A strong jobs report these days runs counter to the Fed’s wishes. The line of thought is that if the job market is still too hot, the Fed won’t be keen on loosening its tight monetary policy in the ongoing efforts to tame inflation. And this is a scenario the market is keen to avoid after a series of 75 basis-point hikes this year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But J.P. Morgan Asset Management chief strategist David Kelly thinks the latest numbers flatter to deceive and believes the way the data is reported distorts the reality, which beneath the surface hides “more weakness.” This is good news for those worried about more aggressive hikes.

“When I look at the overall mosaic of what’s going on in the jobs market, I think it’s still moderating here, and I think the Federal Reserve will ultimately have plenty of excuse to taper down the rate hikes and pause them in the first quarter of next year,” Kelly explained.

That could signal that the bear maker might be reaching its apex and the bottom could be in sight for some beaten-down names.

Against this backdrop, Kelly’s analyst colleagues at the banking giant are recommending investors lean into several names that fit a certain profile; down significantly recently but primed to push ahead. We ran these tickers through the TipRanks database to see what the rest of the Street makes of these choices. Let’s check the details.

ChargePoint (CHPT)

One of the biggest developments in the stock market over the past few years has been the rise of the electric vehicle (EV) segment. Led by Tesla, other companies have clocked an opportunity to ride this secular trend, but with increasing adoption, there’s also the attendant infrastructure needed to support this new industry. This is where ChargePoint enters the frame.

The company operates one of the biggest EV charging networks in the world, boasting a leading position in North America – 7x more market share than the nearest rival in networked level 2 charging – whilst continuing to make a big dent in Europe too. In total, there are over 211,000 ChargePoint charging spots in the U.S. and Europe.

However, ChargePoint has been at the mercy of supply chain woes, and these impacted the company’s latest quarterly results – for the third quarter of fiscal 2023 (October quarter). While revenue climbed by 93% from the same period a year ago to $125.34 million, the figure missed Street expectations by $6.78 million. And with supply chain disruptions impacting both cost and supply availability, gross margins dropped year-over-year from 25% to 18% of sales. As such, EPS came in at -$0.25, worse than consensus at -$0.23.

The market was not happy with the display and sent shares down in the subsequent session, adding to the year’s losses, which now stand at 38%.

However, while noting the current issues, J.P. Morgan’s Bill Peterson lays out the reasons to stay bullish.

“While supply constraints are generally abating, the team is still facing cost headwinds such that full-year margins are now expected to come in below expectations (though directionally in-line with our preview),” the analyst explained. “Nevertheless, with opex coming in below expectations and ChargePoint delivering solid operating leverage, we are increasingly confident that ChargePoint can demonstrate further improvement to be on track to free cash flow positive by the end of CY24.”

“We continue to think ChargePoint’s scale and leadership across verticals (fleet, commercial, and residential) is underappreciated, as are the software and service offerings, which, while lagging the hyper-growth seen in connected hardware sales, should accelerate in the coming years with an expanding share of repeat customers,” Peterson went on to add.

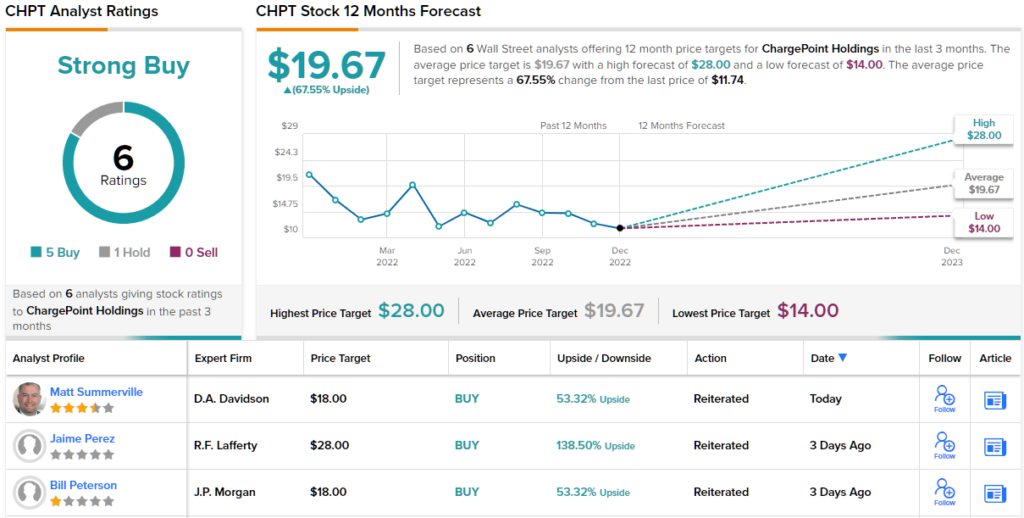

As such, Peterson rates CHPT an Overweight (i.e. Buy) rating along with an $18 price target. This figure conveys his confidence in CHPT’s ability to soar 53% in the next twelve months. (To watch Peterson’s track record, click here)

