The idea of the green economy – that is, low or zero carbon emissions – has taken hold, with a strong social and political impetus behind it. This has become the driving force behind the expansion of renewable power sources in utility-scale electricity generation and the increasing production and use of electrically powered vehicles. At its core, this push is predicated on a reduction in the use of fossil fuels. However, there is one sector in which the transition away from fossil fuel power has proven difficult.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Air travel remains primarily oil-dependent. Until recently, the technology simply did not exist to build viable battery-powered aircraft with sufficient size, lift, speed, and passenger/cargo capacity to truly meet an economic need. That’s beginning to change, particularly in the realm of short-range urban commuter flights. It’s a niche segment, but it’s one that is amenable to a switch from fossil fuel to battery power.

Analyst Austin Moeller, from Canaccord Genuity, has taken an in-depth look at the eVTOL (electric vertical takeoff and landing) aircraft class, and writes, “eVTOL aircraft, which can take off from a traditional heliport (or vertiport) and ferry passengers over busy traffic below using purely battery power, have the potential to substantially reduce carbon emissions in major urban areas and break up traffic congestion by taking to the air.”

“Based on our estimates,” Moeller added, “~15% of rides hailed to and from airports and 5% of longer-distance regional trips could be replaced by eVTOL aircraft, potentially reaching 45M monthly active riders within the next decade. At a target ticket price of ~$107 for an airport-ranged flight, we estimate that the TAM for eVTOL travel in urban metros could be worth nearly $58B by 2033.”

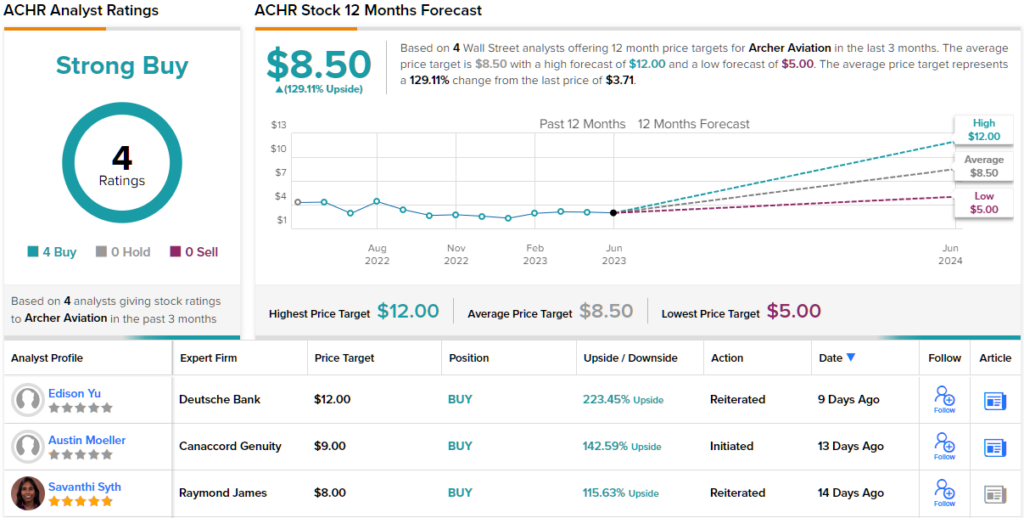

Moeller doesn’t just praise the sector generally, but he also provides a specific recommendation of an eVTOL stock that investors should consider. Despite the speculative nature of this company, Moeller predicts a remarkable upside potential of ~140%. This optimistic outlook is shared by other analysts as well, as the stock is rated as a Strong Buy according to TipRanks’ database.

Archer Aviation (ACHR)

Archer is developing the Midnight aircraft, a short-range urban commuter aircraft designed for distances of up to 100 miles. The Midnight, when it is scaled up to full size, will be capable of short flights, up to 20 miles, back-to-back, with just 12 minutes charging time between. The aircraft’s design incorporates six independent battery packs, each linked to a pair of electric motors, and capacity to carry a pilot, 4 passengers, and luggage. With speeds up to 150 miles per hour, and an optimized rage of 20 to 50 miles, the aircraft is intended to act as an urban connector and air taxi, economically linking major airports within a larger urban area.

Archer is already working with a major airline partner, United, to make eVTOL air taxi routes a reality. The two companies announced in March of this year the first commercial electric air taxi route, to start in in Chicago. The link will connect Chicago’s O’Hare airport, one of North America’s largest, with Vertiport Chicago, the largest North American vertical takeoff and landing aircraft facility. Vertiport is located in the famous Loop; the Archer/United agreement will connect the Loop directly to O’Hare.

This unique aviation firm is also partnering with Stellantis, the auto manufacturer, to kickstart production of the Midnight. Stellantis will provide the manufacturing tech and expertise, along with experienced factory personnel and available capital, to get the Midnight past the prototype stage and into mass production. Archer’s goal is to have 6,000 aircraft deployed by 2030. Archer and Stellantis together will be attending the 2023 Paris Airshow, which starts on June 19. The companies will jointly feature the Midnight eVTOL at the Air Mobility event.

While Archer is purely pre-revenue for now, the company is aiming to begin commercialization of the Midnight in 2025. In its 1Q23 report, Archer noted that the first Midnight aircraft has passed final assembly, and is ready for test flights this summer, and that the FAA certification program is progressing. Archer has plenty of liquidity to maintain operations, with cash reserves of $450 million as of March 31, as well as strategic funding, available from Stellantis, of $150 million.

For Canaccord’s Austin Moeller, all of this adds up to an impressive beginning. The analyst writes, “We expect Archer’s strong established relationships with a major airline (United) and a major global automotive manufacturer (Stellantis) to give the company an intellectual, technical and financial edge over its other peers in the eVTOL industry as it works to scale up production and delivery of the Midnight aircraft. Given the robust demand from the airlines to reduce carbon emissions and a vested interest from major metro areas in reducing smog and traffic congestion, we believe that Archer’s Midnight aircraft could be a significant contributor to sustainable air travel and short-mid range travel from urban city centers to airport hubs and surrounding suburbs.”

Looking forward, Moeller rates ACHR shares as a Buy, and he sets a $9 price target to suggest a powerful one-year upside of ~140%. (To watch Moeller’s track record, click here)

Like Canaccord, the rest of the Street is bullish on ACHR. Based on the 4 Buy recommendations assigned in the last three months and 129% upside potential, it’s clear this ‘Strong Buy’ eVTOL stock has a lot to brag about. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.