Heading into the second ‘COVID winter,’ with the worst of the virus safely behind us and new vaccines and medication therapies promising to ease the damage going forward, now is a good time to pause and take a look at where we are, and some of the economic and market changes we’ll need to live with.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The retail sector felt profound effects from the COVID-19 crisis, and those effects are to a large part here to stay. Brick and mortar stores saw foot traffic decline, and sales shifted strongly to e-commerce. The dominance of online retail had been predicted; COVID brought it forward several years.

But the real change resulting from the shift of retail to the online space comes in metrics. While sales remain important, website traffic is taking an ever-more relevant role in determining retailers health. Strong website traffic has been shown to correlate, on average, with a retailer’s stock price; it is the equivalent of store visits in brick and mortar shops. Every site visit marks another potential customer, and another potential product sale. Building up a critical mass of site visitors has become a key activity for retailers.

With this in mind, we’ve used the Website Traffic Screener, based on SEMrush data, to start looking at the connection between site visits and stock value. The traffic screener shows the top trending sites, the sites that are losing traffic, and for individual stocks, the traffic tool can be used to show how website traffic has been lining up with share value. Data can be compared from quarter to quarter, or from year to year, giving investors a versatile new way to look at stocks.

So, let’s take a dive in, and check out a couple of internet stocks, using the new traffic screener, and the analyst commentary.

Coupang (CPNG)

We’ll start with Coupang, an e-commerce company from South Korea that is rapidly becoming the leader in that country’s online retail sector. Think Amazon, but with a Korean twist. Coupang saw US$5.9 billion in total sales for 2019, which more than doubled to US$12 billion during the ‘pandemic year’ of 2020.

Coupang’s site sells pretty much everything. Customers can find automotive needs, childcare items, household furnishings, kitchen utensils, pet supplies – all of the things that are usually found on separate sites, and Coupang puts them all in one place. The company guarantees fast delivery on more than 5 million discreet items – same-day or next-day, at the customer’s choice – through its Rocket Delivery network.

Earlier this year, in March, Coupang held its IPO for the US markets. The CPNG ticker started trading on Wall Street on March 11. In its second quarterly release as a public company, for 2Q21, Coupang reported $4.5 billion at the top line, up more than 7% from Q1.

That’s what the traditional metrics tell us. Turning to the CPNG website traffic, we find that Coupang’s site visits have been rising. The company tallied 82.6 million unique visitors in Q2; that number is up ~23% to 101.3 million for Q3. More impressively, the Q3 figure is up 650% from $13.5 million in the year-ago quarter.

In coverage for Deutsche Bank, analyst Peter Milliken notes that retail is rebounding in South Korea, and that Coupang has been leading the way.

“Koreans have been heading back to the stores, allowing retail sales growth to hit a four plus-year high in Q2, growing 8.1% YoY. Online shopping still grew at three times that rate, and Coupang at almost three times the rate of online growth. We see this as a sign of how it has broadened its category penetration,” Milliken opined.

To this end, Milliken rates the stock a Buy, along with a $44 price target to suggest ~60% upside potential for the coming year. (To watch Milliken’s track record, click here)

Overall, Coupang has 4 recent analyst reviews on file, and they are evenly split – 2 to Buy and 2 to Hold, for a Moderate Buy consensus rating. The shares are selling for $27.33 and their $38.67 average price target implies a 12-month upside of 41%. (See CPNG stock analysis on TipRanks)

Farfetch (FTCH)

The second stock we’ll look at is Farfetch, an online sales platform specializing in luxury goods and brands. The company exemplifies the cross-border, international, nature of the internet; it got its start in Portugal, keeps its headquarters in London, and has offices in Brazil, Shanghai, Tokyo, LA, and New York. Farfetch connects sellers and buyers in the world of high-end fashion and boutique retail.

After taking steep losses in 2020, when COVID tanked consumer activity worldwide, Farfetch saw profits in both Q1 and Q2 of this year. The bottom line in Q1 was $1.44 per share, a value that slipped to 24 cents in Q2. Revenues moved in the opposite direction, from $485 million in Q1 to $523 million in Q2. The Q2 top line was also up 43% year-over-year.

