There’s been a lot of talk lately about the Fed’s high interest rate policy finally taking hold against inflation – but underneath that, there’s also been worry about the housing market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Higher rates pushed the average 30-year fixed-rate mortgage up to 7% in March and increased the average mortgage payment by 1.6%, which together put pressure on housing from two directions. Combined with elevated home prices, it makes housing less affordable; it also makes homeowners hesitant to sell and move, as they’ll likely be forced to refinance at a higher rate than they currently have. Unsurprisingly, the real estate market began to falter at the end of last year.

Higher rates pushed the average 30-year fixed-rate mortgage up to 7% in March, resulting in a 1.6% increase in the average mortgage payment. This dual impact put pressure on the housing market from two directions. Combined with elevated home prices, it makes housing less affordable; it also makes homeowners hesitant to sell and move, as they’ll likely be forced to refinance at a higher rate than they currently have. Unsurprisingly, the real estate market began to falter at the end of last year.

The past few months, however, have shown resilience in housing. Easily affordable or not, housing is still a necessity, and now that inflation is moderating, some of the pressures are easing. Major home builders across the country saw lower cancellation rates on new construction in 1Q23 compared to 4Q22, a sign of buyer confidence and solvency.

Wall Street’s analysts have noticed, too, and are pointing out that stronger-than-expected Q1 results and a possible housing rebound just ahead of spring are making residential construction firms more attractive in the stock market. If you’re as optimistic analysts are, here are the top two stocks you should add to your watch list.

PulteGroup, Inc. (PHM)

Founded in 1950, PulteGroup is the third-largest homebuilder in the US construction industry. PulteGroup operates in more than 40 major metro areas across the country, and counts among its assets some of the better-known brands in home construction, including Centex, American West, and the eponymous Pulte. The company saw revenues last year of $16.23 billion, for a year-over-year increase of 16.5% – and that was in a year that, as we’ve noted, the real estate market was facing serious pressure.

From an investor’s perspective, PulteGroup offers a history of proven long-term returns. The company has a commitment to capital returns, and between 2018 and 2022 gave some $3.4 billion back to shareholders via stock repurchases and dividend payments. Through the same period, the company also invested heavily in land, a key asset for a homebuilder, spending $17 billion on land purchases.

PulteGroup built on its solid position in the industry to realize solid share gains over the past year or more. In the last 12 months, the company saw its stock rise 55%, compared to the 2% loss on the S&P 500.

In the most recent reported quarter, 1Q23, PulteGroup showed a 14% year-over-year increase in top line revenue to $3.58 billion, a number that beat the Street’s forecast by $310 million. At the bottom line, the company’s non-GAAP EPS number of $2.35 beat the forecast by 53 cents, or 29%.

Turning to the analysts, we’ll check in with Barclays’ 5-star analyst Matthew Bouley who believes that PHM is well-positioned to benefit from the increasing demand for affordable housing in the US.

“We expect that homebuilders overall should continue to outperform the market as new resi construction improves, and that PHM has among the most severe disconnects between valuation and returns. We think PHM’s [earnings] results further illustrate new construction’s inflection from the trough, as the need for affordable supply in the inventory-starved U.S. transcends buyer sensitivity to traditional affordability metrics,” Bouley opined.

“For PHM, we view the company as positioned to further recover sales pace as it flexes its spec positioning and expands community count, linking with its premium margin profile and ongoing share buyback, altogether driving peer-leading returns into 2024,” the analyst added.

These comments back up Bouley’s Overweight (i.e. Buy) rating on PHM shares, while his $86 price target implies a one-year potential gain of ~30% (To watch Bouley’s track record, click here)