Most analysts are thinking along the same lines; with 5 Buys vs. 1 Hold, the stock claims a Strong Buy consensus rating. There’s plenty of upside projected too; at $19.67, the average target makes room for 12-month gains of 68%. (See CHPT stock forecast on TipRanks)

Guidewire (GWRE)

The digital transformation has been given a makeover for many segments, including the insurance industry. Stepping in to cater to the transition is Guidewire, a company that provides essential software systems for the Property and Casualty (P&C) insurance market and is considered a leader in the space. Its products cover everything from policy administration to claims, to underwriting and analytics and the company has been focusing on moving customers to its cloud platform. This is still an undeveloped area in the insurance industry, so there’s plenty of room for growth here.

Guidewire will release its latest quarterly results on Tuesday (December 6), but we can look at the July quarter results to get a feel for the business’ standing.

In the fourth quarter of fiscal 2022, revenue increased by 7% year-over-year to $244.6 million, while beating the Street’s call by $14.97 million. Likewise on the bottom-line, adj. EPS of $0.03 beat the analysts’ forecast of -$0.01.

However, concerns about softening demand given the troubled economic backdrop have weighed on the shares, which in total are down 48% year-to-date.

Nevertheless, J.P. Morgan’s Alexei Gogolev highlights the potential for growth ahead. He writes, “GWRE caters to the part of the insurance market that is less than one-third penetrated, implying a sustainable growth outlook… GWRE has established one of the leading competitive positions, which allows the company to 1) lead the on-premise software integration and 2) successfully transition into the leading provider of cloud solutions to the insurance carriers. The latter allowed GWRE to become the go-to vendor for both new and existing insurance carriers that wish to migrate their operations to the cloud. We estimate that GWRE could potentially more than double its existing revenue by migrating its existing customer base to the cloud.”

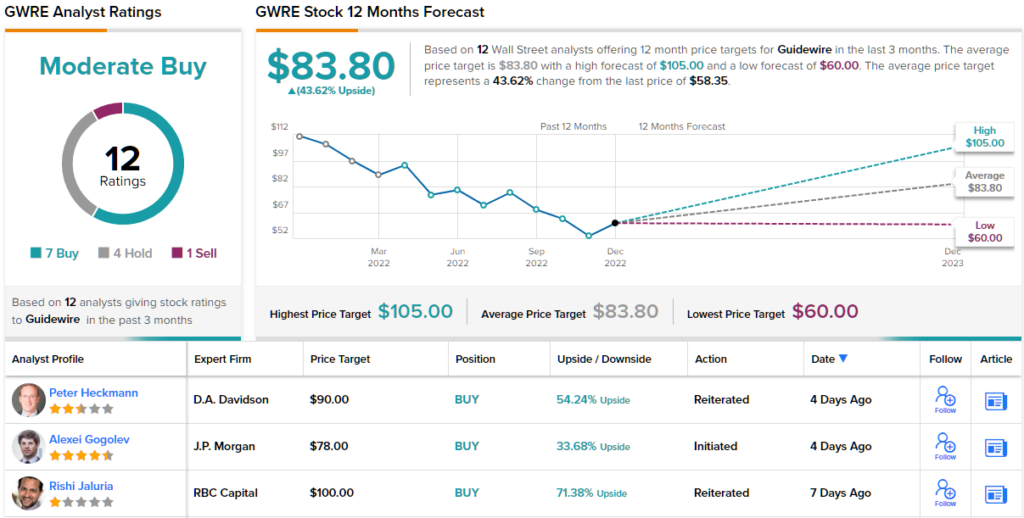

These comments underpin Gogolev’s Overweight (i.e., Buy) rating on Guidewire shares. With a price tag of $78, the analyst believes shares could surge 34% in the next twelve months. (To watch Gogolev’s track record, click here)

