There’s really no hiding from AI anymore. Even if you don’t work with it professionally, chances are that AI has powered your search engine use, or you’ve at least tinkered with a chatbot like ChatGPT. Beyond that, AI is behind the targeted ads that we see on social media or Google; it tracks our internet and social media use, and selects ads accordingly.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What this means for the future – of computing, of statistics, of data analysis, of marketing and advertising – hasn’t yet come fully into focus. But one thing is certain: AI is going to open up opportunities for a wide range of companies to ride the wave. Everything from digital advertisers to IoT is going to be impacted by the AI boom, and a smart investor can buy in and take advantage.

This may not be as easy as it looks, but there are paths an investor can follow into the AI landscape. First, recognize that not every company or stock out there is directly related to artificial intelligence; companies can benefit from the new tech by putting it to use, even if they don’t directly work with it or work to write the software behind it. Second, don’t necessarily look for the big-name tech firms. Plenty of AI-linked companies are out there that haven’t ‘boomed’ yet; they may offer more room for share price appreciation going forward.

The analysts at Needham are following that strategy, locating stocks that can benefit from AI – but haven’t fully priced that in. We’ve pulled up the details on two AI-adjacent stocks from the TipRanks database for whom the Needham analysts give plenty of room to run – on the order of 40% upside or better. Here are the details.

Cerence, Inc. (CRNC)

The first stock we’ll look at is Cerence, a software company with 20-plus years of innovation under its belt and a current focus directly on artificial intelligence. Specifically, the company is developing AI-powered platforms to back up new tools in mobility. Cerence’s products are geared to provide voice-activated AI assistance for drivers. The AI tools use generative learning to predict a driver’s preferences, and can link to the car’s sensors and engine systems, to make driving easier and safer, or can connect with the car’s environment and entertainment systems, allowing the driver to focus on the road.

This is not autonomous driving; rather, it’s making a smarter car that can work with the driver. Cerence’s technology is already found in more than 475 million cars produced today, and the company works with more than 80 OEMs and Tier-1 automotive companies. Its partners include such major names as Subaru and Suzuki, GM and Ford, and Mercedes and Renault.

On the financial performance side, in its recent fiscal 2Q23 report (March quarter), Cerence showed $68.4 million in revenue, for a 21% year-over-year drop – but it beat the forecast by almost $2.5 million. At the bottom line, Cerence’s earnings showed a non-GAAP EPS loss of 4 cents per share, beating expectations by 9 cents per share.

Drilling down in the results, we find that Cerence had a strong gain in bookings during the first half of fiscal 2023, with a total of $263 million in bookings at the end of Q2. This represented a y/y gain of 11%. The company is predicting Q3 revenues of $58 million to $62 million, and has bumped up the bottom end of its full-year revenue guide. The new guidance for fiscal year 2023 predicts total revenues in the range of $280 million to $290 million.

This stock has caught the eye of Needham’s Rajvindra Gill, who says Cerence is “our favorite small cap to play AI.”

“The company has been developing next-generation Voice Assist products, based on their internal deep learning IP and coupled with state-of-the-art generative AI,” the 5-star analyst went on to say. “We are incrementally positive on the story following the company’s recent earnings which narrowed the FY23 guide to the upside. We continue to view FY23 as a transition year and FY24 as a strong growth year, based on higher ASPs from their new solutions.”