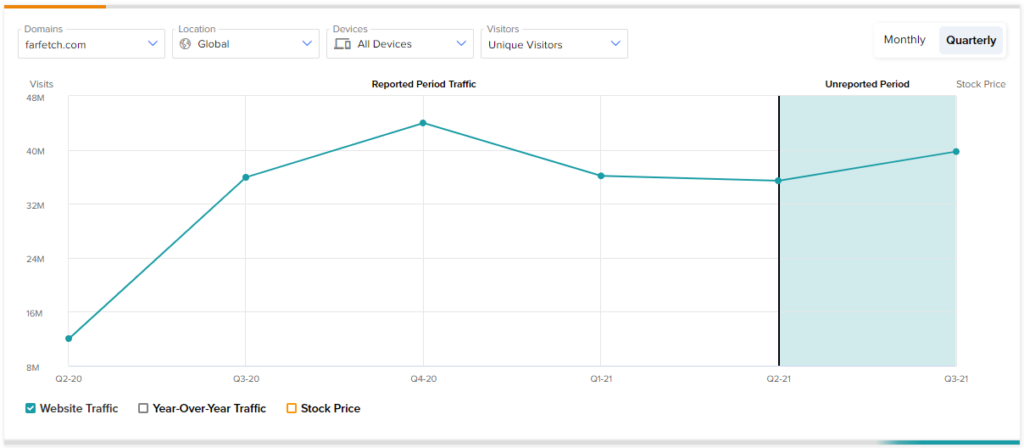

When it comes to Farfetch’s website traffic, we must also look at the company’s customer base. Farfetch has more than 3 million active customer accounts and operates in 190 countries. Traffic data shows that unique visits climbed 12.2% from 35.4 million in Q2 to 39.7 million in Q3, and up from $35.9 million in the year-ago quarter, a gain of ~11%.

Wells Fargo analyst Ike Boruchow writes of Farfetch: “In 2021, ecommerce names have lagged broadly after being ‘COVID winners’ in 2020. Our view is that underperformance is more a function of positioning for some names (such as FTCH) where the model continues to operate very efficiently. As we transition to mid-cycle, we’re looking for structural winners with momentum at their backs, and with FTCH, we see a rare ecomm name actually achieving profitability this year.”

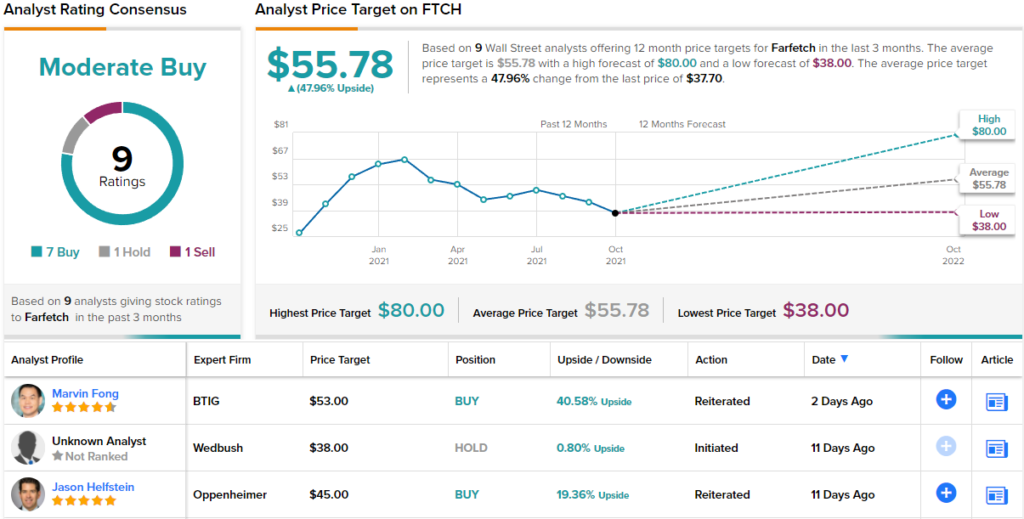

Unsurprisingly, Boruchow rates this stock an Overweight (i.e. Buy), and his $55 price target implies that it has room to grow ~46% in the coming months. (To watch Boruchow’s track record, click here)

The Wells Fargo view is bullish here, and the firm is not alone. Of the 9 recent reviews on the stock, 7 are to Buy, while 1 each are to Hold and Sell, giving the stock its Moderate Buy consensus rating. With a share price of $37.27 and an average price target of $55.78, FTCH has a 49% one-year upside potential. (See FTCH stock analysis on TipRanks)

To find publicly traded companies with trending websites (i.e. top websites which have the highest website traffic increases over the past month), visit TipRanks’ Website Traffic Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.