This year started with a strong rally in the markets, but the past month has seen the positive sentiments start to sputter. The failure of Silicon Valley Bank started fears of a contagion and consequent bank runs, which were only partially offset by Federal regulatory actions. But there’s a growing consensus that it was the Federal actions that set the conditions for the bank crisis, when the central bank raised interest rates to fight inflation. Now, investors are trying to cope with the fallout: a simmering bank troubles, persistent high inflation, and elevated interest rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But not all is doom and gloom. According to Mike Wilson, the chief US equity strategist at Morgan Stanley, what we’re seeing now may herald the beginning of the end in the bear market. While the market is volatile, Wilson describes a positive set-up for investors looking to hold stocks for the long-term.

“From an equity market perspective, the [recent] events mean that credit availability is decreasing for a wide swath of the economy, which may be the catalyst that finally convinces market participants that earnings estimates are too high. We have been waiting patiently for this acknowledgment because with it comes the real buying opportunity… We think this is exactly how bear markets end,” Wilson opined.

The stock analysts at Morgan Stanley are following Wilson’s lead, and pointing out the equities that offer solid opportunities for the long-term. We’ve looked up the details on three of these picks.

UnitedHealth Group (UNH)

First up is the world’s largest health insurer, UnitedHealth. The company is primarily a provider of health insurance policies, and in partnership with employers, providers, and governments, it makes healthcare accessible to more than 151 million people.

The scale of this business is visible in the company’s earnings reports. In the last reported quarter, 4Q22, UnitedHealth showed a quarterly top line of $82.8 billion, up 12% year-over-year and some $270 million ahead of expectations. At the bottom line, the company had a non-GAAP EPS of $5.34, up 19% y/y, and above consensus estimate of $5.17. For the full year, UnitedHealth had revenues of $324 billion, for a 13% y/y gain. The firm’s full-year adjusted net earnings came to $22.19 per share.

Looking ahead, UNH is guiding toward $357 billion to $360 billion in revenues for 2023, and is projecting to bring in $24.40 to $24.90 in adjusted net EPS.

Covering this stock for Morgan Stanley, 5-star analyst Erin Wright lays out a simple case for investors to consider, saying, “In health insurance, scale is king and UNH is the largest national insurer with top-three position in almost all insurance end markets. We believe the resiliency of UNH’s diversified businesses will generate long-term double-digit earnings growth with high visibility as a best-in-class vertically integrated MCO in a highly defensive category.”

To this end, Wright rates UNH shares an Overweight (i.e. Buy), and her price target of $587 implies a gain of ~22% on the one-year time horizon. (To watch Wright’s track record, click here)