The rest of the Street offers an array of opinions when considering Guidewire’s prospects; all told, the stock claims a Moderate Buy consensus rating, based on 7 Buys, 4 Holds and 1 Sell. The forecast calls for 12-month gains of ~44%, considering the average target clocks in at $83.80. (See GWRE stock forecast on TipRanks)

Farfetch Limited (FTCH)

The last JPM-endorsed stock we come across is Farfetch, a company specializing in the sale of luxury fashion goods. These are sold via FTCH’s online platform, with the 1,400+ luxury brands on offer ranging from jewelry to high-end shoes, to fashion for men and women, and plenty of accessories in between. The British-Portuguese venture is headquartered in London, UK, but also has offices in major global hubs such as New York, LA, Tokyo and Shanghai, amongst others.

Luxury goods are thought to be somewhat shielded from the inflationary environment, but that line of thought has not helped Farfetch overcome 2022’s bear. In fact, the shares are down by a miserable 83% this year, with the company’s Q3 report not helping matters. Specifically, adj. EPS of -$0.24 came in worse than the prognosticators’ call for -$0.20.

That disappointing event was followed by another. The company recently held an Investor Day in which it laid out its 3-year outlook but it failed to impress. The shares tumbled by 35% in the subsequent session, a sell-off J.P. Morgan’s Doug Anmuth calls “overdone” and one that creates an “attractive entry point.”

Anmuth’s bull thesis for FTCH rests on several points: “1) FTCH’s position as the leading global marketplace in the $300B luxury market that is rapidly shifting online; 2) FTCH’s well-established e-concessions model that attracts more brands & inventory to the platform; 3) FTCH’s strong position in the high growth China luxury market through both the FTCH app & recently launched store on Alibaba’s Tmall Luxury Pavilion (TLP); & 4) FTCH’s several partnerships & growth drivers ahead including Richemont/YNAP, Reebok, Neiman Marcus, & Ferragamo.”

“We recognize that FTCH is a show-me story,” the 5-star analyst summed up, “but we believe the company continues to become a more valuable partner to the global luxury industry.”

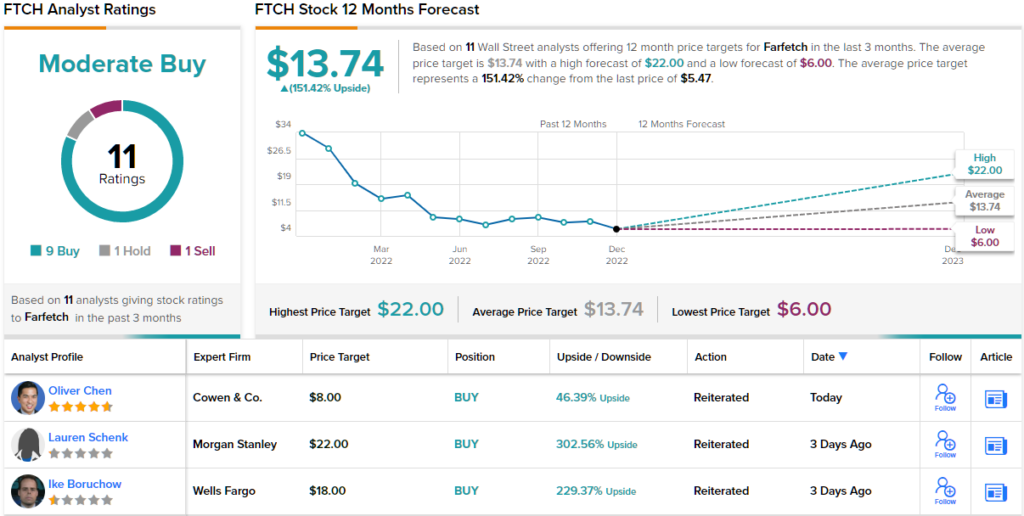

To this end, Anmuth reiterates an Overweight (i.e. Buy) rating for the shares along with a $15 price target. The implication for investors? Upside of a hefty 174% from current levels. (To watch Anmuth’s track record, click here)

Looking at the consensus breakdown, the analysts’ view is that this stock is a Moderate Buy, based on 9 Buys vs. 1 Hold and Sell, each. Most appear to think the shares have taken too much of a beating; at $13.74, the average target suggests they will climb 151% higher over the one-year timeframe. (See Farfetch stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.