The five best-performing ETFs of 2023 so far have one thing in common — all five are focused on various aspects of the cryptocurrency industry. When screening out leveraged ETFs, the top-performing ETFs year-to-date are the Valkyrie Bitcoin Miners ETF, the VanEck Digital Assets Mining ETF, the VanEck Digital Transformation ETF, the Bitwise Crypto Industry Innovators ETF and the Global X Blockchain ETF.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why are These ETFs Surging?

Cryptocurrencies had a terrible year in 2022, as surging inflation, rising interest rates, and a number of high-profile scandals in the sector caused the previously high-flying asset class to plummet. Bitcoin and Ethereum fell 64% and 67%, respectively, so it’s no surprise that crypto-related ETFS struggled. For example, DAPP, BKCH, and BITQ all fell about 85% in 2022.

After this pronounced decline in 2022, some reversion was likely inevitable in 2023. Bitcoin and Ethereum have surged to year-to-date gains of 37.3% and 31.6%, respectively.

These top-performing ETFs have followed them higher, as the Valykyrie Bitcoin Miners ETF, VanEck Digital Assets Mining ETF, VanEck Vectors Digital Transformation ETF, Bitwise Crypto Industry Innovators ETF, and Global X Blockchain ETF have posted scintillating year-to-date gains of 99.4%, 94.9%, 83.4%, 78.2%, and 75.8% respectively. Let’s take a look at these ETFs and whether they can keep up their strong performance.

Valkyrie Bitcoin Miners ETF (WGMI)

The Valkyrie Bitcoin Miners ETF is an offering from Valkyrie exclusively focused on Bitcoin miners. The ticker is a play on ‘WAGMI,’ a popular acronym and rallying cry within the crypto community that stands for “We’re all gonna make it.”

This is a small ETF with just $5 million in assets under management (AUM). WGMI’s top 10 holdings are all Bitcoin miners such as Cleanspark, Digihost Technology, Bitfarms, HIVE Blockchain Technologies, and Riot Platforms. The Valkyrie Bitcoin Miners ETF is concentrated with just 20 holdings, and the top 10 holdings make up nearly 75% of the fund. Top position Cleanspark accounts for nearly 10% of holdings.

WGMI has a neutral ETF smart score of 5. While it has a Hold consensus rating, the average WGMI stock price target of $15.64 indicates upside of 66% from current levels. Lastly, the Valkyrie Bitcoin Miners ETF has a relatively high expense ratio of 0.75%.

VanEck Digital Assets Mining ETF (DAM)

Like WGMI, the VanEck Digital Assets Mining ETF is a small ETF focused on Bitcoin miners. However, it is even smaller than WGMI, with just $1.3 million in AUM. Like WGMI, DAM is a concentrated fund with 21 positions. DAM’s top 10 holdings make up 71.4% of the fund, and they have significant overlap with that of WAGMI.

Top 10 stocks include names like Riot Platforms, Hive Blockchain Technologies, Hut 8 Mining, Cleanspark, and Marathon Digital. One difference between DAM and WGMI is that DAM also holds positions in companies like Coinbase, Galaxy Digital, and Silvergate Capital, giving it some exposure to different parts of the crypto economy.

DAM has a neutral ETF Smart Score of 4 out of 10. Meanwhile, the analyst consensus calls DAM a Hold, although the average DAM price target of $19.24 indicates significant upside potential of 76% from the current price.

DAM’s expense ratio of 0.5% is lower than that of WGMI.

VanEck Digital Transformation ETF (DAPP)

The VanEck Digital Transformation ETF is much larger than WGMI and DAM, but it’s still a relatively small ETF with $28.5 million in AUM. DAPP differs from these two ETFs in that its focus goes well beyond crypto mining. It invests in companies involved in all aspects of the digital asset ecosystem.

While DAPP’s top 10 holdings include some of the same names from WGMI and DAM, crypto exchange Coinbase is the top holding. The second largest holding is Block, a fintech company with significant involvement in crypto. The third-largest holding, MicroStrategy, is an enterprise software company that holds significant amounts of Bitcoin on its balance sheet.

This makes DAPP more diversified than the two names above and gives DAPP exposure to the growth of other facets of the digital assets space. DAPP is fairly concentrated, with just 22 holdings, and the top 10 holdings make up 63.5% of the fund.

The ETF’s ticker is a play on ‘dApp’ the term given to decentralized applications on the Ethereum blockchain.

While DAPP fell 85% last year, it’s up 83% year to date, as top holdings like Coinbase and MicroStrategy have surged early this year.

