TipRanks’ Top Hedge Fund Managers tool reveals that Christopher Niemczewski of Marshfield Associates, John Kim of Night Owl Capital Management, and Nelson Peltz of Trian Fund Management are the three high-performing hedge fund managers. Given their impressive average returns, we were intrigued to explore the Street’s recommendations regarding their top holdings. Notably, analysts express optimism about Niemczewski’s and Kim’s key investments but remain sidelined on Peltz’s primary holding.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But before we dig deeper, investors should note that Niemczewski’s top pick is Arch Capital Group (NASDAQ:ACGL). Meanwhile, Kim’s primary holding is Amazon (NASDAQ:AMZN). At the same time, Janus Henderson Group (NYSE:JHG) is Peltz’s top holding. Let’s look at what the Street suggests for these stocks.

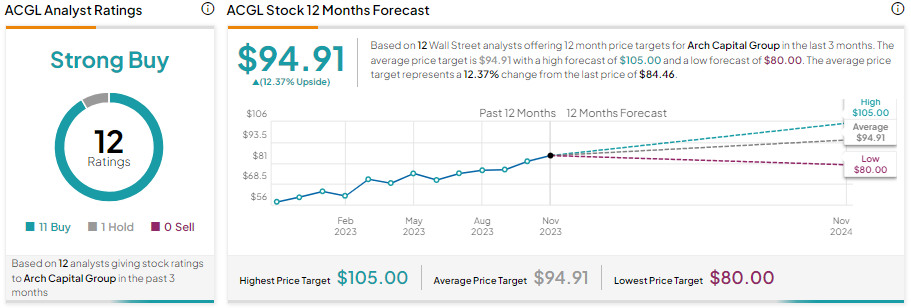

What is the Stock Price Forecast for ACGL?

Arch Capital Group provides specialty insurance, reinsurance, and mortgage insurance solutions. ACGL stock has gained about 35% year-to-date. Meanwhile, the analysts’ average 12-month price target of $94.91 suggests an upside potential of 12.37% from current levels.

Further, with 11 Buy and one Hold recommendations, ACGL stock has a Strong Buy consensus rating.

Is Amazon Stock Expected To Go Up?

Amazon stock has already gained about 74% year-to-date. However, analysts see further upside potential in AMZN shares. The analysts’ average 12-month price target of $175.51 suggests that it has the potential to go up by 20.11% from current levels.

Meanwhile, Wall Street analysts are bullish about the e-commerce giant’s prospects. All analysts covering Amazon stock recommend a Buy, which translates into a Strong Buy consensus rating.

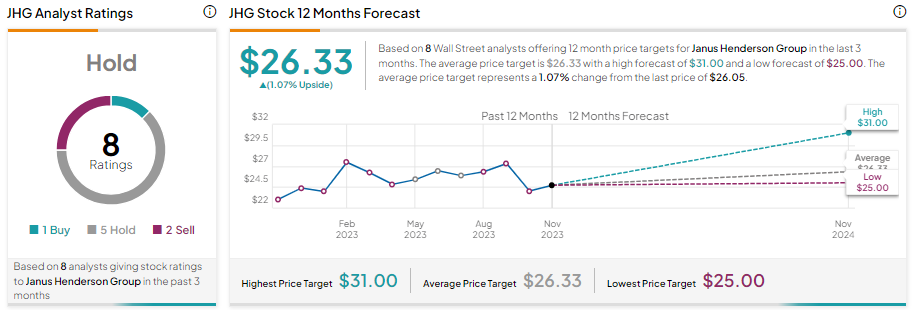

Is JHG a Good Stock?

Janus Henderson Group is a leading global asset manager. While JHG stock has witnessed a roller coaster ride so far this year, it is still up over 17% year-to-date. However, the analysts’ average price target of $26.33 suggests a limited upside potential of 1.07% from current levels.

At the same time, Wall Street analysts remain sidelined on the stock. With one Buy, five Hold, and two Sell recommendations, JHG stock has a Hold consensus rating.

Bottom Line

Monitoring the trades of top hedge funds can help retail investors formulate their investment strategies. However, it is crucial for retail investors to thoroughly assess various elements, including advice from Wall Street analysts, insider transactions, and fundamental indicators when planning for long-term investments. To enhance their decision-making process, they can use TipRanks’ valuable tools, such as Smart Score and Expert Center.