AI has become the new ‘shiny object,’ attracting investors’ attention. The rush began this past November when OpenAI’s ChatGPT made its debut, demonstrating in the clearest possible way how AI can change the ways computers use the data they collect and the ways we interact with them.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The sudden interest in AI has had a spiraling effect. Investors are seeking companies with greater exposure to AI, while tech firms are eager to publicize their own AI links and offerings.

Keeping a close watch on these developments is JPMorgan analyst Alexei Gogolev. He recently said, “Since Chat GPT came to the public domain, many companies rushed to highlight their AI expertise, lauding themselves as AI winners. We consulted a number of companies in our coverage, technology leaders, and went through various public information in order to analyze who are the true beneficiaries and leaders in this ecosystem.”

Gogolev goes on to make specific recommendations, suggesting tech stocks that are likely to realize strong gains from the AI revolution. Using the TipRanks database, we’ve looked up two of his picks to see what makes them stand out.

Alkami Technology (ALKT)

We’ll start with Alkami Technology, a provider of cloud-based digital banking solutions for the US financial market. Alkami has been in business since 2009, and its products allow banks and other institutions to drive their ROI through an improved digital banking experience for customers. The cloud-based platform provides enterprise customers with tools to enhance the user experience, manage large-scale data, and leverage continuous software update delivery.

The company’s tools and products are adaptable to a wide range of banking needs, from retail banking services to business and commercial financial products. Data and management solutions include customer insights and marketing automation, data cleansing, and AI-driven predictive marketing. Alkami’s ability to manage data at scale is a prerequisite for making effective use of AI; machine learning systems utilize a ‘brute force’ approach, basing AI on the analysis of vast amounts of data.

Earlier this month, Alkami launched its first product specifically designed to combine its data resources and AI capabilities. The Engagement AI Model, a first of its kind in the industry, employs AI and machine learning, together with Alkami’s proprietary Key Lifestyle Indicators, to identify customer behaviors most likely to lead to account retention – a crucial capability for banks seeking to increase account holder engagement with products and services.

This product announcement followed shortly after Alkami released its 2Q23 financial results. The company has displayed a recent trend of increasing quarterly revenues and moderating quarterly earnings losses – and the second quarter of this year saw the continuation of both these trends. Alkami reported $65.8 million in revenues, marking a 30% year-over-year increase and surpassing estimates by approximately $2.65 million. Regarding the bottom line, the company’s non-GAAP EPS loss was 3 cents, exceeding the forecast by 2 cents.

Alkami’s customer metrics supported the upward revenue and earnings trends. The company concluded Q2 with 40 new clients and reported that 15.8 million users were utilizing the digital banking platform.

JPMorgan’s Alexei Gogolev is impressed by Alkami’s use of AI in its operations and products, noting, “Alkami’s transparency and optimization of AI use put it in a good position among the analyzed coverage group. We believe that Alkami has been successfully using Artificial Intelligence internally and externally to create efficient and exciting solutions for its customers. Alkami’s business model is providing regional banks and credit unions with high-tech banking solutions. The company incorporates AI to personalize user experience and provide automated data analytics (20+ products with AI integration) and publishes white papers, case studies, data insights, and digital banking blogs to educate consumers…”

“Alkami is ranked among the leading players in our Financial Services coverage given the versatility of its solutions (including fraud protection, customer chatbots, etc.),” the analyst summed up.

Quantifying his stance, Gogolev rates ALKT an Overweight (i.e. Buy), with a price target of $19 to point towards a 25% one-year upside. (To watch Gogolev’s track record, click here)

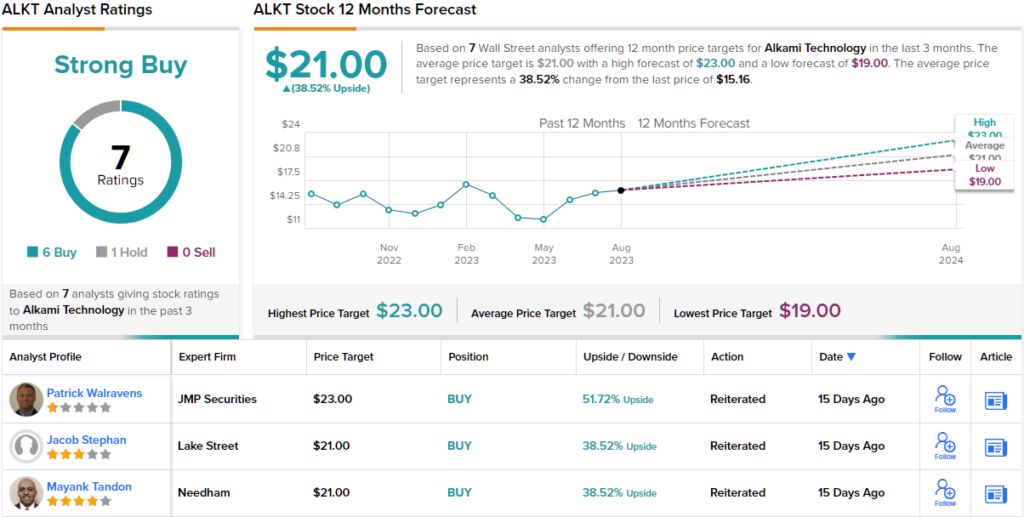

Overall, there are 7 recent analyst reviews on record for ALKT shares and they break down to 6 Buys and 1 Hold, for a Strong Buy consensus view. The stock is selling for $15.16 and its $21 average price target suggests a potential upside of ~38% in the next 12 months. (See ALKT stock forecast)