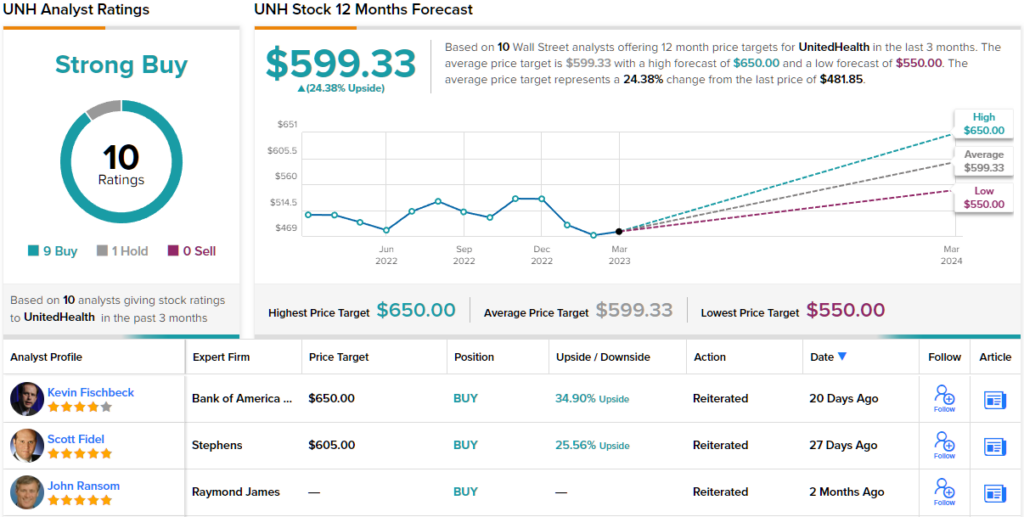

Overall, the Strong Buy consensus on this stock is backed by 10 recent analyst reviews, featuring a 9 to 1 breakdown favoring Buys over Holds. The stock’s average price target of $599.33 indicates potential for a 24% one-year upside from the current share price of $481.82. As a small bonus, the company also pays regular dividends that currently yield 1.4% annually. (See UNH stock forecast)

T-Mobile US (TMUS)

The next Morgan Stanley pick we’re looking at is another giant of its industry. T-Mobile is one of the best-known names in the US wireless business, and is the second-largest provider of wireless networking services in the US market.

As of the end of 2022, the company had 1.4 million new postpaid accounts for the year, and a total net customer count of 113.6 million. T-Mobile is a leader in the rollout of 5G services in the US, and boasted 2.6 million high-speed internet customers at the end of 2022.

Large customer counts and hefty market share have led to strong earnings results. T-Mobile’s last quarterly release, for 4Q22, showed $1.18 in GAAP EPS, beating the forecast by 8 cents, or 7%, and rising an impressive 247% year-over-year.

The company achieved those earnings results despite a modest miss in revenue. The quarterly top line of $20.3 billion was $39 million below expectations, and slipped 2.4% y/y.

The free cash flow, however, really stood out. T-Mobile generated $2.2 billion in FCF for Q4, and its full-year FCF figure, of $7.7 billion, shown an ‘industry-leading’ increase of 36% while also beating previously published guidance. The company’s cash generation made it possible to support share value by repurchasing 21.4 million shares in 2022 for a total of $3 billion.

This stock got the nod from Simon Flannery, another of Morgan Stanley’s 5-star analysts. Flannery wrote of TMUS: “The company has a clear growth strategy predicated primarily on share gains in key, underpenetrated markets: small town/rural, enterprise and top 100 market network seekers. Additionally, T-Mobile has led the way on fixed wireless home broadband as a brand new market opportunity for the company that’s expected to scale to 7-8mn subs by 2025.”

Tracking this stance forward, Flannery rates TMUS shares an Overweight (i.e. Buy) with a $175 price target indicating ~22% upside for the next 12 months. (To watch Flannery’s track record, click here)

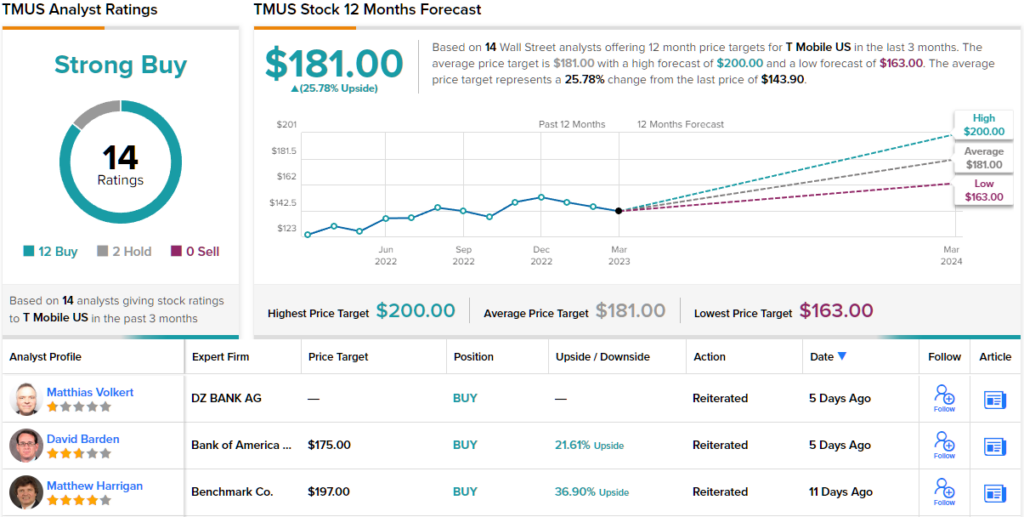

No fewer than 14 of Wall Street’s analysts have reviewed T-Mobile’s shares recently, and they’ve given the stock 12 Buys and 2 Holds for a Strong Buy consensus rating. The shares are trading for $143.90, with an average price target of $181 to suggest ~26% upside potential by the end of this year. (See TMUS stock forecast)

