Many investors are worried that Pfizer (NYSE:PFE) might not have good prospects if it does not come up with an encore after its windfall during COVID-19. However, its market-leading range of drugs for a plethora of health conditions, as well as its healthy financials, are keeping many analysts bullish.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The COVID-19 Windfall and Its Continued Effects

Pfizer emerged to be one of the biggest beneficiaries of the COVID-19 era, and the momentum is expected to continue this year. In 2022, the company expects to mint around $54 billion from its COVID-19 vaccine and antiviral pill, which is more than half of its $100 billion total expected yearly sales.

To that end, Pfizer’s successful U.S.-approved COVID-19 vaccine, Comirnaty, developed in partnership with BioNTech (NYSE:BNTX), is now approved for an emergency shot in several countries worldwide. Moreover, last week, the booster dose for the vaccine, adjusted for Omicron BA.4/BA.5, was approved for patients aged 12 and above.

Additionally, the antiviral pill, Paxlovid, is also gaining more popularity. The pill is expected to generate $22 billion in revenues this year. Recently, White House COVID-19 coordinator Ashish Jha noted that consumption of Paxlovid can reduce the number of hospitalizations and deaths from COVID-19. This can boost the number of users for this pill.

Other Important Revenue-Driving Efforts

However, COVID-19 is not the only growth driver for Pfizer. Pfizer has committed considerable resources toward developing treatments for cancer, rare diseases, immune-deficient disorders, and inflammation. Moreover, its contribution to the fields of internal medicine, the development of vaccines, and others are also noteworthy.

Over the years, Pfizer has gained FDA approval for several innovative and effective cancer medicines like Daurismo, Lorbrena, Vizimpro, Talzenna, Besponsa, and Mylotarg, which have kept its oncology sales up.

BMO (NYSE:BMO) Capital analyst Evan Seigerman expressed his optimism about the upbeat results from Pfizer’s oral GLP-1 program (danuglipron and PF-07081532) for obesity, which showed early signs of “dose-dependent responses in glucose levels and weight loss.”

Financial Health and Valuation Look Favorable

Considering that Pfizer expects non-COVID-19 sales to be about $46 billion in 2022, it is still progressively higher than the $41.61 billion in 2020 sales, $41.17 billion in 2019 sales, and $40.83 billion in 2018 sales.

A favorable debt profile is yet another interesting point for investors to note. At the end of Q2, Pfizer had $34.3 billion in long-term debt and $5.99 billion in short-term borrowings as of June 30, 2022. Its cash, cash equivalents, and short-term investments (total cash in hand) of $33.3 billion are sufficient to fulfill short-term debt obligations. As for meeting long-term debt obligations, its debt-to-equity ratio seems appreciable. The ratio, as of June 30, was 0.46x, which is considered favorably leveraged.

In December last year, research and credit rating firm Moody’s (NYSE:MCO) reiterated an A2 rating for Pfizer’s long-term debt, indicating low credit risk. Overall, Pfizer can be seen to be in good financial health.

Moreover, its price-to-earnings ratio of 8.3x is near its five-year lows, giving investors all the more reason to consider the PFE stock.

How High is PFE Stock Expected to Go?

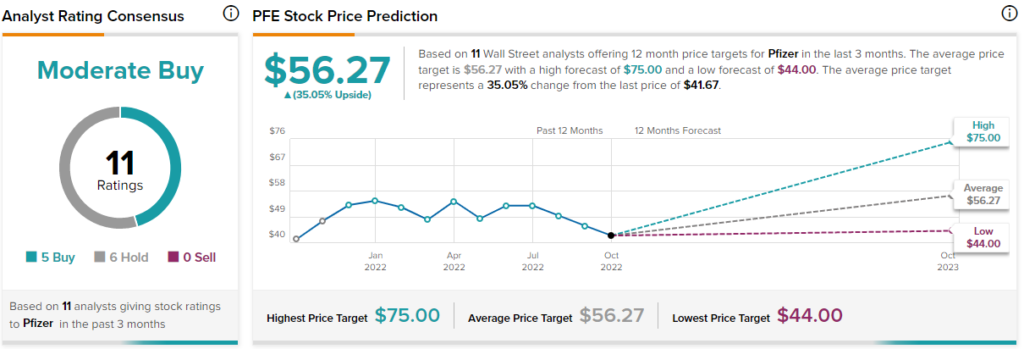

Wall Street analysts expect PFE stock to climb 35.05% higher over the next 12 months, reaching the average price target of $56.27. Moreover, five analysts have Buy ratings on Pfizer stock, and six analysts have Hold ratings. The consensus is a Moderate Buy.

Conclusion: Its Probably Wise to Stay Long on PFE

Acknowledging the fact that earnings per share may have downside risk over the coming months, a longer-term view of the company remains encouraging.