Tech stocks have been leading the market this year; that’s no secret. The tech-heavy NASDAQ index, even after recent losses, has a year-to-date gain of ~32%, and the S&P 500, which includes a large tech segment, is up 16%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Those broad numbers cover up some important drill-downs. It’s the giant tech firms that are leading the way, and among them, AI has played a conspicuous part in the gains. The technology came to sudden prominence last November, when OpenAI released its ChatGPT AI-powered chatbot, and showed just what AI was capable of.

It’s not just conversational chatbots, however. AI lies behind advances in autonomous vehicles, it has enhanced facial and speech recognition software systems, and it is widely used in digital communication and encryption systems, to name just a few of its applications.

All of this, and more, has Wall Street’s analysts putting AI stocks under the microscope, seeking out the names that stand to gain the most. While that list includes the tech giants, it also includes other firms, in a wider variety of fields. These include some of the obvious, such as semiconductor chip making and data center operations.

Now, let’s shift our focus to two AI-related stocks that Wall Street analysts have tagged as Strong Buys. According to their analysis, the AI boom hasn’t fully impacted these share prices yet, presenting investors with an opportunity that has yet to play out.

Marvell Technology (MRVL)

We’ll start with a chip maker, Marvell Technology Group. Marvell is both a designer and producer of semiconductor chips, and is no minnow with a market cap over $48 billion and a trailing 12-month revenue figure of $5.62 billion. The company specializes in the design and manufacture of chips for data infrastructure, creating the underlying tech that allows the movement, processing, storage, and security of data in a wide range of applications.

Those applications include server stacks, ethernet networks, storage accelerators, and are cloud-optimized for today’s interconnected digital world. Marvell has chipset product lines aimed squarely at the heart of the AI boom. The company’s technology offers the processing capabilities needed in AI-heavy applications such as data centers and self-driving vehicles, and Marvell said this past spring that it expected its AI revenue to double for the year. And, in the company’s last quarterly financial release, it reported a 6% quarter-over-quarter revenue gain in the AI-heavy data center segment.

That report, for fiscal 2Q24, showed that the company brought in total revenues of $1.34 billion. While down almost 12% year-over-year – lingering supply chain issues, the impact of inflation on sales, and a slowdown in China all had an impact – the company’s top line slightly beat the forecast by $9.73 million. At the bottom line, the 33-cent non-GAAP EPS was also ahead of expectations, by a penny per share.

Covering Marvell for Benchmark, 5-star analyst Cody Acree sees the company in a solid position, with some of the same strengths as the market leader Nvidia.

“Echoing many of the same thematic end-market drivers recently highlighted by Nvidia and its extremely strong growth outlook, we believe Marvell is similarly well positioned to benefit from the industry-wide adoption of AI and the changes to their customers’ data infrastructure spending plans that are driven by the shifting reprioritization of network architectural decisions… We believe Marvell’s leadership in data infrastructure connectivity solutions offers the company a solid leverage to growth of global AI implementation,” Acree opined.

Along with these comments, Acree gives Marvell’s shares a Buy rating and a $75 price target that suggests a one-year upside potential of 35%. (To watch Acree’s track record, click here)

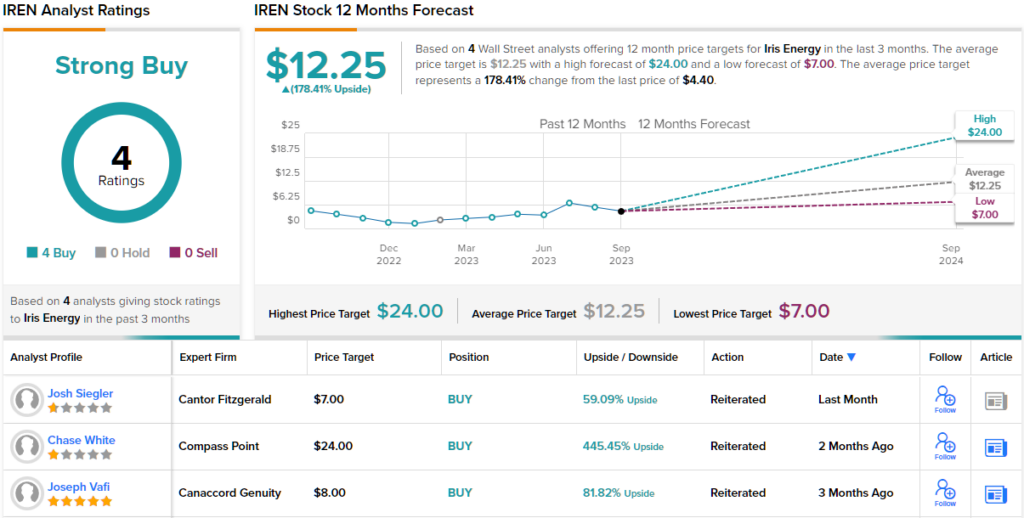

Tech stocks like Marvell never lack for attention from the Street – and Marvell has 20 recent analyst reviews on record. These include a 19 to 1 breakdown favoring the Buys over Holds, to back up the Strong Buy consensus from the analysts. The stock is selling for $55.65 and its average price target, at $72.57, implies a gain of 29% on the one-year horizon. (See Marvell stock forecast)