Thermo Fisher Scientific (TMO)

We’ll wrap up this list of Morgan Stanley’s long-term stock picks with Thermo Fisher Scientific, an important player in the field of laboratory research.

Thermo Fisher is a maker and supplier of laboratory equipment – scientific instruments, chemicals and reagents, sampling and testing supplies, and even lab-related software systems. Thermo Fisher works with a broad customer base, serving any clients in any field involving lab work; the company frequently deals with academics, medical researchers, and government entities.

While Thermo Fisher occupies a highly particular niche, supplying research labs has been profitable in the post-pandemic world. The company’s 4Q22 results saw both the top and bottom line beat expectations, even if they did not expand year-over-year. At the top line, the quarterly revenue of $11.45 billion was a full $1.04 billion above the forecast, while at the bottom line the non-GAAP EPS of $5.40 was 20 cents ahead of consensus estimates.

Thermo Fisher caught the eye of Morgan Stanley analyst Tejas Savant who writes: “We like TMO for the breadth of its portfolio, diversified customer base and scale – attributes that we believe will prove advantageous in navigating a potential recession, in addition to inflationary pressures and geopolitical uncertainty. TMO’s favorable end market exposure, PPI business system, and track record of consistent all-weather execution underpin our confidence in management’s long-term core organic growth target of 7- 9% with mid-teens EPS growth.”

Unsurprisingly, Savant rates TMO shares an Overweight (i.e. Buy), while his $670 suggests the stock will grow 19% in the year ahead. (To watch Savant’s track record, click here)

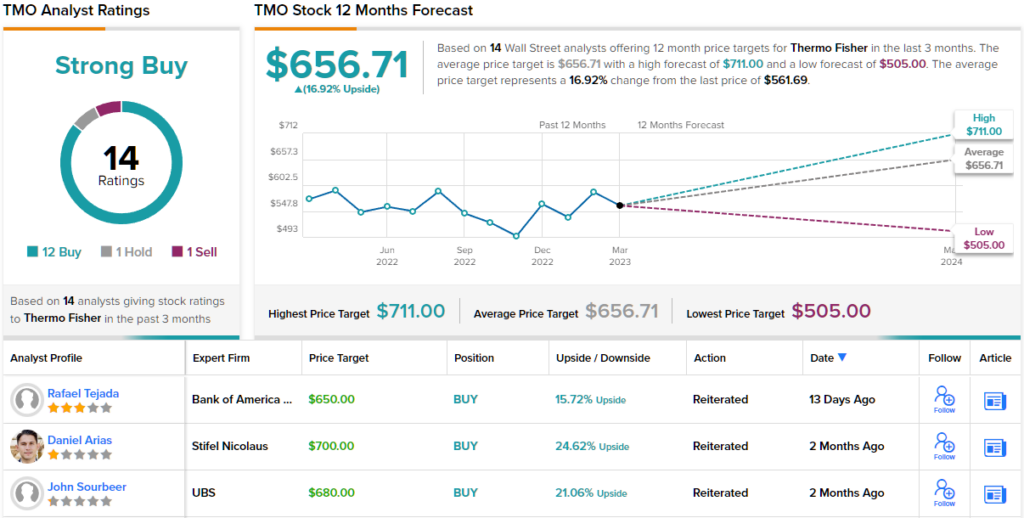

Overall, this stock has picked up 14 recent analyst reviews, and these include 12 Buys that overbalance 1 Hold and 1 Sell for a Strong Buy consensus rating. The stock’s average price target of $656.71 implies ~17% one-year gain from the current share price of $561.69. (See TMO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.