Rule number one in business in the modern age may be to never anger pop superstar Taylor Swift, which Ticketmaster – under Live Nation Entertainment (NYSE:LYV) – has found out the hard way. At the same time, the uproar over Swift’s “Eras Tour” ticket distribution shined a negative light on reseller Vivid Seat (NASDAQ:SEAT). Despite the ugliness of the matter, Vivid presents an intriguing investment idea. I am bullish on SEAT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SEAT Stock is a Tale of Two Cities

To understand the public relations dilemma surrounding SEAT stock, one must go back to late last year. As TipRanks reporter Sheryl Sheth stated, the Department of Justice (DOJ) probed Ticketmaster for possible misconduct. During a presale of Swift’s concert tickets exclusively targeting “invitees,” a surge of fan interest crashed the Ticketmaster system. The incident forced consumers to wait hours in online queues, only to be eventually timed out.

Shortly after the incident, Ticketmaster canceled sales of tour tickets to the general public. One of the accusations regarding the probe centered on Ticketmaster willfully causing the system to crash to cynically raise ticket rates and earn extra money. In the aftermath, critics blasted the platform for commanding a monopoly.

Further, a fan-driven class action lawsuit stated that Ticketmaster’s service is neither superior nor reliable, citing the disastrous Taylor Swift presale as evidence. That’s part one of the controversy. Part two focuses on the secondary market, which is where SEAT stock comes into play.

As the initial distributor of tickets at face value, Ticketmaster represents the primary market reseller. However, most working people live busy lives and don’t have time to wait in online queues for desired events. That’s where secondary market specialists like Vivid Seats offer a valuable service.

However, a wrinkle exists. To attend Taylor Swift’s blisteringly-hot Eras Tour, fans must now pay exorbitant premiums in the secondary market. Thus, Vivid Seats and its ilk – the modern-day scalpers – now have a bad rap.

Vivid Seats Really Isn’t the Bad Guy

To be fair to non-Swift events, scalping has long had a bad reputation. Even the word conjures up images of slimy hucksters preying upon unsuspecting victims. In reality, though, Vivid and its secondary market peers simply offer a capitalistic exchange. In other words, it’s not the bad guy. Indeed, one could make the argument that SEAT stock represents a viable investment.

While a complex spectrum exists, at the most basic level, the ticketing process involves two choices. If you have time, you wait (for an opportunity in the primary market). If you have money but no time, you pay (in the secondary market).

Each choice has its pros and cons. Obviously, going to the primary market affords you the chance to acquire tickets at face value. However, you don’t have a guarantee of success. For the secondary market approach, you do have a guarantee (notable exceptions aside) and can skip the inconveniences. Of course, you must pay for the privilege.

Where it gets contentious for Swifties – the colloquial term for fans of the popstar – are the exorbitant premiums for those forced out of the aforementioned online queues. On Vivid’s website, tickets for Swift’s show on August 3 in Inglewood, California, are over $900 at the cheapest. If you want great seats, you’re talking tens of thousands of dollars.

Generally, the core demographic of Swifties doesn’t have that kind of money. However, SEAT stock, in a way, represents a lesson in capitalism. If folks really want to see Swift, they’ll have to fork over the money, just like any premium experience in life.

Sentiment for Experiences Bolsters the Financials

While a strong debate exists about the resilience of the consumer economy at large, for now, people have no problems opening their wallets. In particular, due to the extended disruption of COVID-19, the revenge travel phenomenon still shines brightly as folks seek to engage in experiences denied them because of the pandemic. Better yet, SEAT stock rates as a beneficiary.

After succumbing to a revenue haul of only $35 million in 2020, in the following year, Vivid posted $443 million in revenue. In 2022, the company rang up sales of over $511 million, representing year-over-year growth of over 15%. Not only that, the tally topped 2019’s haul of nearly $469 million.

Even better, momentum continues to point in the positive direction. In the first quarter of 2023, Vivid posted sales of $136.58 million, up 4.4% against the year-ago period’s tally of $130.77 million. With exciting events opening up – like Taylor Swift concerts – the backdrop looks surprisingly robust for SEAT stock.

Is SEAT Stock a Buy, According to Analysts?

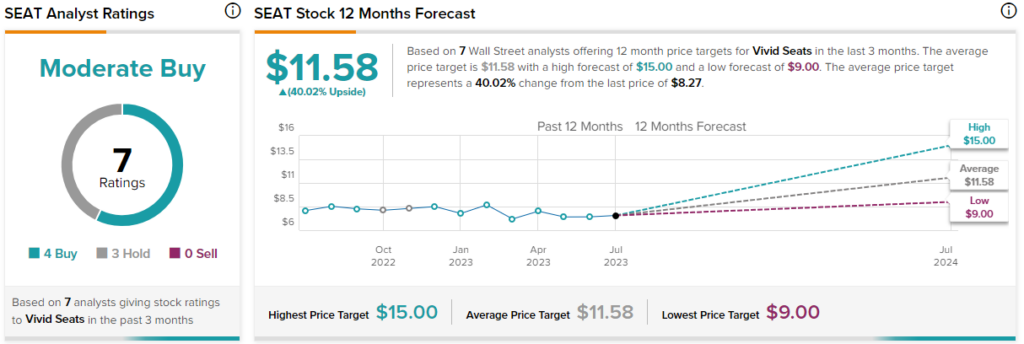

Turning to Wall Street, SEAT stock has a Moderate Buy consensus rating based on four Buys, three Holds, and zero Sell ratings. The average SEAT stock price target is $11.58, implying 40% upside potential.

The Takeaway: SEAT Stock is Capitalism at Its Finest

While it’s easy to blast ticket resellers like Vivid Seats as opportunistic scalpers, in reality, they offer fans convenient access to their desired events. After all, not everybody has the time nor the patience to stand in long lines, literally or digitally. Plus, Vivid’s revenue growth confirms the viability of the business despite the bad press.