Unhappy with the state of the portfolio after miserable 2022 stock market action? You are probably far from alone. Most investors have struggled to make headway in this year’s ongoing bear market, which has provided only short periods of relief.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That said, with the year’s end getting ever nearer, Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, thinks the bears are showing signs of exhaustion and this spells good news for battered investors.

“You’ve got to adjust your mindset to a world where the bears are finally in retreat, because I’m betting the next four weeks will be much better than what we’ve come to be used to,” Cramer said.

With this in mind, let’s take a closer look at two stocks that recently received Cramer’s nod of approval in his ‘lightning round’ segment. According to TipRanks’ database, Cramer is not alone in thinking these tickers are ripe for the picking; both are rated as Strong Buys by the analyst consensus. Here are the details.

MP Materials (MP)

The first name we’ll look at is a “winner,” according to Cramer. MP Materials is a North American-based miner of rare earth materials. Its deposit-rich Mountain Pass mine in California is the United States’ largest rare earth mine and processing facility and provides the company with a ~15% global market share in upstream rare earth manufacturing.

Its production is mainly focused on Neodymium-Praseodymium (NdPr), a rare earth element utilized in high-strength permanent magnets that drive the traction motors used in electric vehicles, drones, wind turbines, robotics, and other cutting-edge motion technologies.

Being able to produce much-needed components used in segments gaining adoption should be a recipe for success, and the company built on the rise in the realized price of rare earth oxide in its latest earnings report – for Q3.

Despite COVID-19 lockdowns in China and global economic headwinds, which accounted for a sequential decline in NdPr prices, average prices were up significantly year-over-year, underscoring the ongoing robust demand for NdPr.

Revenue rose by 24.8% year-over-year to $124.45 million, beating the Street’s call by $6.73 million. The increase in revenues resulted in a 34% y/y uptick in adjusted EBITDA, which reached $91.4 million. As a result, Adj. EPS of $0.36, also beat the Street’s forecast of $0.30.

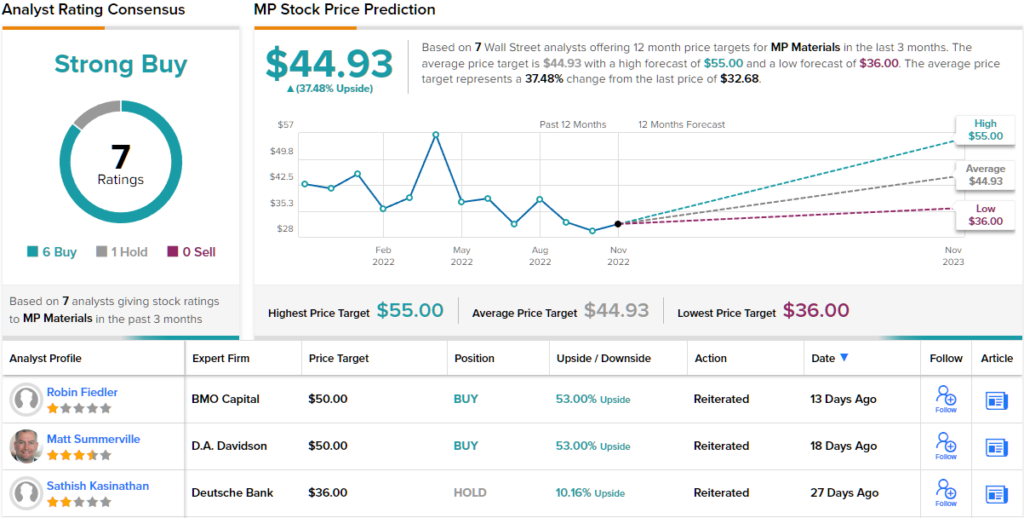

So, Cramer thinks MP is a “winner” and so does BMO analyst Robin Fiedler.

“MP is a rare earth pureplay with a tier-1 asset amid scarce alternatives. We view MP’s unique and multi-faceted vertical-integration growth and Chinese supply chain circumvention strategy as compelling and thus able to stomach near-term price and expansion risks,” the analyst said. “We believe at current levels risk-reward is attractive considering our assessment of mid- to long-term vertical integration upside and the potential for various legislative ‘wins’ next year.”

Accordingly, Fiedler rates MP shares an Outperform (i.e. Buy) while his $50 price target makes room for 12-month gains of 53%. (To watch Fiedler’s track record, click here)

Fiedler’s take on MP is bullish – and he’s far from the only bull on the stock. MP has 7 recent analyst reviews, with 6 Buys and 1 Hold for a Strong Buy consensus rating. The shares are priced at $32.68 and their $44.93 average price target implies ~37% one-year upside potential. (See MP Materials stock forecast on TipRanks)

ICON plc (ICLR)

“I like it. It’s a very inexpensive stock.” That is Cramer’s short and succinct explanation for backing the next company we’ll look at.

Icon is a big name in the world of clinical research organizations (CROs). That is, the company helps pharma, biotech, and other research labs get their work done. It is one of the sector’s biggest names offering across the board services. These include everything from strategic development, program analysis, and assistance in compound selection to patient recruitment and retention, site monitoring, and data management, amongst others.

Icon has been through some big changes over the past year and a half. In July 2021, the company closed its acquisition of contract research company PRA Health Sciences in a deal worth ~$12 billion, creating what it touts as the “world’s most advanced healthcare intelligence and clinical research organization.”

On the financials front, Icon’s latest statement was a success. In the Q3 report, the company generated revenue of $1.94 billion, coming in $10 million above Street expectations. Likewise, EPS of $1.94 beats the analysts’ forecast of $1.82. The company also reaffirmed its full year 2022 revenue and adj. EPS guidance.

Assessing the Q3 print, J.P. Morgan analyst Casey Woodring thinks the long-term thesis remains “intact” whilst highlighting the importance of the FRAH deal.

“We are encouraged by how the company has executed in 2022 and view the reiteration of the LT targets out to 2025 as a positive indicator of the overall health of the market and ICLR’s competitive positioning,” the analyst wrote. “We continue to view ICLR as a top-tier clinical CRO with a compelling financial profile that is more levered to large pharma during this time of smid biotech uncertainty along upside potential from new business wins as a result of the company’s scale and integrated capabilities from the PRAH deal.”

These comments underpin Woodring’s Overweight (i.e., Buy) rating, which is backed by a $265 price target. The implication for investors? Upside of ~22% from current levels. (To watch Woodring’s track record, click here)

Overall, ICON gets robust support from the Street; the ratings break down as 7 to 2 in favor of Buys over Holds and culminate in a Strong Buy consensus rating. The average target is slightly lower than Woodring’s objective; at $259, the figure suggests a one-year upside potential of ~20%. (See ICLR stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.