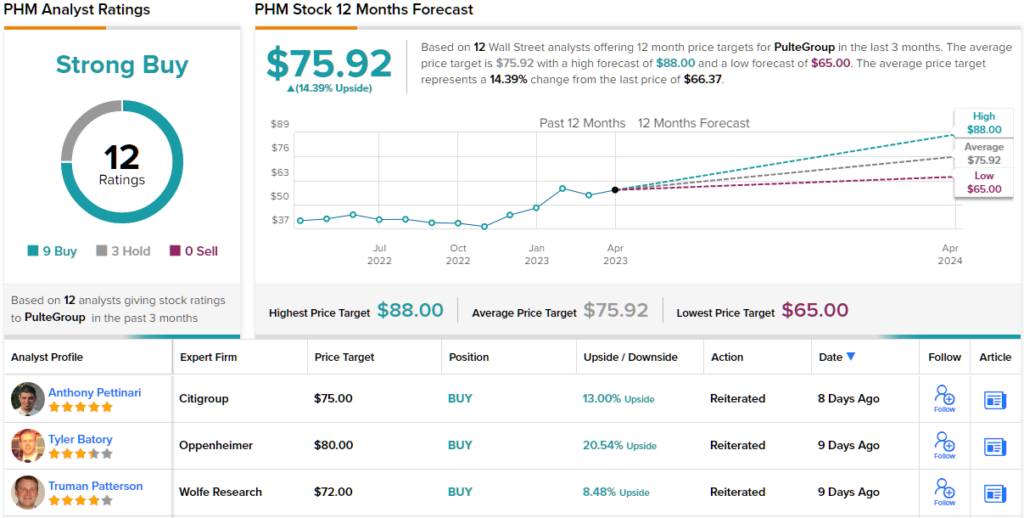

Overall, PulteGroup gets a Strong Buy rating from the Wall Street analysts, based on 12 recent reviews that include 9 Buys and 3 Holds. (See PHM stock forecast)

DR Horton, Inc. (DHI)

By business volume, DR Horton is the largest homebuilder in the US, a position it has held since 2002. The company was founded in 1978, and in the 45 years since then it has expanded its operations into 33 states, and 110 residential markets. DHI’s construction operations include single-family residences, as well as multi-family apartment rental properties.

DHI has its hands in every income bracket of the single-family home market, spanning the full range of what residential consumers want from relatively low-end houses for $150,000 up to $1 million-plus mansions. The company doesn’t just rest on homebuilding; it also has subsidiaries in the fields of mortgage financing, title services, and insurance – all vital services that a homebuyer needs.

That was visible in the last quarterly earnings release, for fiscal 2Q23, which ended on March 31 of this calendar year. The company’s revenues came in at $7.97 billion, slightly lower than the $8 billion reported in the year-ago period. However, the company still managed to beat the analyst forecasts by $1.49 billion, representing an impressive 23% beat. Furthermore, the company’s non-GAAP EPS of $2.73 was 82 cents higher than the expectations.

More importantly, company management published revenue guidance for fiscal year 2023 in the range of $31.5 billion to $33 billion, well ahead of the $28.5 billion that had been expected.

Investors were pleased with DHI’s performance, bidding up the stock 53% over the past 12 months.

All of this brought DHI to the attention of Evercore 5-star analyst Stephen Kim, who describes the recent quarter as ‘extremely strong.’

“DHI’s closings in the quarter exceeded both our and management’s prior expectations. More importantly, the company’s impressive closings guide for the year of 77k-80k implies a significant ramp in orders from here – we estimate in the 30%-range for 3Q23 (vs. 2Q23’s -5%). Given the company’s focus on volume, we expect it to achieve the high end of its range, but if demand accelerates faster than management expects, the upside will be captured in stronger margins,” Kim wrote.

Putting his cards on the table, Kim gives DHI an Outperform (i.e. Buy) rating, with a $148 price target suggesting a one-year upside of 38%. (To watch Kim’s track record, click here)

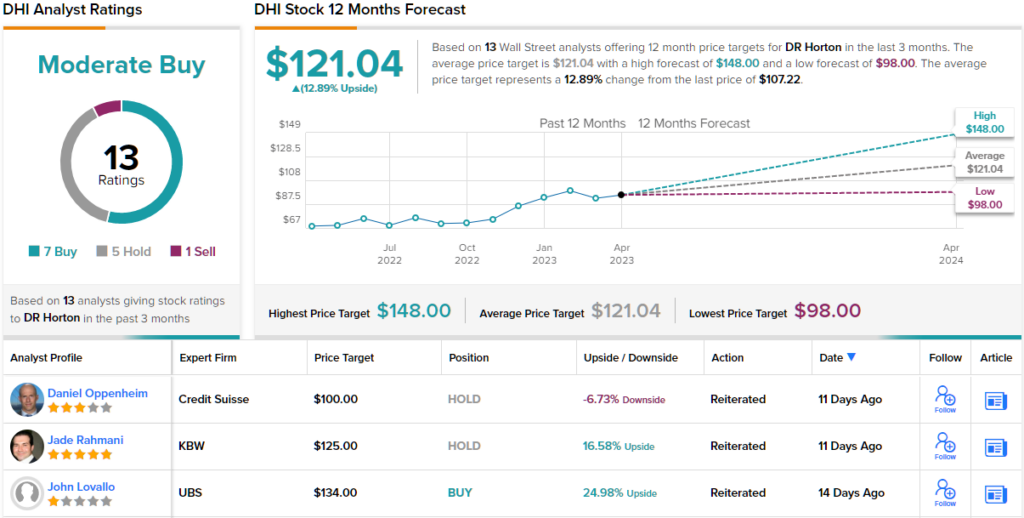

The rest of the Street offers an array of opinions when considering DHI’s prospects; all told, the stock claims a Moderate Buy consensus rating, based on 7 Buys, 5 Holds and 1 Sell. (See DHI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.