Like its fellow VanEck ETF DAM, VanEck Digital Transformation ETF has an expense ratio of 0.5%.

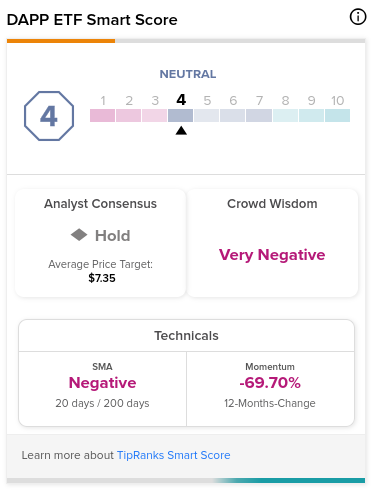

DAPP has a neutral ETF Smart Score of 4 out of 10 and a consensus rating of Hold. The average DAPP stock price target of $7.35 represents upside potential of 45% from current levels.

Bitwise Crypto Industry Innovators ETF (BITQ)

The Bitwise Crypto Industry Innovators ETF is the fourth-best performing ETF of 2023 using the parameters discussed earlier, with a 78.2% gain year-to-date. BITQ is larger than the three names above, with $51.6 million in AUM, but it is still a small ETF in the grand scheme of things.

Like DAPP, this ETF is focused on innovation in the crypto space as a whole, so BITQ’s top holdings include Bitcoin miners as well as the likes of Coinbase, Microstrategy, and Galaxy Digital.

BITQ has the highest expense ratio on this list, with an expense ratio of 0.85%.

BITQ is a bit more diversified than the other ETFs mentioned here, with 28 holdings. Its top 10 holdings account for 64.7% of the fund, with Microstrategy and Coinbase each accounting for over 10% of holdings.

BITQ has a neutral ETF Smart Score of 4 out of 10 and a Hold consensus rating. The average analyst price target of $7.95 represents upside potential of 30% from current prices.

Global X Blockchain ETF (BKCH)

Lastly, the Global X Blockchain ETF is sized similarly to BITQ, with $58 million in AUM. Like DAPP and BITQ, it invests in the cryptocurrency and blockchain space as a whole. Block has the largest weighting by far, accounting for nearly 18% of the fund. Other top 10 holdings include Coinbase and the same Bitcoin miners as the other ETFs here. Interestingly, Nvidia is a top 10 position, as Nvidia’s semiconductors are used for crypto mining. BKCH has 25 holdings, and its top 10 holdings make up 73.8% of the fund.

BKCH has an ETF Smart Score of 4 and a Hold consensus rating. The average BKCH stock price target of $31.16 indicates potential upside of 40% from here.

BKCH has an expense ratio of 0.5% and is unique amongst these five ETFs in that it pays a dividend, currently yielding 0.7%.

The Takeaway

Because cryptocurrency performed so poorly in 2022, it’s unsurprising that there has been some reversion to the mean. What is somewhat surprising is the size and pace of these gains.

One word of caution here is that historically, cryptocurrency has been a volatile asset class. The crypto mining ETFs have essentially acted as levered plays on the price of Bitcoin. As Bitcoin climbed higher this year, they have surged to outsize gains.

However, if Bitcoin moves lower, these ETFs could see significant and rapid declines in excess of the decline of Bitcoin. Their minuscule size could also lead to additional volatility, leaving them vulnerable to the vagaries of the market.

Therefore, I prefer the ETFs that are focused on the crypto space as a whole. They are more diversified and slightly larger. Of these, I prefer DAPP and BKCH to BITQ due to their lower expense ratios (and BKCH’s dividend). However, it should be noted that these are all relatively small ETFs. All three will still be subject to the volatility of the crypto sector. If growth stocks sell off in 2023, these ETFs will suffer as well.

Investors who bought these ETFs in advance of these large moves to the upside can take a bow. While these ETFs may post solid returns for 2023, the pace of these returns so far is likely unsustainable, and there will be plenty of volatility along the way.

Alternative Considerations

There is one final note for interested investors to consider. Investors interested in cryptocurrency can simply purchase cryptocurrencies like Bitcoin or Ethereum and get more direct exposure to the assets themselves instead of doing it through these ETFs. Investors interested in Bitcoin mining can buy shares of one of the large Bitcoin miners like Marathon Digial or Riot Platforms.

This would give them the same exposure with a much larger market cap and without the management fees. Lastly, investors interested in innovation in the industry, in general, can consider simply investing in a name like Coinbase or Block.