Iris Energy (IREN)

The second stock we’ll look at, Iris Energy, is a bitcoin miner. That is, Iris owns large-scale data centers needed to mine the cryptocurrency, and uses its success to generate bitcoins which can be sold for revenue. Bitcoin mining data centers are notoriously energy intensive, and Iris Energy also owns power generation facilities sufficient to maintain its operations. The company boasts that its power generation is derived from renewable energy sources.

To that end, Iris set up the majority of its data centers in the Canadian province of British Columbia – where the local geography, featuring steep mountains and swift rivers, is particularly amenable to the production of clean, constantly-renewable, hydroelectric power generation. Iris currently has three facilities online in BC, using 100% renewable power. Their combined power capacity is 160 megawatts, and they are capable of supporting approximately 50,000 bitcoin miner rigs. A fourth facility, in Texas, uses wind and solar energy to power a 20-megawatt data center with a capacity of some 6,500 miner rigs.

Bitcoin endeavors aside, as a company heavily invested in data centers, Iris has a natural reason to also move toward the AI market. Iris is a large buyer of high-end, AI-capable processing chips for its data center server stacks.

The company will report its results for fiscal 4Q23 on Wednesday (Sep 13) – but a look at some recently released monthly results will give a good idea of where the firm stands today. For last month, August, Iris produced 410 bitcoins, compared to 423 in July. The average operating hashrate for the month was 5,493 PH/s, down slightly from 5,562 PH/s in July. Iris generated $11.5 million in mining revenue for August, and realized $27,937 per bitcoin mined.

Iris has caught the eye of Canaccord analyst Joseph Vafi, who brings investors’ attention to the moves the company is making to become a force in the AI space. He writes, “Iris took a step forward in its recently renewed HPC/AI strategy with the purchase of NVIDIA’s latest generation AI H100 GPUs. This initial purchase of 248 GPUs for ~$10M will enable the company to further assess the readiness of its data centers for servicing the generative AI market and demonstrate its capabilities to prospective customers. With 760 MW of available power capacity, next gen data centers proven for power dense computing, an unencumbered balance sheet, and a management team with deep expertise in energy and infrastructure, we think Iris has essential pieces to capitalize on the emerging generative AI opportunity.”

To this end, the 5-star analyst rates IREN shares a Buy, and his $8 price target implies a robust one-year upside potential of 82%. (To watch Vafi’s track record, click here)

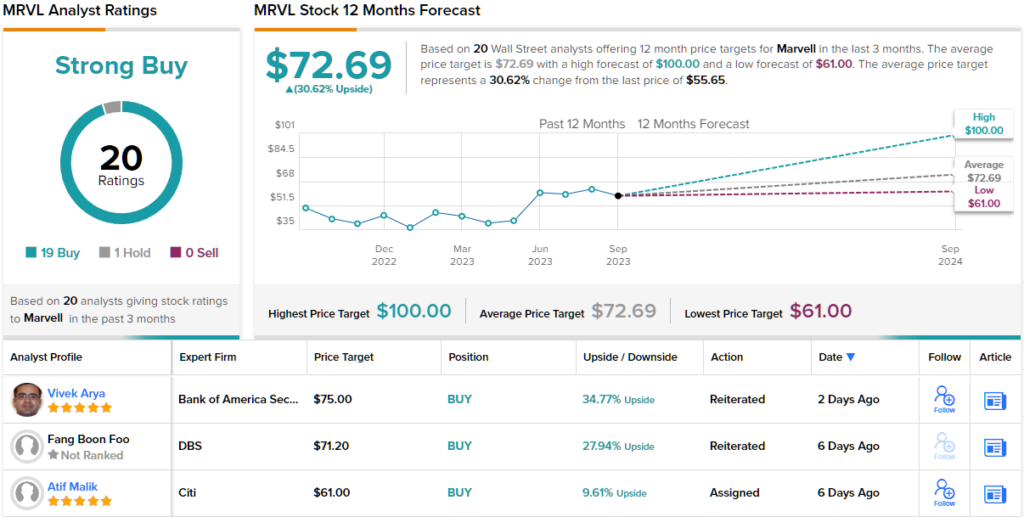

Overall, all four of the recent analyst reviews here are positive, making Iris’s Strong Buy consensus rating unanimous. The stock has a sale price of $4.40 and an average price target of $12.25, suggesting returns of a solid 178% lie in store for the year ahead. (See IREN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.