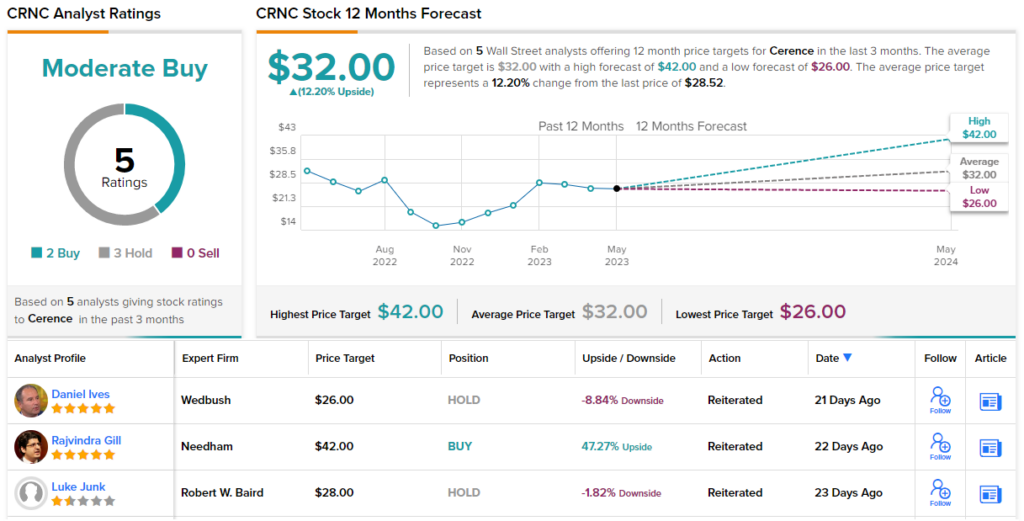

Accordingly, Gill rates these shares as a Buy, and his $42 price target implies a one-year upside potential of 47%. (To watch Gill’s track record, click here.)

This firm has picked up 5 recent analyst reviews, and they break down to 3 Holds and 2 Buys – for a Moderate Buy consensus rating. With an average price target of $32, and a current trading price of $28.52, Cerence has an upside potential of 12% looking out to the one-year time horizon. (See Cerence’s stock forecast.)

Etsy (ETSY)

The second stock we’re looking at, Etsy, is not an AI stock in itself; rather, Etsy is a company with great potential to benefit from the application of AI technology to its current model. Etsy is an online e-commerce firm, making available a platform that connects buyers and sellers in a global marketplace. The company’s platform is particularly popular with hobbyists, artists, and craft suppliers, who use it to set up independent stores, frequently specializing in handmade, vintage, or other niche merchandise.

So this is not an AI stock – but Etsy can use AI, as can sellers on the platform. The latter have recently been experimenting with selling AI products, an interesting foray but a sideshow compared to the company’s use of artificial intelligence. Etsy bills itself as ‘keeping commerce human,’ but it’s not shy about using AI as a tool.

Simply put, Etsy has over 100 million separate items listed on the site, and last year it connected more than 7 million sellers with more than 95 million buyers. That’s far too much of everything for one person to search – but Etsy has made use of generative AI on its in-platform search engine to give both buyers and sellers more refined searches for better results. An AI search, with machine learning capabilities, can get a better sense of the highly individualized and unique items typically found on Etsy, and of the idiosyncratic searches needed to find them.

Unsurprisingly, for an e-commerce firm, Etsy sees its best quarterly results in the fourth quarter. The company’s recently reported first quarter, however, did show some good news for investors. At the top line, Etsy reported $640.78 million in revenue. This was up more than 10% y/y and beat the estimates by $19.95 million. The company’s net income, at $74.5 million, was down 13% y/y, although EPS of 53 cents per share was 3 cents ahead of expectations.

Weighing in on Etsy for Needham, analyst Anna Andreeva views ETSY as a “top of the list beneficiary” from Generative AI. Expounding on the matter, she further said, “Since most of ETSY’s search is unstructured (company uses multiple techniques simultaneously), generative AI is viewed as a big opportunity to improve search (ability to categorize and narrow results from Etsy’s 100M+ listings) and drive frequency; management views this as another tool in the tool kit (not necessarily replacing what’s used today). So far ETSY has 2 squads working with Github co-pilot (around 20 people, some newly hired, some reallocated) and is being methodical about the opportunity; frequency followed by AOV (from ‘cushion to couch’ initiative) are viewed as the biggest AI applications.”

In-line with her comments, Andreeva gives Etsy shares a Buy rating with a price tag of $160 indicating room for an impressive gain of 97% in the coming year. (To watch Andreeva’s track record, click here.)

The 18 recent analyst reviews on Etsy show a wide spread, with 12 Buys, 5 Holds, and 1 Sell making the consensus view a Moderate Buy. The shares are priced at $81.05 and the $125.76 average price target implies a one-year potential gain of 55%. (See Etsy’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.