Procore Technologies (PCOR)

The next stock under JPMorgan’s radar is Procore, a company that leverages technology and high-end software systems to transform the construction industry. Procore offers a comprehensive suite of collaboration tools through its cloud-based construction management software platform, enabling seamless integration and coordination among builders, contractors, project managers, and property owners – essential stakeholders in any construction project. The platform empowers them to use connected devices such as smartphones and tablets for sharing documents, site and project plans, as well as critical data.

Procore’s software platform includes various features, such as document storage, drawing markups, and meeting minutes – the essential components of any project. By providing digital access to these components in real-time, Procore streamlines construction projects of all sizes.

With its sights on a lucrative market, Procore targets the global construction industry, which has a total value exceeding $14 trillion. The industry incurs over $500 billion annually due to rework and communication inefficiencies. Procore estimates that by addressing these issues, construction stakeholders could potentially realize $1.6 trillion in productivity gains. For now, the company notes that over 1 million construction projects around the world, totaling over $1 trillion, have used its platform.

Utilizing AI, Procore has developed ‘construction intelligence’ – AI-guided workflows based on accurate data analysis, enhancing insights and decision-making accuracy. Each construction project’s data is centralized within Procore’s platform, allowing customers to leverage AI-powered analytical tools for a comprehensive understanding of historical data and the formulation of effective KPIs for optimal efficiency. Procore boasts that its customers save, on average, 15 days on each project and realize a 16% reduction in rework.

Procore released its 2Q23 results at the beginning of this month, demonstrating yet another quarter of increasing revenues and earnings. After transitioning from a net loss to a net profit in Q1, the company continued to perform well in Q2. The non-GAAP EPS doubled from 1 cent per share to 2 cents, while exceeding the forecast by 11 cents. Furthermore, the company’s revenue totaled $228.5 million, surpassing estimates by over $10.52 million, marking a nearly 33% year-over-year increase.

Strong performance and a smart use of AI led JPMorgan’s Gogolev to rate this stock highly in his notes. The analyst says, “Construction needs to be digitized, and early AI adopters stand to benefit and establish themselves as industry leaders. Similar to internet infrastructure, real estate is driven by consumers’ desire for efficiency and comfort with AI. PCOR (we rank #1) stands out in the space; in an industry where pen and paper are the norm, they have used construction and workflow data to provide insights and better the process… Procore does not appear to be monetizing AI separately from its product offerings and instead is working on increased AI integration and product offerings. Early adoption and innovation with AI provides plenty of growth potential, along with collecting more data to become an industry leader.”

Looking forward, Gogolev sees his stance justifying an Overweight (i.e. Buy) rating, while his $85 price target implies an upside potential of ~36% for the year ahead.

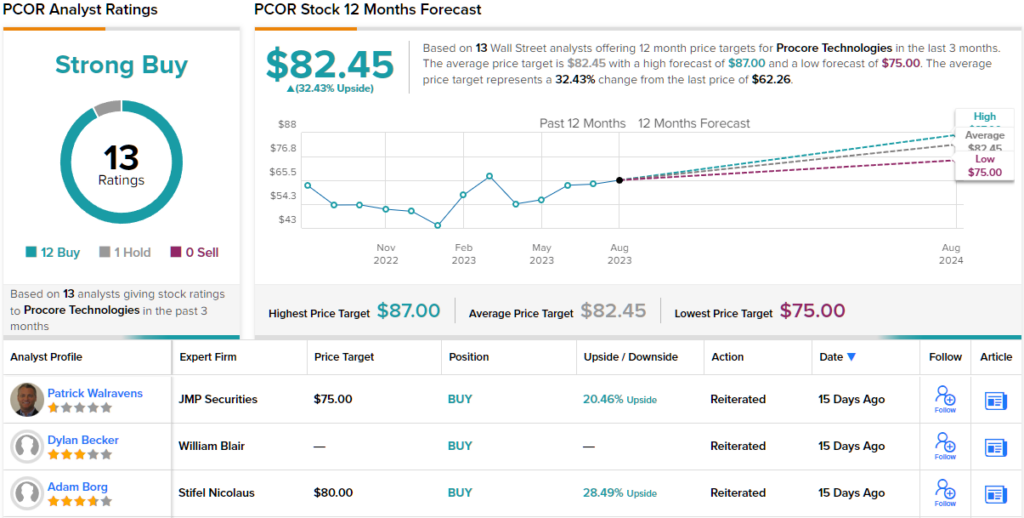

Overall, this construction-tech firm has picked up 13 recent reviews from the Street’s analysts, and these include 12 Buys against 1 Hold for a Strong Buy consensus rating. The stock is selling for $62.26 and carries an $82.45 average price target, suggesting it will appreciate by 32% going into next year. (See Procore stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.