enterprises continue to focus on cost optimization, but expect DAVA to benefit when companies begin to shift focus to growth, with the company focused on returning to +20% y/y cc growth.”

This all adds up, in the analyst’s opinion, to a Buy rating – and he adds a $60 price target that suggests a robust upside for the next 12 months of 55%.

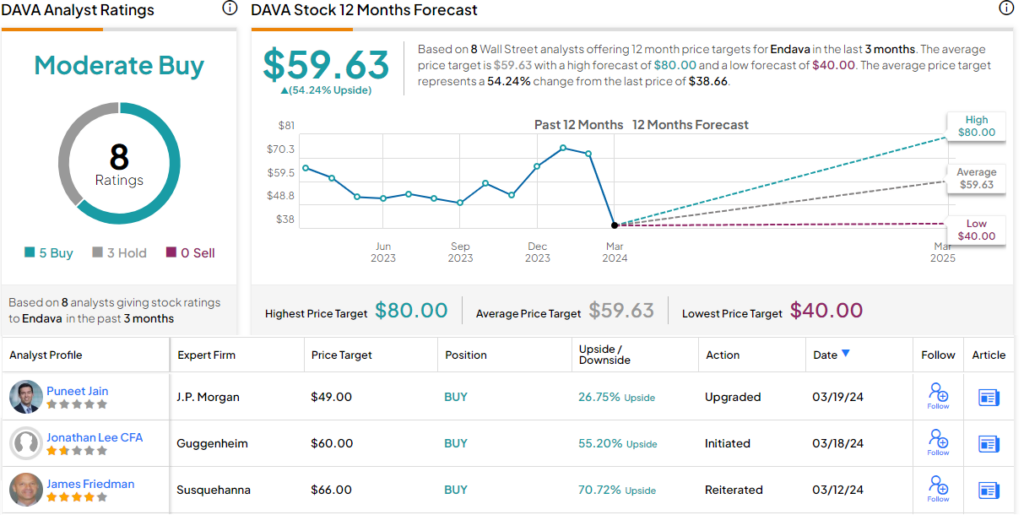

Turning now to the rest of the Street, where the stock has a Moderate Buy consensus rating based on an additional 4 Buys and 3 Holds set in recent months. The shares are currently trading for $38.66, and the $59.63 average target price implies that they will gain 54% over the coming year. (See DAVA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.